Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> Fund<br />

The Delaware Studio Green property was due for refinancing in July 20<strong>11</strong>. As these borrowings were not refinanced by the<br />

due date, the Fund is in default of the debt facility agreement. The carrying amount of Property, plant and equipment has<br />

been written down to the fair value of the debt outstanding as at 30 June 20<strong>11</strong> of US$47.2m. Total impairment for the year<br />

on this property was US$14.7m.<br />

The city of Christchurch (location of University of Canterbury) continues to experience earthquake activity. There is<br />

uncertainty about the extent of economic impact on the city and the university and on the timeframe over which the city<br />

might rebuild and recover.<br />

Sensitivity Analysis<br />

If the discount rate used had been 1% higher than management’s estimate, the Fund would have recognised a further<br />

impairment of $13.9m.<br />

If the budgeted revenue was 5% lower each quarter than management’s estimate, the Fund would have recognised a<br />

further impairment of $13m.<br />

If the budgeted operating expenditure was 5% higher each quarter than management’s estimate, the Fund would have<br />

recognised no further impairment.<br />

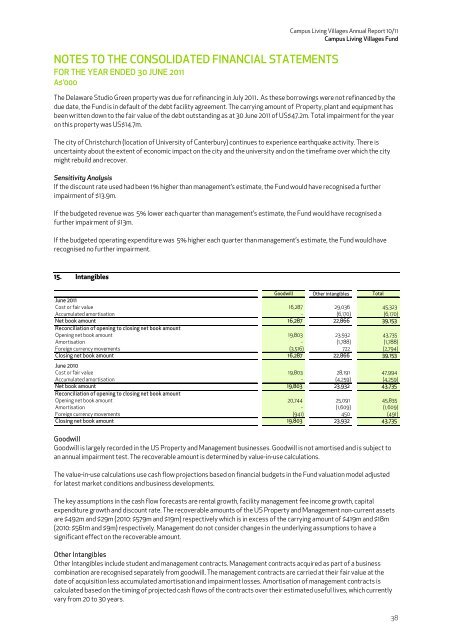

15. Intangibles<br />

Goodwill Other intangibles Total<br />

June 20<strong>11</strong><br />

Cost or fair value 16,287 29,036 45,323<br />

Accumulated amortisation - (6,170) (6,170)<br />

Net book amount 16,287 22,866 39,153<br />

Reconciliation of opening to closing net book amount<br />

Opening net book amount 19,803 23,932 43,735<br />

Amortisation - (1,788) (1,788)<br />

Foreign currency movements (3,516) 722 (2,794)<br />

Closing net book amount 16,287 22,866 39,153<br />

June 20<strong>10</strong><br />

Cost or fair value 19,803 28,191 47,994<br />

Accumulated amortisation - (4,259) (4,259)<br />

Net book amount 19,803 23,932 43,735<br />

Reconciliation of opening to closing net book amount<br />

Opening net book amount 20,744 25,091 45,835<br />

Amortisation - (1,609) (1,609)<br />

Foreign currency movements (941) 450 (491)<br />

Closing net book amount 19,803 23,932 43,735<br />

Goodwill<br />

Goodwill is largely recorded in the US Property and Management businesses. Goodwill is not amortised and is subject to<br />

an annual impairment test. The recoverable amount is determined by value-in-use calculations.<br />

The value-in-use calculations use cash flow projections based on financial budgets in the Fund valuation model adjusted<br />

for latest market conditions and business developments.<br />

The key assumptions in the cash flow forecasts are rental growth, facility management fee income growth, capital<br />

expenditure growth and discount rate. The recoverable amounts of the US Property and Management non-current assets<br />

are $492m and $29m (20<strong>10</strong>: $579m and $19m) respectively which is in excess of the carrying amount of $419m and $18m<br />

(20<strong>10</strong>: $561m and $9m) respectively. Management do not consider changes in the underlying assumptions to have a<br />

significant effect on the recoverable amount.<br />

Other Intangibles<br />

Other Intangibles include student and management contracts. Management contracts acquired as part of a business<br />

combination are recognised separately from goodwill. The management contracts are carried at their fair value at the<br />

date of acquisition less accumulated amortisation and impairment losses. Amortisation of management contracts is<br />

calculated based on the timing of projected cash flows of the contracts over their estimated useful lives, which currently<br />

vary from 20 to 30 years.<br />

38