Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> Fund<br />

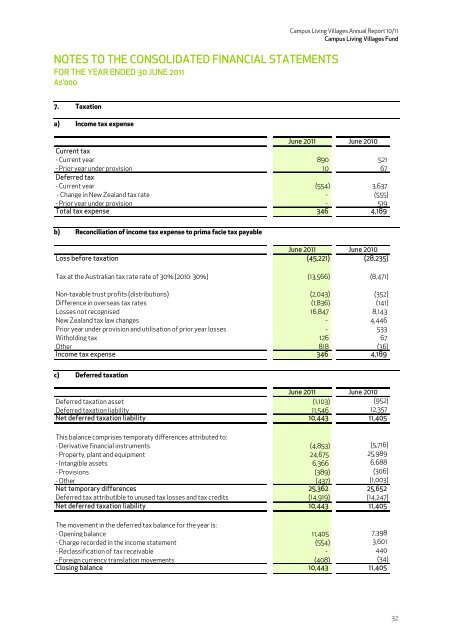

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

7. Taxation<br />

a) Income tax expense<br />

a) Income tax expense<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Current tax<br />

- Current year 890 521<br />

- Prior year under provision <strong>10</strong> 67<br />

Deferred tax<br />

- Current year (554) 3,637<br />

- Change in New Zealand tax rate - (555)<br />

- Prior year under provision - 519<br />

Total tax expense 346 4,189<br />

b) Reconciliation of income tax expense to prima facie tax payable<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Loss before taxation (45,221) (28,235)<br />

Tax at the Australian tax rate rate of 30% (20<strong>10</strong>: 30%) (13,566) (8,471)<br />

Non-taxable trust profits (distributions) (2,043) (352)<br />

Difference in overseas tax rates (1,836) (141)<br />

Losses not recognised 16,847 8,143<br />

New Zealand tax law changes - 4,446<br />

Prior year under provision and utilisation of prior year losses - 533<br />

Witholding tax 126 67<br />

Other 818 (36)<br />

Income tax expense 346 4,189<br />

c) Deferred taxation<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Deferred taxation asset (1,<strong>10</strong>3) (952)<br />

Deferred taxation liability <strong>11</strong>,546 12,357<br />

Net deferred taxation liability <strong>10</strong>,443 <strong>11</strong>,405<br />

This balance comprises temporaty differences attributed to:<br />

- Derivative financial instruments (4,853) (5,716)<br />

- Property, plant and equipment 24,675 25,989<br />

- Intangible assets 6,366 6,688<br />

- Provisions (389) (306)<br />

- Other (437) (1,003)<br />

Net temporary differences 25,362 25,652<br />

Deferred tax attributible to unused tax losses and tax credits (14,919) (14,247)<br />

Net deferred taxation liability <strong>10</strong>,443 <strong>11</strong>,405<br />

The movement in the deferred tax balance for the year is:<br />

- Opening balance <strong>11</strong>,405 7,398<br />

- Charge recorded in the income statement (554) 3,601<br />

- Reclassification of tax receivable - 440<br />

- Foreign currency translation movements (408) (34)<br />

Closing balance <strong>10</strong>,443 <strong>11</strong>,405<br />

32