Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> Australia Trust<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

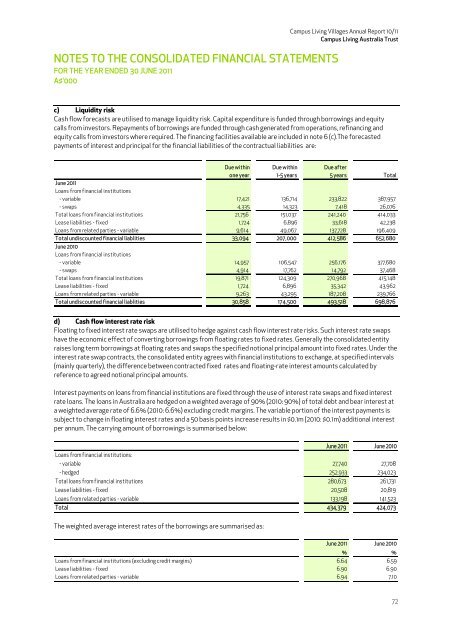

c) Liquidity risk<br />

Cash flow forecasts are utilised to manage liquidity risk. Capital expenditure is funded through borrowings and equity<br />

calls from investors. Repayments of borrowings are funded through cash generated from operations, refinancing and<br />

equity calls from investors where required. The financing facilities available are included in note 6 (c).The forecasted<br />

payments of interest and principal for the financial liabilities of the contractual liabilities are:<br />

Due within<br />

one year<br />

Due within<br />

1-5 years<br />

Due after<br />

5 years Total<br />

June 20<strong>11</strong><br />

Loans from financial institutions<br />

- variable 17,421 136,714 233,822 387,957<br />

- swaps 4,335 14,323 7,418 26,076<br />

Total loans from financial institutions 21,756 151,037 241,240 414,033<br />

Lease liabilities - fixed 1,724 6,896 33,618 42,238<br />

Loans from related parties - variable 9,614 49,067 137,728 196,409<br />

Total undiscounted financial liablities 33,094 207,000 412,586 652,680<br />

June 20<strong>10</strong><br />

Loans from financial institutions<br />

- variable 14,957 <strong>10</strong>6,547 256,176 377,680<br />

- swaps 4,914 17,762 14,792 37,468<br />

Total loans from financial institutions 19,871 124,309 270,968 415,148<br />

Lease liabilities - fixed 1,724 6,896 35,342 43,962<br />

Loans from related parties - variable 9,263 43,295 187,208 239,766<br />

Total undiscounted financial liablities 30,858 174,500 493,518 698,876<br />

d) Cash flow interest rate risk<br />

Floating to fixed interest rate swaps are utilised to hedge against cash flow interest rate risks. Such interest rate swaps<br />

have the economic effect of converting borrowings from floating rates to fixed rates. Generally the consolidated entity<br />

raises long term borrowings at floating rates and swaps the specified notional principal amount into fixed rates. Under the<br />

interest rate swap contracts, the consolidated entity agrees with financial institutions to exchange, at specified intervals<br />

(mainly quarterly), the difference between contracted fixed rates and floating-rate interest amounts calculated by<br />

reference to agreed notional principal amounts.<br />

Interest payments on loans from financial institutions are fixed through the use of interest rate swaps and fixed interest<br />

rate loans. The loans in Australia are hedged on a weighted average of 90% (20<strong>10</strong>: 90%) of total debt and bear interest at<br />

a weighted average rate of 6.6% (20<strong>10</strong>: 6.6%) excluding credit margins. The variable portion of the interest payments is<br />

subject to change in floating interest rates and a 50 basis points increase results in $0.1m (20<strong>10</strong>: $0.1m) additional interest<br />

per annum. The carrying amount of borrowings is summarised below:<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Loans from financial institutions:<br />

- variable 27,740 27,708<br />

- hedged 252,933 234,023<br />

Total loans from financial institutions 280,673 261,731<br />

Lease liabilities - fixed 20,508 20,819<br />

Loans from related parties - variable 133,198 141,523<br />

Total 434,379 424,073<br />

The weighted average interest rates of the borrowings are summarised as:<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

% %<br />

Loans from financial institutions (excluding credit margins) 6.64 6.59<br />

Lease liabilities - fixed 6.90 6.90<br />

Loans from related parties - variable 6.94 7.<strong>10</strong><br />

72