Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> Fund<br />

Revised IAS 1 Presentation of Financial Statements (effective 1 July 2012). In June 20<strong>11</strong>, the IASB made an amendment to<br />

IAS 1 Presentation of Financial Statements. The AASB is expected to make equivalent changes to AASB <strong>10</strong>1 shortly. The<br />

amendment requires entities to separate items presented in other comprehensive income into two groups, based on<br />

whether they may be recycled to profit or loss in the future. It will not affect the measurement of any of the items<br />

recognised in the balance sheet or the profit or loss in the current period. The Fund intends to adopt the new standard<br />

from 1 July 2012.<br />

Certain new accounting standards and interpretations have been published that are not mandatory for the 30 June 20<strong>11</strong><br />

reporting period other than those mentioned above. The Fund has assessed the new standards and interpretations as<br />

unlikely to have a material impact.<br />

2. Financial risk management<br />

The Fund’s activities expose it to a variety of financial risks, which include market risk (currency risk and cash flow interest<br />

rate risk), credit risk and liquidity risk. The Fund’s overall risk management program focuses on the unpredictability of<br />

financial markets and seeks to minimise potential adverse effects on the financial performance of the Fund.<br />

The Fund uses derivative financial instruments such as interest rate swaps to mitigate cash flow interest rate risk.<br />

The Fund uses different methods to measure different types of risk to which it is exposed. These methods include<br />

sensitivity analysis in the case of interest rate and foreign exchange risk; age analysis for credit risk; and cash flow<br />

forecasts for liquidity risks.<br />

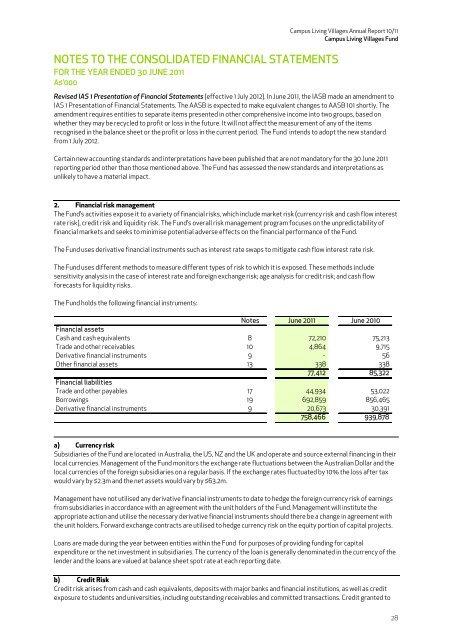

The Fund holds the following financial instruments:<br />

Notes June 20<strong>11</strong> June 20<strong>10</strong><br />

Financial assets<br />

Cash and cash equivalents 8 72,2<strong>10</strong> 75,213<br />

Trade and other receivables <strong>10</strong> 4,864 9,715<br />

Derivative financial instruments 9 - 56<br />

Other financial assets 13 338 338<br />

77,412 85,322<br />

Financial liabilities<br />

Trade and other payables 17 44,934 53,022<br />

Borrowings 19 692,859 856,465<br />

Derivative financial instruments 9 20,673 30,391<br />

758,466 939,878<br />

a) Currency risk<br />

Subsidiaries of the Fund are located in Australia, the US, NZ and the UK and operate and source external financing in their<br />

local currencies. Management of the Fund monitors the exchange rate fluctuations between the Australian Dollar and the<br />

local currencies of the foreign subsidiaries on a regular basis. If the exchange rates fluctuated by <strong>10</strong>% the loss after tax<br />

would vary by $2.3m and the net assets would vary by $63.2m.<br />

Management have not utilised any derivative financial instruments to date to hedge the foreign currency risk of earnings<br />

from subsidiaries in accordance with an agreement with the unit holders of the Fund. Management will institute the<br />

appropriate action and utilise the necessary derivative financial instruments should there be a change in agreement with<br />

the unit holders. Forward exchange contracts are utilised to hedge currency risk on the equity portion of capital projects.<br />

Loans are made during the year between entities within the Fund for purposes of providing funding for capital<br />

expenditure or the net investment in subsidiaries. The currency of the loan is generally denominated in the currency of the<br />

lender and the loans are valued at balance sheet spot rate at each reporting date.<br />

b) Credit Risk<br />

Credit risk arises from cash and cash equivalents, deposits with major banks and financial institutions, as well as credit<br />

exposure to students and universities, including outstanding receivables and committed transactions. Credit granted to<br />

28