MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EUR Covered Bonds: Market Update<br />

• Activity in the primary market has delivered<br />

several good signs: despite the end of the ECB<br />

CBPP, new EUR issuance has soared in<br />

September and the average size is back to<br />

almost EUR 1bn.<br />

• After an easing in ASW around July/August,<br />

mainly due to the summer lull, covered bonds in<br />

peripheral markets have re-widened since late<br />

August.<br />

• STRATEGY: 1) Underweight Irish and<br />

Portuguese covered bonds, which we expect to<br />

widen further; 2) overweight Spanish and Italian<br />

covered bonds which should start compressing<br />

again; and 3) PGB 4y is priced cheaper than<br />

Caixa Geral De Depositos Covered 4y (CXGD)!<br />

CXGD/PGB 4y and BKIR/GILT 5y ASW<br />

differentials should widen by at least 55bp and<br />

44bp respectively.<br />

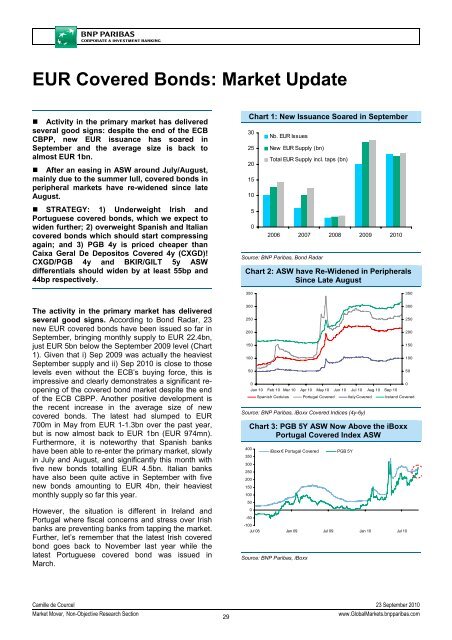

Chart 1: New Issuance Soared in September<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Nb. EUR Issues<br />

New EUR Supply (bn)<br />

Total EUR Supply incl. taps (bn)<br />

2006 2007 2008 2009 2010<br />

Source: <strong>BNP</strong> Paribas, Bond Radar<br />

Chart 2: ASW have Re-Widened in Peripherals<br />

Since Late August<br />

350<br />

350<br />

The activity in the primary market has delivered<br />

several good signs. According to Bond Radar, 23<br />

new EUR covered bonds have been issued so far in<br />

September, bringing monthly supply to EUR 22.4bn,<br />

just EUR 5bn below the September 2009 level (Chart<br />

1). Given that i) Sep 2009 was actually the heaviest<br />

September supply and ii) Sep 2010 is close to those<br />

levels even without the ECB’s buying force, this is<br />

impressive and clearly demonstrates a significant reopening<br />

of the covered bond market despite the end<br />

of the ECB CBPP. Another positive development is<br />

the recent increase in the average size of new<br />

covered bonds. The latest had slumped to EUR<br />

700m in May from EUR 1-1.3bn over the past year,<br />

but is now almost back to EUR 1bn (EUR 974mn).<br />

Furthermore, it is noteworthy that Spanish banks<br />

have been able to re-enter the primary market, slowly<br />

in July and August, and significantly this month with<br />

five new bonds totalling EUR 4.5bn. Italian banks<br />

have also been quite active in September with five<br />

new bonds amounting to EUR 4bn, their heaviest<br />

monthly supply so far this year.<br />

However, the situation is different in Ireland and<br />

Portugal where fiscal concerns and stress over Irish<br />

banks are preventing banks from tapping the market.<br />

Further, let’s remember that the latest Irish covered<br />

bond goes back to November last year while the<br />

latest Portuguese covered bond was issued in<br />

March.<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Jan 10 Feb 10 Mar 10 Apr 10 May 10 Jun 10 Jul 10 Aug 10 Sep 10<br />

Spanish Cedulas Portugal Covered Italy Covered Ireland Covered<br />

Source: <strong>BNP</strong> Paribas, iBoxx Covered Indices (4y-6y)<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

-50<br />

Chart 3: PGB 5Y ASW Now Above the iBoxx<br />

Portugal Covered Index ASW<br />

50<br />

0<br />

iBoxx € Portugal Covered<br />

-100<br />

Jul 08 Jan 09 Jul 09 Jan 10 Jul 10<br />

Source: <strong>BNP</strong> Paribas, iBoxx<br />

PGB 5Y<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Camille de Courcel 23 September 2010<br />

Market Mover, Non-Objective Research Section<br />

29<br />

www.GlobalMarkets.bnpparibas.com