Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

Fund manager fees paid to the Responsible Entity<br />

The fund manager fees are allocated to each trust based on the NAV of the trust. The constitutions of the individual trusts<br />

prescribe the method of calculation of the fund manager fees, which is borne by the individual trusts. The total fees<br />

payable are subject to the total fund management fees in any year being capped at 1.5% of the net asset value of the trust<br />

as determined and calculated in the final NAV of the Fund. The fees above the cap will be payable in future years if the fees<br />

earned in those years are below the cap at that date. This amount is recorded as a provision (refer note 16) and is<br />

discounted to reflect the estimated timing and value of the future payment.<br />

Management fees include base fees $65,547 (20<strong>10</strong>: $28,764) and performance fees below the cap $240,008 (20<strong>10</strong>:<br />

$124,996). Performance fees above the cap are included in provisions (refer note 16).<br />

Directors’ fees paid to Responsible Entity<br />

Directors’ fees of $162,704 (20<strong>10</strong>: $157,508) have been paid to the non-executive Directors of the RE.<br />

Support services costs<br />

CLOT paid CLFM $6,344 for equity raising costs.<br />

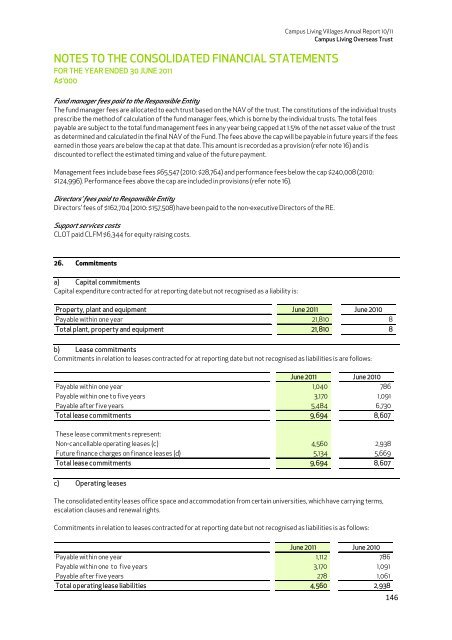

26. Commitments<br />

a) Capital commitments<br />

Capital expenditure contracted for at reporting date but not recognised as a liability is:<br />

Property, plant and equipment June 20<strong>11</strong> June 20<strong>10</strong><br />

Payable within one year 21,8<strong>10</strong> 8<br />

Total plant, property and equipment 21,8<strong>10</strong> 8<br />

b) Lease commitments<br />

Commitments in relation to leases contracted for at reporting date but not recognised as liabilities is are follows:<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Payable within one year 1,040 786<br />

Payable within one to five years 3,170 1,091<br />

Payable after five years 5,484 6,730<br />

Total lease commitments 9,694 8,607<br />

These lease commitments represent:<br />

Non-cancellable operating leases (c) 4,560 2,938<br />

Future finance charges on finance leases (d) 5,134 5,669<br />

Total lease commitments 9,694 8,607<br />

c) Operating leases<br />

The consolidated entity leases office space and accommodation from certain universities, which have carrying terms,<br />

escalation clauses and renewal rights.<br />

Commitments in relation to leases contracted for at reporting date but not recognised as liabilities is as follows:<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Payable within one year 1,<strong>11</strong>2 786<br />

Payable within one to five years 3,170 1,091<br />

Payable after five years 278 1,061<br />

Total operating lease liabilities 4,560 2,938<br />

146