Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

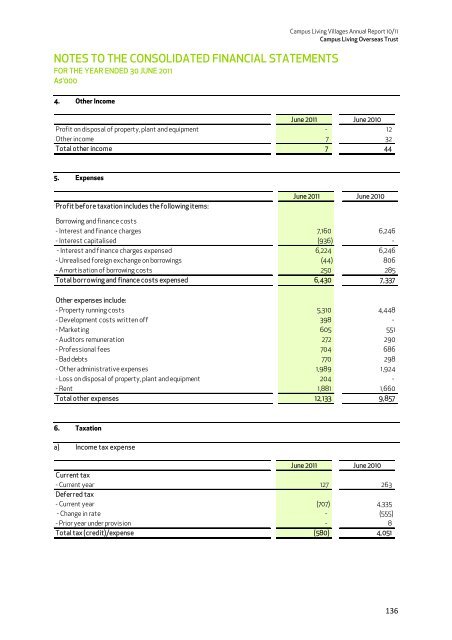

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

4. Other Income<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Profit on disposal of property, plant and equipment - 12<br />

Other income 7 32<br />

Total other income 7 44<br />

5. Expenses<br />

Profit before taxation includes the following items:<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Borrowing and finance costs<br />

- Interest and finance charges 7,160 6,246<br />

- Interest capitalised (936) -<br />

- Interest and finance charges expensed 6,224 6,246<br />

- Unrealised foreign exchange on borrowings (44) 806<br />

- Amortisation of borrowing costs 250 285<br />

Total borrowing and finance costs expensed 6,430 7,337<br />

Other expenses include:<br />

- Property running costs 5,3<strong>10</strong> 4,448<br />

- Development costs written off 398 -<br />

- Marketing 605 551<br />

- Auditors remuneration 272 290<br />

- Professional fees 704 686<br />

- Bad debts 770 298<br />

- Other administrative expenses 1,989 1,924<br />

- Loss on disposal of property, plant and equipment 204 -<br />

- Rent 1,881 1,660<br />

Total other expenses 12,133 9,857<br />

6. Taxation<br />

a) Income tax expense<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Current tax<br />

- Current year 127 263<br />

Deferred tax<br />

- Current year (707) 4,335<br />

- Change in rate - (555)<br />

- Prior year under provision - 8<br />

Total tax (credit)/expense (580) 4,051<br />

136