Financial Plan - Cornell University Division of Budget & Planning

Financial Plan - Cornell University Division of Budget & Planning

Financial Plan - Cornell University Division of Budget & Planning

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

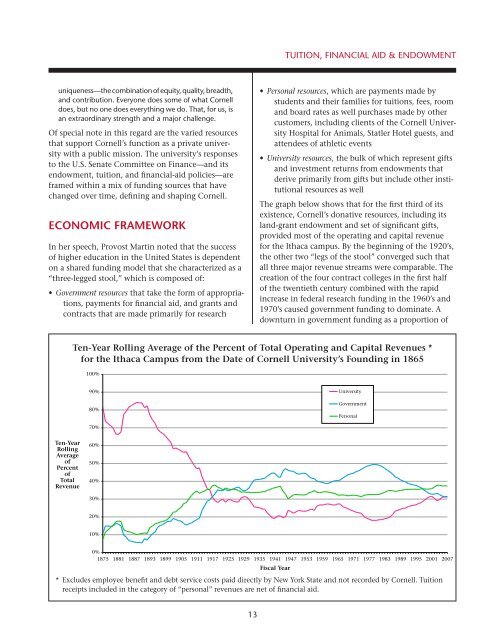

Tuition, <strong>Financial</strong> Aid & Endowmentuniqueness—the combination <strong>of</strong> equity, quality, breadth,and contribution. Everyone does some <strong>of</strong> what <strong>Cornell</strong>does, but no one does everything we do. That, for us, isan extraordinary strength and a major challenge.Of special note in this regard are the varied resourcesthat support <strong>Cornell</strong>’s function as a private universitywith a public mission. The university’s responsesto the U.S. Senate Committee on Finance—and itsendowment, tuition, and financial-aid policies—areframed within a mix <strong>of</strong> funding sources that havechanged over time, defining and shaping <strong>Cornell</strong>.Economic FrameworkIn her speech, Provost Martin noted that the success<strong>of</strong> higher education in the United States is dependenton a shared funding model that she characterized as a“three-legged stool,” which is composed <strong>of</strong>:• Government resources that take the form <strong>of</strong> appropriations,payments for financial aid, and grants andcontracts that are made primarily for research• Personal resources, which are payments made bystudents and their families for tuitions, fees, roomand board rates as well purchases made by othercustomers, including clients <strong>of</strong> the <strong>Cornell</strong> <strong>University</strong>Hospital for Animals, Statler Hotel guests, andattendees <strong>of</strong> athletic events• <strong>University</strong> resources, the bulk <strong>of</strong> which represent giftsand investment returns from endowments thatderive primarily from gifts but include other institutionalresources as wellThe graph below shows that for the first third <strong>of</strong> itsexistence, <strong>Cornell</strong>’s donative resources, including itsland-grant endowment and set <strong>of</strong> significant gifts,provided most <strong>of</strong> the operating and capital revenuefor the Ithaca campus. By the beginning <strong>of</strong> the 1920’s,the other two “legs <strong>of</strong> the stool” converged such thatall three major revenue streams were comparable. Thecreation <strong>of</strong> the four contract colleges in the first half<strong>of</strong> the twentieth century combined with the rapidincrease in federal research funding in the 1960’s and1970’s caused government funding to dominate. Adownturn in government funding as a proportion <strong>of</strong>Ten-Year Rolling Average <strong>of</strong> the Percent <strong>of</strong> Total Operating and Capital Revenues *for the Ithaca Campus from the Date <strong>of</strong> <strong>Cornell</strong> <strong>University</strong>’s Founding in 1865100%90%80%<strong>University</strong>GovernmentPersonal70%Ten-YearRollingAverage<strong>of</strong>Percent<strong>of</strong>TotalRevenue60%50%40%30%20%10%0%1875 1881 1887 1893 1899 1905 1911 1917 1923 1929 1935 1941 1947 1953 1959 1965 1971 1977 1983 1989 1995 2001 2007Fiscal Year* Excludes employee benefit and debt service costs paid directly by New York State and not recorded by <strong>Cornell</strong>. Tuitionreceipts included in the category <strong>of</strong> “personal” revenues are net <strong>of</strong> financial aid.13