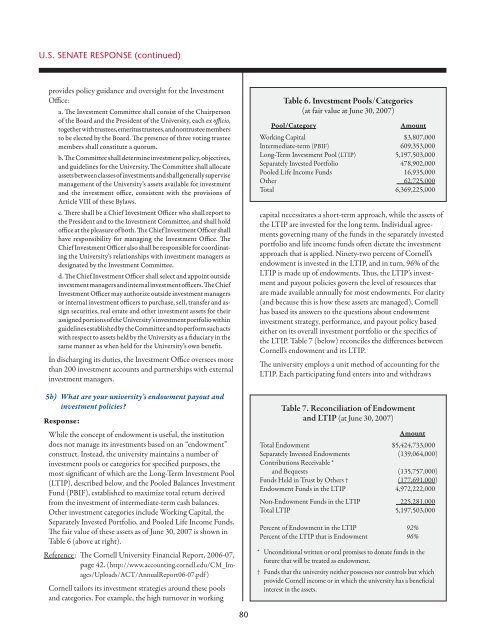

U.S. Senate Response (continued)provides policy guidance and oversight for the InvestmentOffice:a. The Investment Committee shall consist <strong>of</strong> the Chairperson<strong>of</strong> the Board and the President <strong>of</strong> the <strong>University</strong>, each ex <strong>of</strong>ficio,together with trustees, emeritus trustees, and nontrustee membersto be elected by the Board. The presence <strong>of</strong> three voting trusteemembers shall constitute a quorum.b. The Committee shall determine investment policy, objectives,and guidelines for the <strong>University</strong>. The Committee shall allocateassets between classes <strong>of</strong> investments and shall generally supervisemanagement <strong>of</strong> the <strong>University</strong>’s assets available for investmentand the investment <strong>of</strong>fice, consistent with the provisions <strong>of</strong>Article VIII <strong>of</strong> these Bylaws.c. There shall be a Chief Investment Officer who shall report tothe President and to the Investment Committee, and shall hold<strong>of</strong>fice at the pleasure <strong>of</strong> both. The Chief Investment Officer shallhave responsibility for managing the Investment Office. TheChief Investment Officer also shall be responsible for coordinatingthe <strong>University</strong>’s relationships with investment managers asdesignated by the Investment Committee.d. The Chief Investment Officer shall select and appoint outsideinvestment managers and internal investment <strong>of</strong>ficers. The ChiefInvestment Officer may authorize outside investment managersor internal investment <strong>of</strong>ficers to purchase, sell, transfer and assignsecurities, real estate and other investment assets for theirassigned portions <strong>of</strong> the <strong>University</strong>’s investment portfolio withinguidelines established by the Committee and to perform such actswith respect to assets held by the <strong>University</strong> as a fiduciary in thesame manner as when held for the <strong>University</strong>’s own benefit.In discharging its duties, the Investment Office oversees morethan 200 investment accounts and partnerships with externalinvestment managers.5b) What are your university’s endowment payout andinvestment policies?Response:While the concept <strong>of</strong> endowment is useful, the institutiondoes not manage its investments based on an “endowment”construct. Instead, the university maintains a number <strong>of</strong>investment pools or categories for specified purposes, themost significant <strong>of</strong> which are the Long-Term Investment Pool(LTIP), described below, and the Pooled Balances InvestmentFund (PBIF), established to maximize total return derivedfrom the investment <strong>of</strong> intermediate-term cash balances.Other investment categories include Working Capital, theSeparately Invested Portfolio, and Pooled Life Income Funds.The fair value <strong>of</strong> these assets as <strong>of</strong> June 30, 2007 is shown inTable 6 (above at right).Reference: The <strong>Cornell</strong> <strong>University</strong> <strong>Financial</strong> Report, 2006-07,page 42. (http://www.accounting.cornell.edu/CM_Images/Uploads/ACT/AnnualReport06-07.pdf)<strong>Cornell</strong> tailors its investment strategies around these poolsand categories. For example, the high turnover in workingTable 6. Investment Pools/Categories(at fair value at June 30, 2007)Pool/CategoryAmountWorking Capital $3,807,000Intermediate-term (PBIF) 609,353,000Long-Term Investment Pool (LTIP) 5,197,503,000Separately Invested Portfolio 478,902,000Pooled Life Income Funds 16,935,000Other 62,725,000Total 6,369,225,000capital necessitates a short-term approach, while the assets <strong>of</strong>the LTIP are invested for the long term. Individual agreementsgoverning many <strong>of</strong> the funds in the separately investedportfolio and life income funds <strong>of</strong>ten dictate the investmentapproach that is applied. Ninety-two percent <strong>of</strong> <strong>Cornell</strong>’sendowment is invested in the LTIP, and in turn, 96% <strong>of</strong> theLTIP is made up <strong>of</strong> endowments. Thus, the LTIP’s investmentand payout policies govern the level <strong>of</strong> resources thatare made available annually for most endowments. For clarity(and because this is how these assets are managed), <strong>Cornell</strong>has based its answers to the questions about endowmentinvestment strategy, performance, and payout policy basedeither on its overall investment portfolio or the specifics <strong>of</strong>the LTIP. Table 7 (below) reconciles the differences between<strong>Cornell</strong>’s endowment and its LTIP.The university employs a unit method <strong>of</strong> accounting for theLTIP. Each participating fund enters into and withdrawsTable 7. Reconciliation <strong>of</strong> Endowmentand LTIP (at June 30, 2007)AmountTotal Endowment $5,424,733,000Separately Invested Endowments (139,064,000)Contributions Receivable *and Bequests (135,757,000)Funds Held in Trust by Others † (177,691,000)Endowment Funds in the LTIP 4,972,222,000Non-Endowment Funds in the LTIP 225,281,000Total LTIP 5,197,503,000Percent <strong>of</strong> Endowment in the LTIP 92%Percent <strong>of</strong> the LTIP that is Endowment 96%* Unconditional written or oral promises to donate funds in thefuture that will be treated as endowment.† Funds that the university neither possesses nor controls but whichprovide <strong>Cornell</strong> income or in which the university has a beneficialinterest in the assets.80

U.S. Senate Response (continued)from the pooled investment account based on monthly unitmarket values. At June 30, 2007, the fair value per unit was$66.62. Payout is also managed on a unit basis. <strong>Cornell</strong>’strustees declare a payout per share in advance <strong>of</strong> the start <strong>of</strong>the fiscal year, and each fund receives programmatic payoutbased on the number <strong>of</strong> unit shares that it “owns” in the pool.(See below for a description <strong>of</strong> the payout-setting process.)The LTIP’s current payout policy, which was enacted by thetrustees in 1988-89 and revised several times through to1998-99, has the following provisions:• Payout is set in advance by the trustees as part <strong>of</strong> the budgetprocess. Total payout for the LTIP consists <strong>of</strong> programmaticpayout plus payout for the general and stewardshipcosts <strong>of</strong> the programs supported by the LTIP.• The proposed programmatic payout for a coming fiscal yearis normally 5% greater than the prior fiscal year as long asthat increase allows programmatic payout to remain withina defined target range <strong>of</strong> 4.4% <strong>of</strong> a twelve-quarter rollingaverage <strong>of</strong> LTIP unit share values, plus or minus 75 basispoints. The additional payout for general and stewardshipcosts represents 0.46% <strong>of</strong> that rolling average. As the rollingaverage <strong>of</strong> unit share values extends through the end <strong>of</strong>the prior fiscal year and the trustees normally declare theprogrammatic payout in January, the final two quarters <strong>of</strong>the average are estimated.• In lieu <strong>of</strong> the normal 5% annual increase in programmaticpayout, the trustees sometimes make step adjustments—both up and down, based on prior investment performanceand current market conditions—to maintain the totalpayout within its target boundaries. As the general andstewardship cost component <strong>of</strong> payout is a fixed fraction <strong>of</strong>programmatic payout, it rises and falls with any step adjustmentmade in programmatic payout.• Overall spending from the LTIP includes total payoutas well as internal investment management expenses andexternal management fees.The university’s investment strategy incorporates a diversifiedasset allocation approach and maintains, within definedlimits, exposure to the movements <strong>of</strong> the world equity, fixedincome, commodities, real estate, and private equity markets.Based on guidelines established by the Investment Committee,the university’s Investment Office directs the investment<strong>of</strong> endowment and trust assets, certain working capital, andtemporarily invested expendable funds. The trustees have establishedshort- and long-term targets for various asset classes,delineating upper and lower ranges for each. The portfolio isrebalanced periodically to maintain asset classes within theselimits.The investment objective is to achieve a total return, net <strong>of</strong>investment expenses, <strong>of</strong> at least 5% in excess <strong>of</strong> inflation, asmeasured by a rolling average <strong>of</strong> the Consumer Price Index.Achieving favorable returns enables the university to distributeincreasing amounts over time from its investments so thatpresent and future needs can be treated equitably in inflationadjustedterms.Reference: See page 42 <strong>of</strong> the <strong>Cornell</strong> <strong>University</strong> <strong>Financial</strong>Report, 2006-07 for a description <strong>of</strong> the LTIP.(http://www.accounting.cornell.edu/CM_Images/Uploads/ACT/AnnualReport06-07.pdf)5c) What is the mission <strong>of</strong> your university’s endowment?Response:Building on the vision <strong>of</strong> <strong>Cornell</strong> <strong>University</strong>’s founder, Ezra<strong>Cornell</strong>, who aspired to build “an institution where any personcan find instruction in any study,” the general principle<strong>of</strong> <strong>Cornell</strong>’s endowment is to support those two fundamentalthemes: enabling access and providing a comprehensive range<strong>of</strong> academic <strong>of</strong>ferings and activities.Endowments provide <strong>Cornell</strong> with a stable flow <strong>of</strong> operatingrevenues that funds core academic activities like instructionand research and allows the institution to admit and educatestudents from a wide variety <strong>of</strong> economic backgrounds.Endowed pr<strong>of</strong>essorships, like the Frank H.T. Rhodes Pr<strong>of</strong>essorship<strong>of</strong> Humane Letters, permit the university to hire andretain excellent, world-class scholars. As a case in point, NobelLaureate Roald H<strong>of</strong>fmann holds that pr<strong>of</strong>essorship. Pr<strong>of</strong>essorH<strong>of</strong>fmann has taught primarily undergraduates at <strong>Cornell</strong>, andalmost every year since 1966 he has taught first-year generalchemistry. Some undergraduate financial-aid endowments havespecial terms that allow the institution, within the framework <strong>of</strong>need-based aid, to recognize superior academic achievement. Forexample, the John McMullen Scholarship is awarded to studentswith potential for exceptional success at <strong>Cornell</strong> and in the field<strong>of</strong> engineering. The scholarship is named for John McMullen,who was the president <strong>of</strong> the Atlantic Gulf & Pacific DredgingCompany. Although not a <strong>Cornell</strong>ian himself, on the advice <strong>of</strong>a friend who was, McMullen bequeathed his estate to <strong>Cornell</strong> toprovide scholarships for engineering students. The first McMullenScholar entered <strong>Cornell</strong> in 1925. Receiving this honor placesstudents in a select group <strong>of</strong> individuals who received McMullensupport during their undergraduate years at <strong>Cornell</strong>.<strong>Cornell</strong>’s endowment is made up <strong>of</strong> approximately 6,800 separatefunds (as <strong>of</strong> December 31, 2007). Most have individualuses—some imposed by donor restrictions—that limit orprevent payout from being used in a fully fungible manner. Themost common restrictions are tied to the purpose <strong>of</strong> a fund. Afund may be limited for use by a specific college or departmentwithin <strong>Cornell</strong> or the donor agreement may provide that thepayout be reinvested as new principal when the purpose <strong>of</strong> theendowment gift cannot be executed (e.g., payment <strong>of</strong> salarythat cannot be made when an endowed pr<strong>of</strong>essorship is vacant81

- Page 5 and 6:

Operating plan - highlightsIntroduc

- Page 8:

Operating plan - highlightsComposit

- Page 11 and 12:

Tuition, Financial Aid & Endowmentm

- Page 13 and 14:

Tuition, Financial Aid & Endowmentu

- Page 15 and 16:

Tuition, Financial Aid & EndowmentC

- Page 17 and 18:

Tuition, Financial Aid & Endowmentf

- Page 19 and 20:

Tuition, Financial Aid & EndowmentD

- Page 21 and 22:

Tuition, Financial Aid & EndowmentC

- Page 23 and 24:

Tuition, Financial Aid & EndowmentS

- Page 25 and 26:

Tuition, Financial Aid & Endowmentw

- Page 27:

Tuition, Financial Aid & Endowmentt

- Page 31 and 32: Tuition, Financial Aid & Endowmentp

- Page 33 and 34: Operating plan - DetailsIthaca Camp

- Page 35 and 36: Operating plan - DetailsSignificant

- Page 37 and 38: Operating plan - Detailstive staff

- Page 39 and 40: Operating plan - Detailsand develop

- Page 41 and 42: Operating plan - DetailsCentrallyOt

- Page 43 and 44: Operating plan - DetailsMedical Col

- Page 45 and 46: Capital PlanDistribution of Space -

- Page 47 and 48: Capital Plan• New York State supp

- Page 49 and 50: Capital PlanFUNDING SOURCESFINANCIN

- Page 51 and 52: Capital PlanEXPENDITURE PATTERNEsti

- Page 53 and 54: Capital PlanFUNDING SOURCESFINANCIN

- Page 55 and 56: Capital PlanEXPENDITURE PATTERNEsti

- Page 57 and 58: Capital PlanEXPENDITURE PATTERNEsti

- Page 59 and 60: Capital PlanDebt Service by Operati

- Page 61 and 62: BStudent Fees and Other Tuition Rat

- Page 63 and 64: DUndergraduate Tuition, Fees, Room,

- Page 65 and 66: FAverage Nine-Month Faculty Salarie

- Page 67 and 68: HNew York State AppropriationsSourc

- Page 69 and 70: JInvestment Assets, Returns, and Pa

- Page 71 and 72: LGifts/Contributions - Through Marc

- Page 73 and 74: NWorkforce - Ithaca Campus2007-08 I

- Page 75 and 76: PU.S. Senate ResponseThe Senate Com

- Page 77 and 78: U.S. Senate Response (continued)of

- Page 79: U.S. Senate Response (continued)inc

- Page 83 and 84: U.S. Senate Response (continued)Tab

- Page 85 and 86: U.S. Senate Response (continued)Tab

- Page 87 and 88: U.S. Senate Response (continued)Tab