Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> Finance Trust<br />

2. Financial risk management<br />

CLFT’s activities expose it to a variety of financial risks, which include credit risk, cash flow interest rate risk and liquidity<br />

risk. The overall risk management program focuses on the unpredictability of financial markets and seeks to minimise<br />

potential adverse effects on the financial performance.<br />

a) Currency Risk<br />

Subsidiaries of the Fund operate in Australia and the UK and operate and source external financing in their local currency.<br />

Management of the Fund monitors the exchange rate fluctuations between the Australian Dollar and the local currencies<br />

of the foreign subsidiaries on a regular basis. Management have not utilised any derivative financial instruments to date to<br />

hedge the foreign currency risk of earnings from subsidiaries in accordance with an agreement with the unit holders of the<br />

Fund. If the exchange rate fluctuated by <strong>10</strong>% the loss after tax would vary by $54k and the net assets would vary by $2.2m.<br />

Management will institute the appropriate action and utilise the necessary derivative financial instruments should there<br />

be a change in agreement with the unit holders.<br />

Loans are made between entities within the Fund for purposes of providing funding for capital expenditure or the net<br />

investment in subsidiaries. The currency of the loan is generally denominated in the currency of the lender and the loans<br />

are valued at balance sheet spot rate at each reporting date.<br />

b) Credit risk<br />

Credit risk arises from cash and cash equivalents, deposits with major banks and financial institutions and loans to related<br />

parties and entities within the CLV Fund. Only banks and financial institutions with high credit ratings are used to deposit<br />

funds. Credit granted to related parties is monitored regularly and the loan agreements contain unsecured recourse<br />

against the borrower for default of the loans.<br />

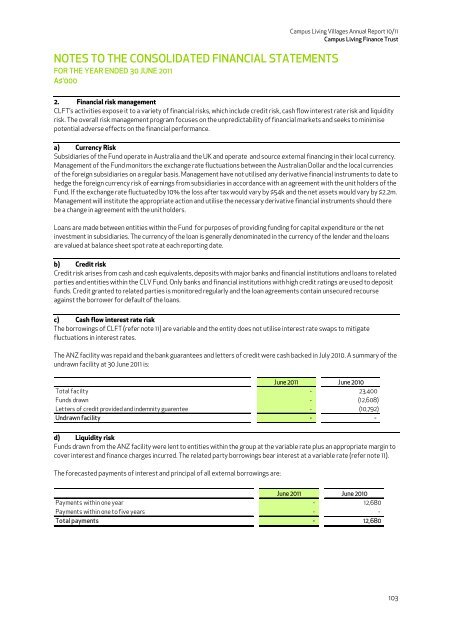

c) Cash flow interest rate risk<br />

The borrowings of CLFT (refer note <strong>11</strong>) are variable and the entity does not utilise interest rate swaps to mitigate<br />

fluctuations in interest rates.<br />

The ANZ facility was repaid and the bank guarantees and letters of credit were cash backed in July 20<strong>10</strong>. A summary of the<br />

undrawn facility at 30 June 20<strong>11</strong> is:<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Total facilty - 23,400<br />

Funds drawn - (12,608)<br />

Letters of credit provided and indemnity guarentee - (<strong>10</strong>,792)<br />

Undrawn facility - -<br />

d) Liquidity risk<br />

Funds drawn from the ANZ facility were lent to entities within the group at the variable rate plus an appropriate margin to<br />

cover interest and finance charges incurred. The related party borrowings bear interest at a variable rate (refer note <strong>11</strong>).<br />

The forecasted payments of interest and principal of all external borrowings are:<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Payments within one year - 12,680<br />

Payments within one to five years - -<br />

Total payments - 12,680<br />

<strong>10</strong>3