Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

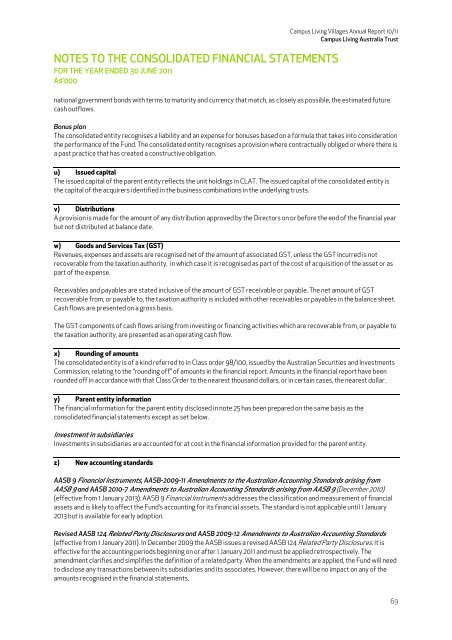

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> Australia Trust<br />

national government bonds with terms to maturity and currency that match, as closely as possible, the estimated future<br />

cash outflows.<br />

Bonus plan<br />

The consolidated entity recognises a liability and an expense for bonuses based on a formula that takes into consideration<br />

the performance of the Fund. The consolidated entity recognises a provision where contractually obliged or where there is<br />

a past practice that has created a constructive obligation.<br />

u) Issued capital<br />

The issued capital of the parent entity reflects the unit holdings in CLAT. The issued capital of the consolidated entity is<br />

the capital of the acquirers identified in the business combinations in the underlying trusts.<br />

v) Distributions<br />

A provision is made for the amount of any distribution approved by the Directors on or before the end of the financial year<br />

but not distributed at balance date.<br />

w) Goods and Services Tax (GST)<br />

Revenues, expenses and assets are recognised net of the amount of associated GST, unless the GST incurred is not<br />

recoverable from the taxation authority, in which case it is recognised as part of the cost of acquisition of the asset or as<br />

part of the expense.<br />

Receivables and payables are stated inclusive of the amount of GST receivable or payable. The net amount of GST<br />

recoverable from, or payable to, the taxation authority is included with other receivables or payables in the balance sheet.<br />

Cash flows are presented on a gross basis.<br />

The GST components of cash flows arising from investing or financing activities which are recoverable from, or payable to<br />

the taxation authority, are presented as an operating cash flow.<br />

x) Rounding of amounts<br />

The consolidated entity is of a kind referred to in Class order 98/<strong>10</strong>0, issued by the Australian Securities and Investments<br />

Commission, relating to the ‘’rounding off’’ of amounts in the financial report. Amounts in the financial report have been<br />

rounded off in accordance with that Class Order to the nearest thousand dollars, or in certain cases, the nearest dollar.<br />

y) Parent entity information<br />

The financial information for the parent entity disclosed in note 25 has been prepared on the same basis as the<br />

consolidated financial statements except as set below.<br />

Investment in subsidiaries<br />

Investments in subsidiaries are accounted for at cost in the financial information provided for the parent entity.<br />

z) New accounting standards<br />

AASB 9 Financial Instruments, AASB-2009-<strong>11</strong> Amendments to the Australian Accounting Standards arising from<br />

AASB 9 and AASB 20<strong>10</strong>-7 Amendments to Australian Accounting Standards arising from AASB 9 (December 20<strong>10</strong>)<br />

(effective from 1 January 2013). AASB 9 Financial Instruments addresses the classification and measurement of financial<br />

assets and is likely to affect the Fund’s accounting for its financial assets. The standard is not applicable until 1 January<br />

2013 but is available for early adoption.<br />

Revised AASB 124 Related Party Disclosures and AASB 2009-12 Amendments to Australian Accounting Standards<br />

(effective from 1 January 20<strong>11</strong>). In December 2009 the AASB issues a revised AASB 124 Related Party Disclosures. It is<br />

effective for the accounting periods beginning on or after 1 January 20<strong>11</strong> and must be applied retrospectively. The<br />

amendment clarifies and simplifies the definition of a related party. When the amendments are applied, the Fund will need<br />

to disclose any transactions between its subsidiaries and its associates. However, there will be no impact on any of the<br />

amounts recognised in the financial statements.<br />

69