MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key Data Preview<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

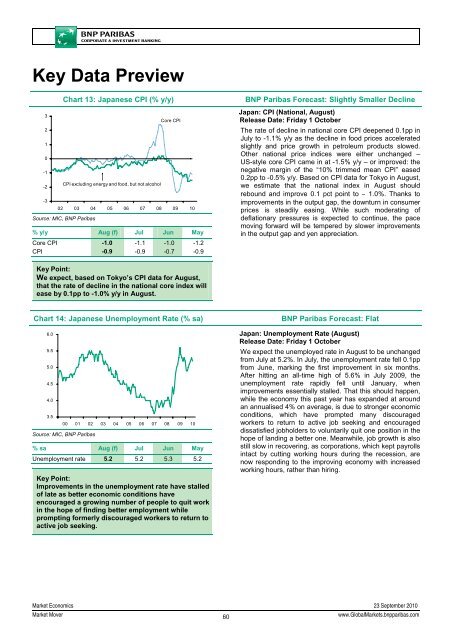

Chart 13: Japanese CPI (% y/y)<br />

CPI excluding energy and food, but not alcohol<br />

Core CPI<br />

02 03 04 05 06 07 08 09 10<br />

Source: MIC, <strong>BNP</strong> Paribas<br />

% y/y Aug (f) Jul Jun May<br />

Core CPI -1.0 -1.1 -1.0 -1.2<br />

CPI -0.9 -0.9 -0.7 -0.9<br />

<strong>BNP</strong> Paribas Forecast: Slightly Smaller Decline<br />

Japan: CPI (National, August)<br />

Release Date: Friday 1 October<br />

The rate of decline in national core CPI deepened 0.1pp in<br />

July to -1.1% y/y as the decline in food prices accelerated<br />

slightly and price growth in petroleum products slowed.<br />

Other national price indices were either unchanged –<br />

US-style core CPI came in at -1.5% y/y – or improved: the<br />

negative margin of the “10% trimmed mean CPI” eased<br />

0.2pp to -0.5% y/y. Based on CPI data for Tokyo in August,<br />

we estimate that the national index in August should<br />

rebound and improve 0.1 pct point to 1.0%. Thanks to<br />

improvements in the output gap, the downturn in consumer<br />

prices is steadily easing. While such moderating of<br />

deflationary pressures is expected to continue, the pace<br />

moving forward will be tempered by slower improvements<br />

in the output gap and yen appreciation.<br />

Key Point:<br />

We expect, based on Tokyo’s CPI data for August,<br />

that the rate of decline in the national core index will<br />

ease by 0.1pp to -1.0% y/y in August.<br />

Chart 14: Japanese Unemployment Rate (% sa)<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

00 01 02 03 04 05 06 07 08 09 10<br />

Source: MIC, <strong>BNP</strong> Paribas<br />

% sa Aug (f) Jul Jun May<br />

Unemployment rate 5.2 5.2 5.3 5.2<br />

Key Point:<br />

Improvements in the unemployment rate have stalled<br />

of late as better economic conditions have<br />

encouraged a growing number of people to quit work<br />

in the hope of finding better employment while<br />

prompting formerly discouraged workers to return to<br />

active job seeking.<br />

<strong>BNP</strong> Paribas Forecast: Flat<br />

Japan: Unemployment Rate (August)<br />

Release Date: Friday 1 October<br />

We expect the unemployed rate in August to be unchanged<br />

from July at 5.2%. In July, the unemployment rate fell 0.1pp<br />

from June, marking the first improvement in six months.<br />

After hitting an all-time high of 5.6% in July 2009, the<br />

unemployment rate rapidly fell until January, when<br />

improvements essentially stalled. That this should happen,<br />

while the economy this past year has expanded at around<br />

an annualised 4% on average, is due to stronger economic<br />

conditions, which have prompted many discouraged<br />

workers to return to active job seeking and encouraged<br />

dissatisfied jobholders to voluntarily quit one position in the<br />

hope of landing a better one. Meanwhile, job growth is also<br />

still slow in recovering, as corporations, which kept payrolls<br />

intact by cutting working hours during the recession, are<br />

now responding to the improving economy with increased<br />

working hours, rather than hiring.<br />

Market Economics 23 September 2010<br />

Market Mover<br />

60<br />

www.GlobalMarkets.bnpparibas.com