Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Annual Report 10/11 - Campus Living Villages

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE 20<strong>11</strong><br />

A$’000<br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> <strong>Annual</strong> <strong>Report</strong> <strong>10</strong>/<strong>11</strong><br />

<strong>Campus</strong> <strong>Living</strong> <strong>Villages</strong> Fund<br />

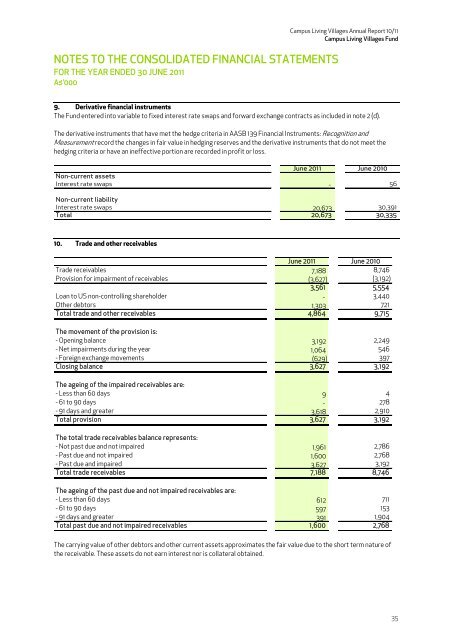

9. Derivative financial instruments<br />

The Fund entered into variable to fixed interest rate swaps and forward exchange contracts as included in note 2 (d).<br />

The derivative instruments that have met the hedge criteria in AASB 139 Financial Instruments: Recognition and<br />

Measurement record the changes in fair value in hedging reserves and the derivative instruments that do not meet the<br />

hedging criteria or have an ineffective portion are recorded in profit or loss.<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Non-current assets<br />

Interest rate swaps - 56<br />

Non-current liability<br />

Interest rate swaps 20,673 30,391<br />

Total 20,673 30,335<br />

<strong>10</strong>. Trade and other receivables<br />

June 20<strong>11</strong> June 20<strong>10</strong><br />

Trade receivables 7,188 8,746<br />

Provision for impairment of receivables (3,627) (3,192)<br />

3,561 5,554<br />

Loan to US non-controlling shareholder - 3,440<br />

Other debtors 1,303 721<br />

Total trade and other receivables 4,864 9,715<br />

The movement of the provision is:<br />

- Opening balance 3,192 2,249<br />

- Net impairments during the year 1,064 546<br />

- Foreign exchange movements (629) 397<br />

Closing balance 3,627 3,192<br />

The ageing of the impaired receivables are:<br />

- Less than 60 days 9 4<br />

- 61 to 90 days - 278<br />

- 91 days and greater 3,618 2,9<strong>10</strong><br />

Total provision 3,627 3,192<br />

The total trade receivables balance represents:<br />

- Not past due and not impaired 1,961 2,786<br />

- Past due and not impaired 1,600 2,768<br />

- Past due and impaired 3,627 3,192<br />

Total trade receivables 7,188 8,746<br />

The ageing of the past due and not impaired receivables are:<br />

- Less than 60 days 612 7<strong>11</strong><br />

- 61 to 90 days 597 153<br />

- 91 days and greater 391 1,904<br />

Total past due and not impaired receivables 1,600 2,768<br />

The carrying value of other debtors and other current assets approximates the fair value due to the short term nature of<br />

the receivable. These assets do not earn interest nor is collateral obtained.<br />

35