Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

IFRS 13 Fair Value Measurement (effective 1 January 2013). IFRS 13 was released in May 20<strong>11</strong>. The AASB is expected to<br />

issue an equivalent Australian standard shortly. IFRS 13 explains how to measure fair value and aims to enhance fair value<br />

disclosures. The Fund does not use fair value measurements extensively. It is therefore unlikely that the new rules will<br />

have a significant impact on any of the amounts recognised in the financial statements. However, application of the new<br />

standard will impact the type of information disclosed in the notes to the financial statements. The Fund does not intend<br />

to adopt the new standard before its operative date, which means that it would be first applied in the annual reporting<br />

period ending 30 June 2014.<br />

Revised IAS 1 Presentation of Financial Statements (effective 1 July 2012). In June 20<strong>11</strong>, the IASB made an amendment to<br />

IAS 1 Presentation of Financial Statements. The AASB is expected to make equivalent changes to AASB <strong>10</strong>1 shortly. The<br />

amendment requires entities to separate items presented in other comprehensive income into two groups, based on<br />

whether they may be recycled to profit or loss in the future. It will not affect the measurement of any of the items<br />

recognised in the balance sheet or the profit or loss in the current period. The Fund intends to adopt the new standard<br />

from 1 July 2012.<br />

Certain new accounting standards and interpretations have been published that are not mandatory for the 30 June 20<strong>11</strong><br />

reporting period other than those mentioned above. The Fund has assessed the new standards and interpretations as<br />

unlikely to have a material impact.<br />

2. Financial risk management<br />

The consolidated entity’s activities expose it to a variety of financial risks, which include market risk (currency risk and<br />

cash flow interest rate risk), credit risk and liquidity risk. The consolidated entity’s overall risk management program<br />

focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the financial<br />

performance of the group.<br />

CLOT uses derivative financial instruments such as interest rate swaps to mitigate cash flow interest rate risk.<br />

CLOT uses different methods to measure different types of risk to which it is exposed. These methods include<br />

sensitivity analysis in the case of interest rate and foreign exchange risk, age analysis for credit risk, and cash flow<br />

forecasts for liquidity risks.<br />

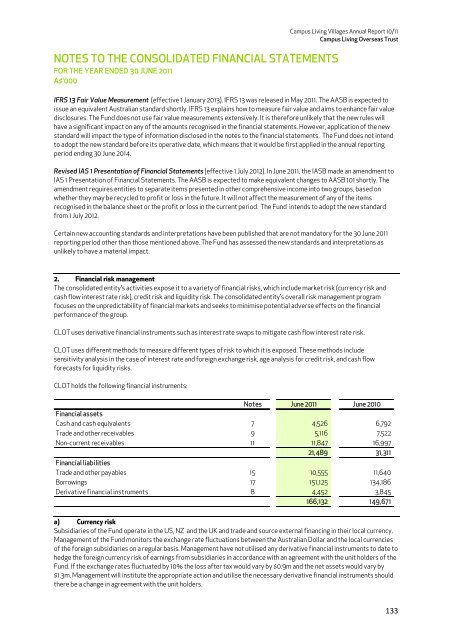

CLOT holds the following financial instruments:<br />

Notes June 20<strong>11</strong> June 20<strong>10</strong><br />

Financial assets<br />

Cash and cash equivalents 7 4,526 6,792<br />

Trade and other receivables 9 5,<strong>11</strong>6 7,522<br />

Non-current receivables <strong>11</strong> <strong>11</strong>,847 16,997<br />

21,489 31,3<strong>11</strong><br />

Financial liabilities<br />

Trade and other payables 15 <strong>10</strong>,555 <strong>11</strong>,640<br />

Borrowings 17 151,125 134,186<br />

Derivative financial instruments 8 4,452 3,845<br />

166,132 149,671<br />

a) Currency risk<br />

Subsidiaries of the Fund operate in the US, NZ and the UK and trade and source external financing in their local currency.<br />

Management of the Fund monitors the exchange rate fluctuations between the Australian Dollar and the local currencies<br />

of the foreign subsidiaries on a regular basis. Management have not utilised any derivative financial instruments to date to<br />

hedge the foreign currency risk of earnings from subsidiaries in accordance with an agreement with the unit holders of the<br />

Fund. If the exchange rates fluctuated by <strong>10</strong>% the loss after tax would vary by $0.9m and the net assets would vary by<br />

$1.3m. Management will institute the appropriate action and utilise the necessary derivative financial instruments should<br />

there be a change in agreement with the unit holders.<br />

133