Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

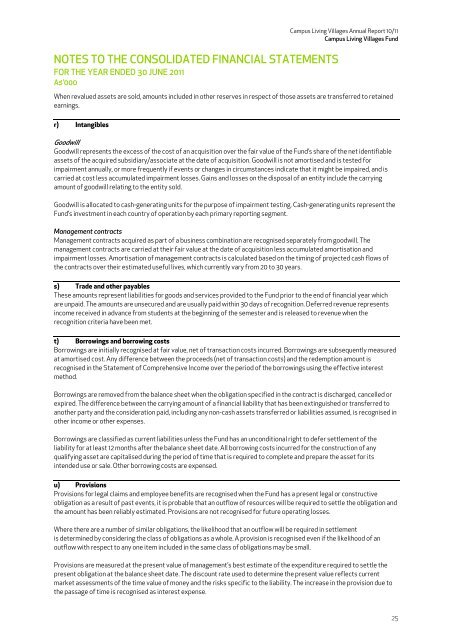

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> Fund<br />

When revalued assets are sold, amounts included in other reserves in respect of those assets are transferred to retained<br />

earnings.<br />

r) Intangibles<br />

Goodwill<br />

Goodwill represents the excess of the cost of an acquisition over the fair value of the Fund’s share of the net identifiable<br />

assets of the acquired subsidiary/associate at the date of acquisition. Goodwill is not amortised and is tested for<br />

impairment annually, or more frequently if events or changes in circumstances indicate that it might be impaired, and is<br />

carried at cost less accumulated impairment losses. Gains and losses on the disposal of an entity include the carrying<br />

amount of goodwill relating to the entity sold.<br />

Goodwill is allocated to cash-generating units for the purpose of impairment testing. Cash-generating units represent the<br />

Fund’s investment in each country of operation by each primary reporting segment.<br />

Management contracts<br />

Management contracts acquired as part of a business combination are recognised separately from goodwill. The<br />

management contracts are carried at their fair value at the date of acquisition less accumulated amortisation and<br />

impairment losses. Amortisation of management contracts is calculated based on the timing of projected cash flows of<br />

the contracts over their estimated useful lives, which currently vary from 20 to 30 years.<br />

s) Trade and other payables<br />

These amounts represent liabilities for goods and services provided to the Fund prior to the end of financial year which<br />

are unpaid. The amounts are unsecured and are usually paid within 30 days of recognition. Deferred revenue represents<br />

income received in advance from students at the beginning of the semester and is released to revenue when the<br />

recognition criteria have been met.<br />

t) Borrowings and borrowing costs<br />

Borrowings are initially recognised at fair value, net of transaction costs incurred. Borrowings are subsequently measured<br />

at amortised cost. Any difference between the proceeds (net of transaction costs) and the redemption amount is<br />

recognised in the Statement of Comprehensive Income over the period of the borrowings using the effective interest<br />

method.<br />

Borrowings are removed from the balance sheet when the obligation specified in the contract is discharged, cancelled or<br />

expired. The difference between the carrying amount of a financial liability that has been extinguished or transferred to<br />

another party and the consideration paid, including any non-cash assets transferred or liabilities assumed, is recognised in<br />

other income or other expenses.<br />

Borrowings are classified as current liabilities unless the Fund has an unconditional right to defer settlement of the<br />

liability for at least 12 months after the balance sheet date. All borrowing costs incurred for the construction of any<br />

qualifying asset are capitalised during the period of time that is required to complete and prepare the asset for its<br />

intended use or sale. Other borrowing costs are expensed.<br />

u) Provisions<br />

Provisions for legal claims and employee benefits are recognised when the Fund has a present legal or constructive<br />

obligation as a result of past events, it is probable that an outflow of resources will be required to settle the obligation and<br />

the amount has been reliably estimated. Provisions are not recognised for future operating losses.<br />

Where there are a number of similar obligations, the likelihood that an outflow will be required in settlement<br />

is determined by considering the class of obligations as a whole. A provision is recognised even if the likelihood of an<br />

outflow with respect to any one item included in the same class of obligations may be small.<br />

Provisions are measured at the present value of management’s best estimate of the expenditure required to settle the<br />

present obligation at the balance sheet date. The discount rate used to determine the present value reflects current<br />

market assessments of the time value of money and the risks specific to the liability. The increase in the provision due to<br />

the passage of time is recognised as interest expense.<br />

25