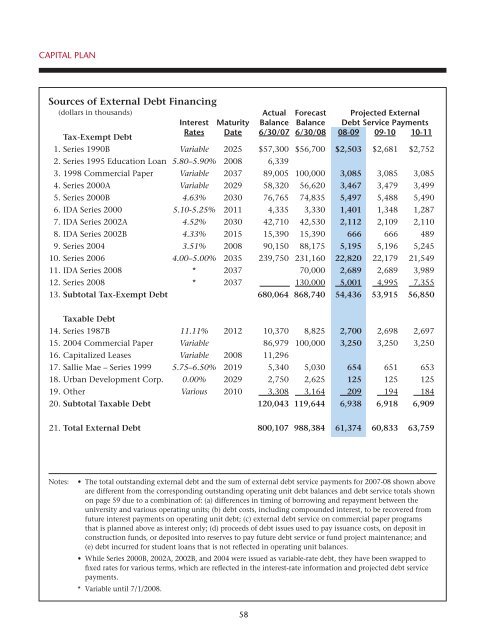

Capital <strong>Plan</strong>Sources <strong>of</strong> External Debt Financing(dollars in thousands)actual Forecast Projected Externalinterest Maturity Balance Balance Debt Service PaymentsTax-Exempt DebtRates Date 6/30/07 6/30/08 08-09 09-10 10-111. Series 1990B Variable 2025 $57,300 $56,700 $2,503 $2,681 $2,7522. Series 1995 Education Loan 5.80–5.90% 2008 6,3393. 1998 Commercial Paper Variable 2037 89,005 100,000 3,085 3,085 3,0854. Series 2000A Variable 2029 58,320 56,620 3,467 3,479 3,4995. Series 2000B 4.63% 2030 76,765 74,835 5,497 5,488 5,4906. IDA Series 2000 5.10-5.25% 2011 4,335 3,330 1,401 1,348 1,2877. IDA Series 2002A 4.52% 2030 42,710 42,530 2,112 2,109 2,1108. IDA Series 2002B 4.33% 2015 15,390 15,390 666 666 4899. Series 2004 3.51% 2008 90,150 88,175 5,195 5,196 5,24510. Series 2006 4.00–5.00% 2035 239,750 231,160 22,820 22,179 21,54911. IDA Series 2008 * 2037 70,000 2,689 2,689 3,98912. Series 2008 * 2037 130,000 5,001 4,995 7,35513. Subtotal Tax-Exempt Debt 680,064 868,740 54,436 53,915 56,850Taxable Debt14. Series 1987B 11.11% 2012 10,370 8,825 2,700 2,698 2,69715. 2004 Commercial Paper Variable 86,979 100,000 3,250 3,250 3,25016. Capitalized Leases Variable 2008 11,29617. Sallie Mae – Series 1999 5.75–6.50% 2019 5,340 5,030 654 651 65318. Urban Development Corp. 0.00% 2029 2,750 2,625 125 125 12519. Other Various 2010 3,308 3,164 209 194 18420. Subtotal Taxable Debt 120,043 119,644 6,938 6,918 6,90921. Total External Debt 800,107 988,384 61,374 60,833 63,759Notes:• The total outstanding external debt and the sum <strong>of</strong> external debt service payments for 2007-08 shown aboveare different from the corresponding outstanding operating unit debt balances and debt service totals shownon page 59 due to a combination <strong>of</strong>: (a) differences in timing <strong>of</strong> borrowing and repayment between theuniversity and various operating units; (b) debt costs, including compounded interest, to be recovered fromfuture interest payments on operating unit debt; (c) external debt service on commercial paper programsthat is planned above as interest only; (d) proceeds <strong>of</strong> debt issues used to pay issuance costs, on deposit inconstruction funds, or deposited into reserves to pay future debt service or fund project maintenance; and(e) debt incurred for student loans that is not reflected in operating unit balances.• While Series 2000B, 2002A, 2002B, and 2004 were issued as variable-rate debt, they have been swapped t<strong>of</strong>ixed rates for various terms, which are reflected in the interest-rate information and projected debt servicepayments.* Variable until 7/1/2008.58

Capital <strong>Plan</strong>Debt Service by Operating Unit2008-09 Debt Service(dollars in thousands)Outstanding Balance Unit CentralIthaca Campus2/28/07 2/29/08 <strong>Budget</strong> <strong>Budget</strong> Total1. Agriculture & Life Sciences $3,820 $4,181 $173 † $147 $3202. Arts & Sciences 11,574 19,106 † 1,442 1,4423. Engineering 9,995 9,120 2,307 2,3074. Hotel Administration 13,161 11,702 1,975 1,9755. Human Ecology 1,352 1,212 311 3116. Industrial & Labor Relations 153 1537. Johnson School 11,244 11,638†8. Law School 4,021 3,606 572 5729. Veterinary College 5,656 8,476 1,772 219 1,99110. Subtotal Colleges 60,823 69,041 4,384 4,687 9,07111. Animal Facilities 34,859 53,100 4,746 4,74612. Biotechnology 7,309 6,555 1,041 1,04113. Life Sciences 36,338 96,346 † 1,774 1,77414. Theory Center 2,875 2,625 127 12715. All Other 3,783 4,070 150 699 84916. Subtotal Research Centers 85,164 162,696 150 8,387 8,53717. Africana Center 2,968 2,698 385 38518. Athletics & Physical Education 8,945 9,006 281 †28119. <strong>Cornell</strong> in Washington 3,017 2,983 265 26520. Library 11,726 12,520 1,890 1,89021. All Other 1,842 1,616 285 28522. Subtotal Other Academic Programs 28,498 28,823 831 2,275 3,10623. Campus Life 160,724 204,760 15,275 15,27524. Fraternities/Sororities 3,200 3,427 217 21725. Gannett Clinic 2,841 2,601 353 35326. All Other 11 206 31 3127. Subtotal Student Services 166,776 210,994 15,523 353 15,87628. Information Technologies 9,187 9,355 813 1,891 2,70429. All Other 1,750 2,098 50 282 33230. Subtotal Administrative & Support 10,937 11,453 863 2,173 3,03631. Facilities & Campus Services 87,779 98,243 14,388 2,404 16,79232. Life Safety 864 775 123 12333. Real Estate 27,651 23,712 2,030 2,03034. Transportation/Mail Service 8,127 8,241 1,686 1,68635. Subtotal Physical <strong>Plan</strong>t 124,421 130,971 18,227 2,404 20,63136. Ithaca Campus All Other 11,134 15,083 3,538 3,53837. Total Ithaca Campus 487,753 629,061 39,978 23,817 63,795Medical College38. Research 28,504 44,206 5,170 5,17039. Residences 84,985 82,538 5,957 5,95740. Clinical Care 1,115 924 234 23441. Infrastructure & Administrative 16,264 16,646 1,327 1,32742. Total Medical College 130,868 144,314 12,688 12,68843. Total <strong>University</strong> 618,621 773,375 52,666 23,817 76,483Note:† These payments are pending receipt <strong>of</strong> gifts; portions <strong>of</strong> the interest are being compounded.59

- Page 5 and 6:

Operating plan - highlightsIntroduc

- Page 8: Operating plan - highlightsComposit

- Page 11 and 12: Tuition, Financial Aid & Endowmentm

- Page 13 and 14: Tuition, Financial Aid & Endowmentu

- Page 15 and 16: Tuition, Financial Aid & EndowmentC

- Page 17 and 18: Tuition, Financial Aid & Endowmentf

- Page 19 and 20: Tuition, Financial Aid & EndowmentD

- Page 21 and 22: Tuition, Financial Aid & EndowmentC

- Page 23 and 24: Tuition, Financial Aid & EndowmentS

- Page 25 and 26: Tuition, Financial Aid & Endowmentw

- Page 27: Tuition, Financial Aid & Endowmentt

- Page 31 and 32: Tuition, Financial Aid & Endowmentp

- Page 33 and 34: Operating plan - DetailsIthaca Camp

- Page 35 and 36: Operating plan - DetailsSignificant

- Page 37 and 38: Operating plan - Detailstive staff

- Page 39 and 40: Operating plan - Detailsand develop

- Page 41 and 42: Operating plan - DetailsCentrallyOt

- Page 43 and 44: Operating plan - DetailsMedical Col

- Page 45 and 46: Capital PlanDistribution of Space -

- Page 47 and 48: Capital Plan• New York State supp

- Page 49 and 50: Capital PlanFUNDING SOURCESFINANCIN

- Page 51 and 52: Capital PlanEXPENDITURE PATTERNEsti

- Page 53 and 54: Capital PlanFUNDING SOURCESFINANCIN

- Page 55 and 56: Capital PlanEXPENDITURE PATTERNEsti

- Page 57: Capital PlanEXPENDITURE PATTERNEsti

- Page 61 and 62: BStudent Fees and Other Tuition Rat

- Page 63 and 64: DUndergraduate Tuition, Fees, Room,

- Page 65 and 66: FAverage Nine-Month Faculty Salarie

- Page 67 and 68: HNew York State AppropriationsSourc

- Page 69 and 70: JInvestment Assets, Returns, and Pa

- Page 71 and 72: LGifts/Contributions - Through Marc

- Page 73 and 74: NWorkforce - Ithaca Campus2007-08 I

- Page 75 and 76: PU.S. Senate ResponseThe Senate Com

- Page 77 and 78: U.S. Senate Response (continued)of

- Page 79 and 80: U.S. Senate Response (continued)inc

- Page 81 and 82: U.S. Senate Response (continued)fro

- Page 83 and 84: U.S. Senate Response (continued)Tab

- Page 85 and 86: U.S. Senate Response (continued)Tab

- Page 87 and 88: U.S. Senate Response (continued)Tab