MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Next we compare Ireland and Portugal and try to<br />

identify the potential threats and opportunities in the<br />

coming months. Starting with the funding needs and<br />

issuance calendar in these countries, Ireland has<br />

already reached 2010’s funding needs and has<br />

actually started pre-funding for 2011. Despite that,<br />

NTMA officials have stated that there is no plan to<br />

skip an auction and thus we could have some more<br />

prefunding in the remainder of the year, most likely<br />

two more auctions (depending on market conditions).<br />

On the other hand, Portugal has completed 90% of<br />

its issuance target (EUR 19bn of EUR 21bn) and we<br />

expect another EUR 2bn before year-end. Hence,<br />

funding pressures will be limited in the remainder of<br />

the year while the main focus will be on the budget<br />

reports and the projections for 2011 funding needs.<br />

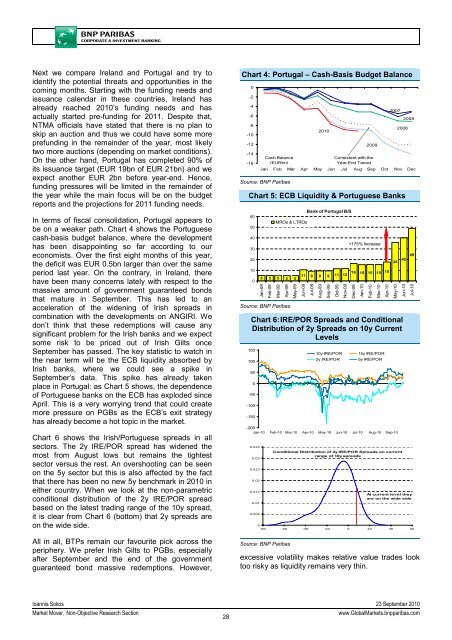

In terms of fiscal consolidation, Portugal appears to<br />

be on a weaker path. Chart 4 shows the Portuguese<br />

cash-basis budget balance, where the development<br />

has been disappointing so far according to our<br />

economists. Over the first eight months of this year,<br />

the deficit was EUR 0.5bn larger than over the same<br />

period last year. On the contrary, in Ireland, there<br />

have been many concerns lately with respect to the<br />

massive amount of government guaranteed bonds<br />

that mature in September. This has led to an<br />

acceleration of the widening of Irish spreads in<br />

combination with the developments on ANGIRI. We<br />

don’t think that these redemptions will cause any<br />

significant problem for the Irish banks and we expect<br />

some risk to be priced out of Irish Gilts once<br />

September has passed. The key statistic to watch in<br />

the near term will be the ECB liquidity absorbed by<br />

Irish banks, where we could see a spike in<br />

September’s data. This spike has already taken<br />

place in Portugal: as Chart 5 shows, the dependence<br />

of Portuguese banks on the ECB has exploded since<br />

April. This is a very worrying trend that could create<br />

more pressure on PGBs as the ECB’s exit strategy<br />

has already become a hot topic in the market.<br />

Chart 6 shows the Irish/Portuguese spreads in all<br />

sectors. The 2y IRE/POR spread has widened the<br />

most from August lows but remains the tightest<br />

sector versus the rest. An overshooting can be seen<br />

on the 5y sector but this is also affected by the fact<br />

that there has been no new 5y benchmark in 2010 in<br />

either country. When we look at the non-parametric<br />

conditional distribution of the 2y IRE/POR spread<br />

based on the latest trading range of the 10y spread,<br />

it is clear from Chart 6 (bottom) that 2y spreads are<br />

on the wide side.<br />

All in all, BTPs remain our favourite pick across the<br />

periphery. We prefer Irish Gilts to PGBs, especially<br />

after September and the end of the government<br />

guaranteed bond massive redemptions. However,<br />

Chart 4: Portugal – Cash-Basis Budget Balance<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

-12<br />

-14<br />

-16<br />

Cash Balance<br />

(EURbn)<br />

2010<br />

2009<br />

Consistent with the<br />

Year-End Target<br />

2007<br />

2006<br />

2008<br />

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 5: ECB Liquidity & Portuguese Banks<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

5 5 5 5 5<br />

Jan-09<br />

Feb-09<br />

Mar-09<br />

Apr-09<br />

Source: <strong>BNP</strong> Paribas<br />

MROs & LTROs<br />

May-09<br />

Bank of Portugal B/S<br />

11 9 9 9 11 12 16 15 15 15 18 36 40 49<br />

Jun-09<br />

Jul-09<br />

Aug-09<br />

Sep-09<br />

excessive volatility makes relative value trades look<br />

too risky as liquidity remains very thin.<br />

Oct-09<br />

Nov-09<br />

+175% Increase<br />

Chart 6: IRE/POR Spreads and Conditional<br />

Distribution of 2y Spreads on 10y Current<br />

Levels<br />

150<br />

100<br />

50<br />

0<br />

-50<br />

-100<br />

-150<br />

-200<br />

Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10 Aug-10 Sep-10<br />

0.035<br />

0.03<br />

0.025<br />

0.02<br />

0.015<br />

0.01<br />

0.005<br />

0<br />

10y IRE/POR<br />

2y IRE/POR<br />

Dec-09<br />

Jan-10<br />

Feb-10<br />

Mar-10<br />

15y IRE/POR<br />

5y IRE/POR<br />

-80 -60 -40 -20 0 20 40 60<br />

Source: <strong>BNP</strong> Paribas<br />

Conditional Distribution of 2y IRE/POR Spreads on current<br />

range of 10y spreads<br />

Apr-10<br />

May-10<br />

Jun-10<br />

Jul-10<br />

At current level they<br />

are on the wide side<br />

Ioannis Sokos 23 September 2010<br />

Market Mover, Non-Objective Research Section<br />

28<br />

www.GlobalMarkets.bnpparibas.com