MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

have been happy to buy the roll to position on the<br />

riskier new index.<br />

In addition to these technical factors, we continue to<br />

think that MAIN trades too wide relative to various<br />

other markets (EUROSTOXX 600 in particular) and<br />

do not rule out a tightening of 5 to 10bp, all other<br />

things being equal. A complete realignment to equity<br />

and volatility indices would imply an outperformance<br />

of about 13bp. It is also worth noting the further drop<br />

in 1-week and 1-month correlations between MAIN<br />

and SOVX; we do not expect the two indices to<br />

completely de-correlate as it is the case for XO but<br />

we see room for MAIN to outperform in the short run.<br />

What’s next? We think compression will remain one<br />

of the main themes in the coming weeks and months<br />

and are now waiting for a new entry point to re-enter<br />

the XO/MAIN trade. In terms of ratio, we would aim<br />

at 4.80x on the new Series, i.e. 110 on MAIN vs. 528<br />

in XO.<br />

SUB/SEN:<br />

With the level of volatility in Ireland CDS and Irish<br />

banks still very elevated – the Sovereign CDS is<br />

80bp wider this week; AIB and BKIR about 120bp<br />

wider – and the level of correlation between SOVX<br />

and FIN SEN still high, we had this week a massive<br />

underperformance of FIN SEN relative to MAIN and<br />

relative to FIN SUB, the latter being perceived as<br />

less systemic. On a weekly basis, FIN SEN and SUB<br />

are respectively wider by 21bp and 26bp; as a result,<br />

the SUB/SEN ratio reached a new 5-month low of<br />

1.47x.<br />

In cash, the momentum has turned much less bullish<br />

for Lower Tier 2, in particular for bullet bonds. We<br />

also saw some profit taking on Tier 1 after the<br />

massive performance of the asset class since the<br />

beginning of the month (120bp in two weeks) but the<br />

tone remains constructive overall, thanks to strong<br />

technicals. Note that the regulatory changes are also<br />

unfolding into the relative performance of Banks in<br />

equity markets and the sector comes as the clear<br />

underperformer on a weekly and monthly basis.<br />

What’s the call?<br />

The more mixed picture in Bank Capital instruments<br />

– T1 being the exception – is making us expect some<br />

underperformance of FIN SUB; given the recent<br />

collapse of the SUB/SEN ratio, we think it makes<br />

sense to take profit on our compression trade “long<br />

risk FIN SUB / Short risk FIN SEN x1.5”, although we<br />

reckon that further pressure on weaker sovereigns<br />

could further compress the ratio. Net gain on the<br />

trade: 11bp01 .<br />

Chart 4: 1m performance by sector (EUROSTOXX 600)<br />

14.0%<br />

12.0%<br />

10.0%<br />

8.0%<br />

6.0%<br />

4.0%<br />

2.0%<br />

0.0%<br />

STOXX 600<br />

Banks<br />

Financial <strong>Services</strong><br />

Insurance<br />

Telecommunications<br />

Media<br />

Technology<br />

Utilities<br />

Oil & Gas<br />

Food & Beverage<br />

Health Care<br />

Retail<br />

Travel & Leisure<br />

Chemicals<br />

Construction & Materials<br />

Basic Resources<br />

Source: <strong>BNP</strong> Paribas<br />

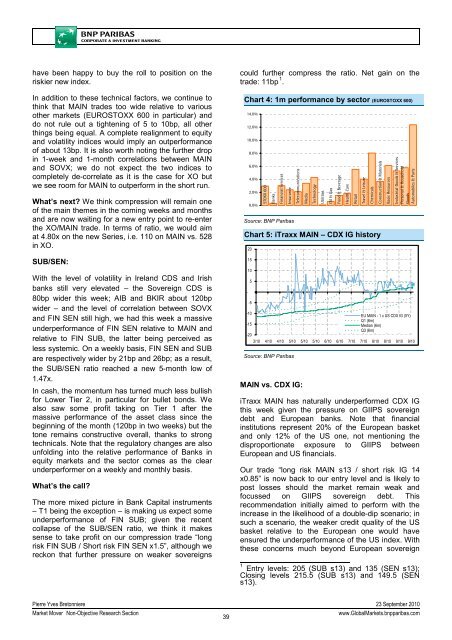

Chart 5: iTraxx MAIN – CDX IG history<br />

-<br />

20<br />

15<br />

10<br />

5<br />

-5<br />

-10<br />

-15<br />

-20<br />

MAIN vs. CDX IG:<br />

Industrial Goods & <strong>Services</strong><br />

Personal & Household<br />

Goods<br />

Automobiles & Parts<br />

3/10 4/10 4/10 5/10 5/10 5/10 6/10 6/10 7/10 7/10 8/10 8/10 9/10 9/10<br />

Source: <strong>BNP</strong> Paribas<br />

EU MAIN - 1 x US CDX IG (5Y)<br />

Q1 (6m)<br />

Median (6m)<br />

Q3 (6m)<br />

iTraxx MAIN has naturally underperformed CDX IG<br />

this week given the pressure on GIIPS sovereign<br />

debt and European banks. Note that financial<br />

institutions represent 20% of the European basket<br />

and only 12% of the US one, not mentioning the<br />

disproportionate exposure to GIIPS between<br />

European and US financials.<br />

Our trade “long risk MAIN s13 / short risk IG 14<br />

x0.85” is now back to our entry level and is likely to<br />

post losses should the market remain weak and<br />

focussed on GIIPS sovereign debt. This<br />

recommendation initially aimed to perform with the<br />

increase in the likelihood of a double-dip scenario; in<br />

such a scenario, the weaker credit quality of the US<br />

basket relative to the European one would have<br />

ensured the underperformance of the US index. With<br />

these concerns much beyond European sovereign<br />

1 Entry levels: 205 (SUB s13) and 135 (SEN s13);<br />

Closing levels 215.5 (SUB s13) and 149.5 (SEN<br />

s13).<br />

Pierre Yves Bretonniere 23 September 2010<br />

Market Mover Non-Objective Research Section<br />

39<br />

www.GlobalMarkets.bnpparibas.com