MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

US FOMC: Just Doing My Job<br />

• The FOMC delivered a statement at its<br />

September meeting that formalised a bias<br />

toward easing, largely as expected.<br />

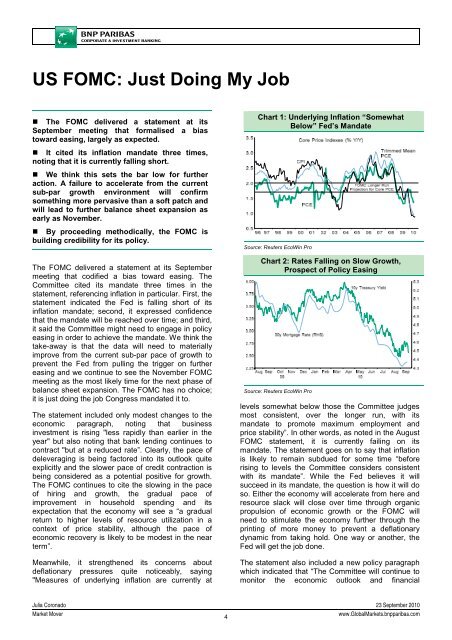

Chart 1: Underlying Inflation “Somewhat<br />

Below” Fed’s Mandate<br />

• It cited its inflation mandate three times,<br />

noting that it is currently falling short.<br />

• We think this sets the bar low for further<br />

action. A failure to accelerate from the current<br />

sub-par growth environment will confirm<br />

something more pervasive than a soft patch and<br />

will lead to further balance sheet expansion as<br />

early as November.<br />

• By proceeding methodically, the FOMC is<br />

building credibility for its policy.<br />

The FOMC delivered a statement at its September<br />

meeting that codified a bias toward easing. The<br />

Committee cited its mandate three times in the<br />

statement, referencing inflation in particular. First, the<br />

statement indicated the Fed is falling short of its<br />

inflation mandate; second, it expressed confidence<br />

that the mandate will be reached over time; and third,<br />

it said the Committee might need to engage in policy<br />

easing in order to achieve the mandate. We think the<br />

take-away is that the data will need to materially<br />

improve from the current sub-par pace of growth to<br />

prevent the Fed from pulling the trigger on further<br />

easing and we continue to see the November FOMC<br />

meeting as the most likely time for the next phase of<br />

balance sheet expansion. The FOMC has no choice;<br />

it is just doing the job Congress mandated it to.<br />

The statement included only modest changes to the<br />

economic paragraph, noting that business<br />

investment is rising "less rapidly than earlier in the<br />

year" but also noting that bank lending continues to<br />

contract "but at a reduced rate”. Clearly, the pace of<br />

deleveraging is being factored into its outlook quite<br />

explicitly and the slower pace of credit contraction is<br />

being considered as a potential positive for growth.<br />

The FOMC continues to cite the slowing in the pace<br />

of hiring and growth, the gradual pace of<br />

improvement in household spending and its<br />

expectation that the economy will see a “a gradual<br />

return to higher levels of resource utilization in a<br />

context of price stability, although the pace of<br />

economic recovery is likely to be modest in the near<br />

term”.<br />

Meanwhile, it strengthened its concerns about<br />

deflationary pressures quite noticeably, saying<br />

"Measures of underlying inflation are currently at<br />

Source: Reuters EcoWin Pro<br />

Chart 2: Rates Falling on Slow Growth,<br />

Prospect of Policy Easing<br />

Source: Reuters EcoWin Pro<br />

levels somewhat below those the Committee judges<br />

most consistent, over the longer run, with its<br />

mandate to promote maximum employment and<br />

price stability”. In other words, as noted in the August<br />

FOMC statement, it is currently failing on its<br />

mandate. The statement goes on to say that inflation<br />

is likely to remain subdued for some time “before<br />

rising to levels the Committee considers consistent<br />

with its mandate”. While the Fed believes it will<br />

succeed in its mandate, the question is how it will do<br />

so. Either the economy will accelerate from here and<br />

resource slack will close over time through organic<br />

propulsion of economic growth or the FOMC will<br />

need to stimulate the economy further through the<br />

printing of more money to prevent a deflationary<br />

dynamic from taking hold. One way or another, the<br />

Fed will get the job done.<br />

The statement also included a new policy paragraph<br />

which indicated that “The Committee will continue to<br />

monitor the economic outlook and financial<br />

Julia Coronado 23 September 2010<br />

Market Mover<br />

4<br />

www.GlobalMarkets.bnpparibas.com