MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Inflation: Bring QE to Europe!<br />

• GLOBAL: Mixed reception to dovish CBs<br />

• EUR: Stay Negative. Keep long EUR/FRF.<br />

• USD: Volatile. Low RY. 5/10y BE flattener.<br />

• GBP: Correction in the Gilt rally. 1y rich.<br />

GLOBAL: Central bank rhetoric from the US and UK<br />

remains very dovish. The FOMC is “prepared to<br />

provide additional accommodation if needed to<br />

support the economic recovery and to return inflation,<br />

over time, to levels consistent with its mandate”. This<br />

has fuelled a rally in bonds although equities are<br />

weaker following their initial positive reaction.<br />

Commodities have not benefited hugely from USD<br />

weakness given struggling risk appetite although<br />

enhanced liquidity should help asset and commodity<br />

markets to perform. Real yields offer more protection<br />

from a depreciating currency and the inflationary<br />

impact of quantitative easing. Indeed, US real yields<br />

have rallied by 30bp in a couple of sessions.<br />

Between 9 and 23 March 2009 – the onset of QE –<br />

we also saw a tremendous rally in real yields and<br />

breakevens did not suffer much as TIPS were<br />

included in the programme whilst BEs rose in the<br />

eventual yield sell-off – Chart 1. The UK issued<br />

550mn UKTi-27 via mini-tender whilst Tesoro will reopen<br />

BTPei-21 for up to EUR 1.5bn. Breakevens<br />

suffered elsewhere and we continue to find EUR and<br />

especially FRF breakevens rich and exposed here.<br />

EUR: Core/peripheral spreads generally remain<br />

under widening pressure, causing disparity in<br />

linker/breakeven performance. BTPeis breakevens<br />

have outperformed core linkers at the front end but<br />

have underperformed materially at 7-15y maturities<br />

with real spreads widening much more than nominal<br />

ones. Supply is partly to blame, with 7y+ BTPeis<br />

suffering on the announcement of EUR 1.5bn BTPei-<br />

21 supply next week. Whilst the BTPei-21 has<br />

underperformed vs. OATei, it has outperformed vs.<br />

BTPei-23. The BTPei-21 may look attractive in the<br />

inflation and ASW discount curve, but it is hit by the<br />

richness of its nominal (BTP Mar-21 and the<br />

cheapness of BTP Aug-23, nominal comparator for<br />

BTPei-23). After adjusting for this, we find the BTPei-<br />

21 no longer looks cheap vs. either OATei or BTPei<br />

curves and we expect a further concession – both<br />

outright and in relative terms ahead of its auction on<br />

Tuesday 28 September. BTPei-21 offers amongst<br />

the highest real ASW on the curve, whilst the bond<br />

does have a closer-to-money inflation floor. OATi<br />

breakevens are underperforming their EUR<br />

counterparts sharply at the front end, as we called<br />

for. Our long OBLei-13/short OATi-13 BE spread has<br />

moved above -40bp from -45bp mid last Friday –<br />

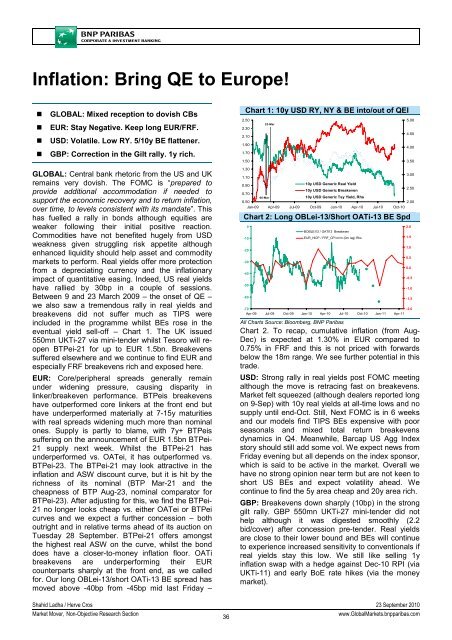

Chart 1: 10y USD RY, NY & BE into/out of QEI<br />

2.50<br />

2.30<br />

2.10<br />

1.90<br />

1.70<br />

1.50<br />

23-Mar<br />

1.30<br />

3.00<br />

1.10<br />

0.90<br />

10y USD Generic Real Yield<br />

2.50<br />

10y USD Generic Breakeven<br />

0.70<br />

06-Mar<br />

10y USD Generic Tsy Yield, Rhs<br />

0.50<br />

2.00<br />

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10<br />

Chart 2: Long OBLei-13/Short OATi-13 BE Spd<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

-60<br />

BOBLEI13 / OATI13 Breakeven<br />

EUR_HICP / FRF_CPI m/m (0m lag) Rhs<br />

-70<br />

-2.0<br />

Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11<br />

All Charts Source: Bloomberg, <strong>BNP</strong> Paribas<br />

Chart 2. To recap, cumulative inflation (from Aug-<br />

Dec) is expected at 1.30% in EUR compared to<br />

0.75% in FRF and this is not priced with forwards<br />

below the 18m range. We see further potential in this<br />

trade.<br />

USD: Strong rally in real yields post FOMC meeting<br />

although the move is retracing fast on breakevens.<br />

Market felt squeezed (although dealers reported long<br />

on 9-Sep) with 10y real yields at all-time lows and no<br />

supply until end-Oct. Still, Next FOMC is in 6 weeks<br />

and our models find TIPS BEs expensive with poor<br />

seasonals and mixed total return breakevens<br />

dynamics in Q4. Meanwhile, Barcap US Agg Index<br />

story should still add some vol. We expect news from<br />

Friday evening but all depends on the index sponsor,<br />

which is said to be active in the market. Overall we<br />

have no strong opinion near term but are not keen to<br />

short US BEs and expect volatility ahead. We<br />

continue to find the 5y area cheap and 20y area rich.<br />

GBP: Breakevens down sharply (10bp) in the strong<br />

gilt rally. GBP 550mn UKTi-27 mini-tender did not<br />

help although it was digested smoothly (2.2<br />

bid/cover) after concession pre-tender. Real yields<br />

are close to their lower bound and BEs will continue<br />

to experience increased sensitivity to conventionals if<br />

real yields stay this low. We still like selling 1y<br />

inflation swap with a hedge against Dec-10 RPI (via<br />

UKTi-11) and early BoE rate hikes (via the money<br />

market).<br />

5.00<br />

4.50<br />

4.00<br />

3.50<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

-1.0<br />

-1.5<br />

Shahid Ladha / Herve Cros 23 September 2010<br />

Market Mover, Non-Objective Research Section<br />

36<br />

www.GlobalMarkets.bnpparibas.com