Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> Australia Trust<br />

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives)<br />

is determined using valuation techniques. The consolidated entity uses a variety of methods and makes assumptions that<br />

are based on market conditions existing at each balance date. Quoted market prices or dealer quotes for similar<br />

instruments are used for long-term debt instruments held. Other techniques, such as estimated discounted cash flows, are<br />

used to determine fair value for the remaining financial instruments. The fair value of interest rate swaps is calculated as<br />

the present value of the estimated future cash flows. The fair value of forward exchange contracts is determined using<br />

forward exchange market rates at the balance sheet date.<br />

The carrying value less impairment provision of trade receivables and payables are assumed to approximate their fair<br />

values due to their short-term nature. The fair value of financial liabilities for disclosure purposes is estimated by<br />

discounting the future contractual cash flows at the current market interest rate that is available to the consolidated<br />

entity for similar financial instruments.<br />

n) Deferred expenses and other capitalised costs<br />

New business and tender costs are deferred to the extent they can be separately identified, measured reliably and it is<br />

probable that the consolidated entity will realise the economic benefits. Further, the costs are to be recoverable out of<br />

future revenue and not relate to revenue which has already been brought into account and will contribute to the future<br />

earning capacity of the consolidated entity.<br />

Capitalised tender expenditure is transferred to property, plant and equipment in respect of owned sites and intangible<br />

assets for management contracts.<br />

Costs related to unsuccessful tenders are recognised as an expense in the period in which they are incurred.<br />

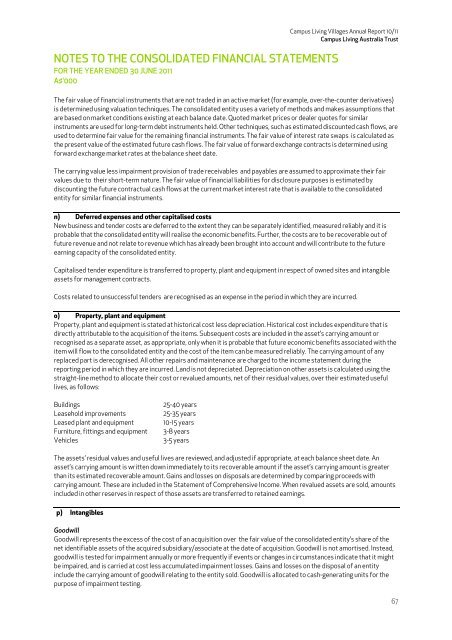

o) Property, plant and equipment<br />

Property, plant and equipment is stated at historical cost less depreciation. Historical cost includes expenditure that is<br />

directly attributable to the acquisition of the items. Subsequent costs are included in the asset’s carrying amount or<br />

recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the<br />

item will flow to the consolidated entity and the cost of the item can be measured reliably. The carrying amount of any<br />

replaced part is derecognised. All other repairs and maintenance are charged to the income statement during the<br />

reporting period in which they are incurred. Land is not depreciated. Depreciation on other assets is calculated using the<br />

straight-line method to allocate their cost or revalued amounts, net of their residual values, over their estimated useful<br />

lives, as follows:<br />

Buildings<br />

Leasehold improvements<br />

Leased plant and equipment<br />

Furniture, fittings and equipment<br />

Vehicles<br />

25-40 years<br />

25-35 years<br />

<strong>10</strong>-15 years<br />

3-8 years<br />

3-5 years<br />

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each balance sheet date. An<br />

asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater<br />

than its estimated recoverable amount. Gains and losses on disposals are determined by comparing proceeds with<br />

carrying amount. These are included in the Statement of Comprehensive Income. When revalued assets are sold, amounts<br />

included in other reserves in respect of those assets are transferred to retained earnings.<br />

p) Intangibles<br />

Goodwill<br />

Goodwill represents the excess of the cost of an acquisition over the fair value of the consolidated entity’s share of the<br />

net identifiable assets of the acquired subsidiary/associate at the date of acquisition. Goodwill is not amortised. Instead,<br />

goodwill is tested for impairment annually or more frequently if events or changes in circumstances indicate that it might<br />

be impaired, and is carried at cost less accumulated impairment losses. Gains and losses on the disposal of an entity<br />

include the carrying amount of goodwill relating to the entity sold. Goodwill is allocated to cash-generating units for the<br />

purpose of impairment testing.<br />

67