Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> Overseas Trust<br />

Loans are made between entities within the Fund for the purposes of providing funding for capital expenditure or the net<br />

investment in subsidiaries. The currency of the loan is generally denominated in the currency of the lender and the loans<br />

are valued at balance sheet spot rate at each reporting date. As at 30 June 20<strong>11</strong> CLOT did not have any foreign currency<br />

denominated loans.<br />

b) Credit risk<br />

Credit risk arises from cash and cash equivalents, deposits with major banks and financial institutions, as well as credit<br />

exposure to students and universities, including outstanding receivables and committed transactions. Credit granted to<br />

customers is monitored regularly and past due receivables are followed up with customers. Student deposits are used as<br />

security and applied against outstanding amounts. Legal contracts provide the basis for collection of outstanding<br />

amounts relating to management and development contracts. Only banks and financial institutions with high credit ratings<br />

are used to deposit funds.<br />

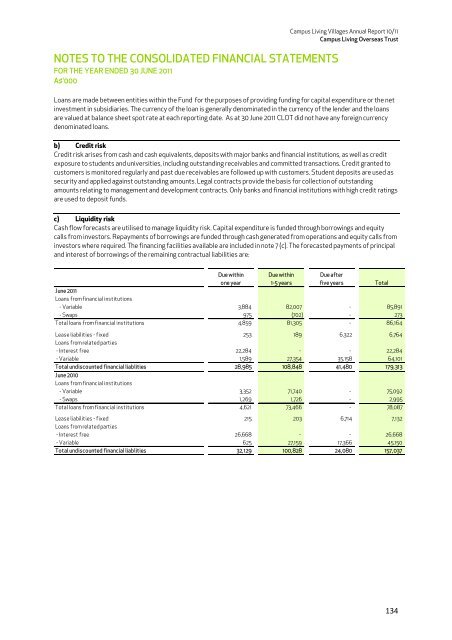

c) Liquidity risk<br />

Cash flow forecasts are utilised to manage liquidity risk. Capital expenditure is funded through borrowings and equity<br />

calls from investors. Repayments of borrowings are funded through cash generated from operations and equity calls from<br />

investors where required. The financing facilities available are included in note 7 (c). The forecasted payments of principal<br />

and interest of borrowings of the remaining contractual liabilities are:<br />

Due within<br />

one year<br />

Due within<br />

1-5 years<br />

Due after<br />

five years<br />

June 20<strong>11</strong><br />

Loans from financial institutions<br />

- Variable 3,884 82,007 - 85,891<br />

- Swaps 975 (702) - 273<br />

Total loans from financial institutions 4,859 81,305 - 86,164<br />

Lease liabilities - fixed 253 189 6,322 6,764<br />

Loans from related parties<br />

- Interest free 22,284 - - 22,284<br />

- Variable 1,589 27,354 35,158 64,<strong>10</strong>1<br />

Total undiscounted financial liablities 28,985 <strong>10</strong>8,848 41,480 179,313<br />

June 20<strong>10</strong><br />

Loans from financial institutions<br />

- Variable 3,352 71,740 - 75,092<br />

- Swaps 1,269 1,726 - 2,995<br />

Total loans from financial institutions 4,621 73,466 - 78,087<br />

Lease liabilities - fixed 215 203 6,714 7,132<br />

Loans from related parties<br />

- Interest free 26,668 - - 26,668<br />

- Variable 625 27,159 17,366 45,150<br />

Total undiscounted financial liablities 32,129 <strong>10</strong>0,828 24,080 157,037<br />

Total<br />

134