MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Liquidity-Driven FX Markets<br />

• Global asset markets are set to overshoot as<br />

G4 central banks increase excessive reserves<br />

while local market monetary authorities try to<br />

control the pace at which their currencies<br />

appreciate.<br />

• Consequently, liquidity is seeking out<br />

investment opportunities.<br />

• Meanwhile, global rebalancing remains a<br />

theme. China has become the trend setter for<br />

successful rebalancing, with its improving<br />

domestic demand conditions offering export<br />

opportunities for the country’s trading partners<br />

• Commodity currencies will remain strong.<br />

The EUR will sail in the slipstream of the sharply<br />

rising AUD.<br />

• The CAD will rally should markets convert<br />

the theme of ‘Japanisation’ into a bullish asset<br />

theme.<br />

• GBPSEK shorts are a conservative way to<br />

trade the bullish China story as the UK’s trading<br />

relationship with China is less developed than<br />

Sweden’s.<br />

US money market outflows will keep the USD<br />

under selling pressure<br />

The USD is likely to remain under selling pressure for<br />

the rest of this year as cheap USD liquidity finds its<br />

way into higher-yielding asset classes. Money market<br />

outflows into local market funds have reduced money<br />

market holdings, but with US rates set to stay low in<br />

the years ahead, there will be little incentive to keep<br />

funds in USD-denominated debt. The rebalancing of<br />

the global economy will keep return expectations for<br />

local markets high, but the highly leveraged<br />

economies in the West will have to save in order to<br />

bring down debt ratios. These savings will be partly<br />

stashed in domestic financial instruments, keeping<br />

bond yields low and reducing the attractiveness of<br />

these assets to foreign investors. Reduced inflows<br />

from abroad will put the USD under selling pressure.<br />

Risk of confidence crisis in US assets is small<br />

Hence, the long-term trend of the USD seems locked<br />

to the downside. However, the real effective<br />

exchange rate of the USD has already fallen by 20%<br />

over the past decade. Nonetheless, an undervalued<br />

exchange rate can become even more undervalued<br />

in extreme situations and an extreme situation could<br />

arise should the US face a buyers’ strike with regard<br />

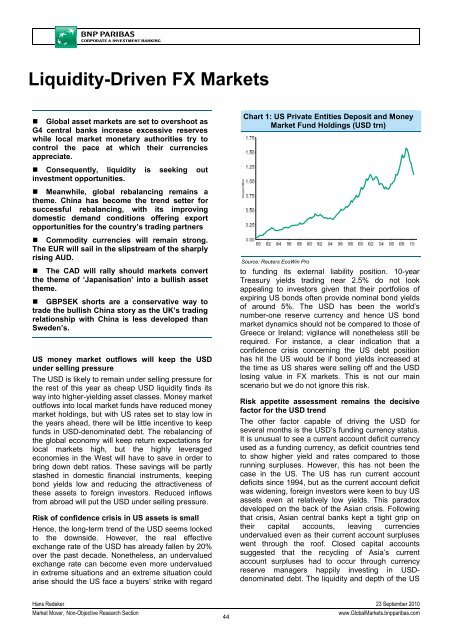

Chart 1: US Private Entities Deposit and Money<br />

Market Fund Holdings (USD trn)<br />

Source: Reuters EcoWin Pro<br />

to funding its external liability position. 10-year<br />

Treasury yields trading near 2.5% do not look<br />

appealing to investors given that their portfolios of<br />

expiring US bonds often provide nominal bond yields<br />

of around 5%. The USD has been the world’s<br />

number-one reserve currency and hence US bond<br />

market dynamics should not be compared to those of<br />

Greece or Ireland; vigilance will nonetheless still be<br />

required. For instance, a clear indication that a<br />

confidence crisis concerning the US debt position<br />

has hit the US would be if bond yields increased at<br />

the time as US shares were selling off and the USD<br />

losing value in FX markets. This is not our main<br />

scenario but we do not ignore this risk.<br />

Risk appetite assessment remains the decisive<br />

factor for the USD trend<br />

The other factor capable of driving the USD for<br />

several months is the USD’s funding currency status.<br />

It is unusual to see a current account deficit currency<br />

used as a funding currency, as deficit countries tend<br />

to show higher yield and rates compared to those<br />

running surpluses. However, this has not been the<br />

case in the US. The US has run current account<br />

deficits since 1994, but as the current account deficit<br />

was widening, foreign investors were keen to buy US<br />

assets even at relatively low yields. This paradox<br />

developed on the back of the Asian crisis. Following<br />

that crisis, Asian central banks kept a tight grip on<br />

their capital accounts, leaving currencies<br />

undervalued even as their current account surpluses<br />

went through the roof. Closed capital accounts<br />

suggested that the recycling of Asia’s current<br />

account surpluses had to occur through currency<br />

reserve managers happily investing in USDdenominated<br />

debt. The liquidity and depth of the US<br />

Hans Redeker 23 September 2010<br />

Market Mover, Non-Objective Research Section<br />

44<br />

www.GlobalMarkets.bnpparibas.com