Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

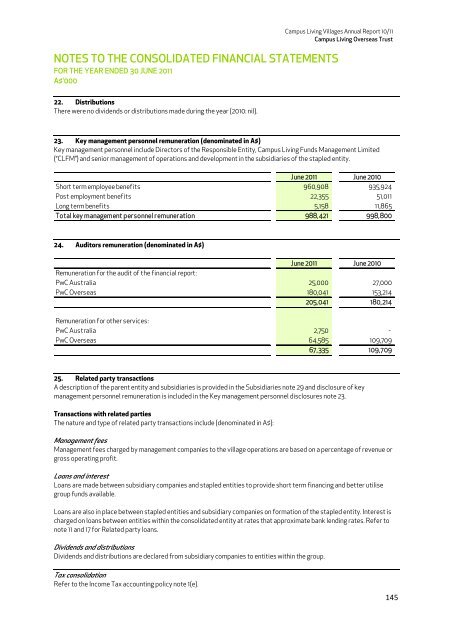

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

22. Distributions<br />

There were no dividends or distributions made during the year (20<strong>10</strong>: nil).<br />

23. Key management personnel remuneration (denominated in A$)<br />

Key management personnel include Directors of the Responsible Entity, <strong>Campus</strong> <strong>Living</strong> Funds Management Limited<br />

(‘‘CLFM’’) and senior management of operations and development in the subsidiaries of the stapled entity.<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Short term employee benefits 960,908 935,924<br />

Post employment benefits 22,355 51,0<strong>11</strong><br />

Long term benefits 5,158 <strong>11</strong>,865<br />

Total key management personnel remuneration 988,421 998,800<br />

24. Auditors remuneration (denominated in A$)<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Remuneration for the audit of the financial report:<br />

PwC Australia 25,000 27,000<br />

PwC Overseas 180,041 153,214<br />

205,041 180,214<br />

Remuneration for other services:<br />

PwC Australia 2,750 -<br />

PwC Overseas 64,585 <strong>10</strong>9,709<br />

67,335 <strong>10</strong>9,709<br />

25. Related party transactions<br />

A description of the parent entity and subsidiaries is provided in the Subsidiaries note 29 and disclosure of key<br />

management personnel remuneration is included in the Key management personnel disclosures note 23.<br />

Transactions with related parties<br />

The nature and type of related party transactions include (denominated in A$):<br />

Management fees<br />

Management fees charged by management companies to the village operations are based on a percentage of revenue or<br />

gross operating profit.<br />

Loans and interest<br />

Loans are made between subsidiary companies and stapled entities to provide short term financing and better utilise<br />

group funds available.<br />

Loans are also in place between stapled entities and subsidiary companies on formation of the stapled entity. Interest is<br />

charged on loans between entities within the consolidated entity at rates that approximate bank lending rates. Refer to<br />

note <strong>11</strong> and 17 for Related party loans.<br />

Dividends and distributions<br />

Dividends and distributions are declared from subsidiary companies to entities within the group.<br />

Tax consolidation<br />

Refer to the Income Tax accounting policy note 1(e).<br />

145