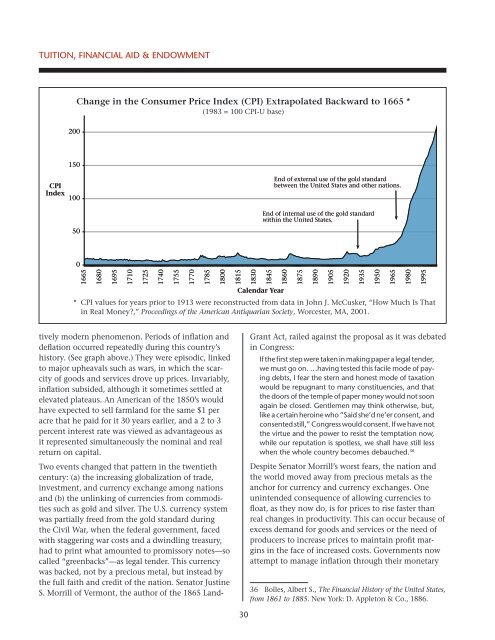

Tuition, <strong>Financial</strong> Aid & EndowmentChange in the Consumer Price Index (CPI) Extrapolated Backward to 1665 *(1983 = 100 CPI-U base)200150CPIIndex10050End <strong>of</strong> external use <strong>of</strong> the gold standardbetween the United States and other nations.End <strong>of</strong> internal use <strong>of</strong> the gold standardwithin the United States.016651680169517101725174017551770178518001815183018451860Calendar Year* CPI values for years prior to 1913 were reconstructed from data in John J. McCusker, “How Much Is Thatin Real Money?,” Proceedings <strong>of</strong> the American Antiquarian Society, Worcester, MA, 2001.187518901905192019351950196519801995tively modern phenomenon. Periods <strong>of</strong> inflation anddeflation occurred repeatedly during this country’shistory. (See graph above.) They were episodic, linkedto major upheavals such as wars, in which the scarcity<strong>of</strong> goods and services drove up prices. Invariably,inflation subsided, although it sometimes settled atelevated plateaus. An American <strong>of</strong> the 1850’s wouldhave expected to sell farmland for the same $1 peracre that he paid for it 30 years earlier, and a 2 to 3percent interest rate was viewed as advantageous asit represented simultaneously the nominal and realreturn on capital.Two events changed that pattern in the twentiethcentury: (a) the increasing globalization <strong>of</strong> trade,investment, and currency exchange among nationsand (b) the unlinking <strong>of</strong> currencies from commoditiessuch as gold and silver. The U.S. currency systemwas partially freed from the gold standard duringthe Civil War, when the federal government, facedwith staggering war costs and a dwindling treasury,had to print what amounted to promissory notes—socalled “greenbacks”—as legal tender. This currencywas backed, not by a precious metal, but instead bythe full faith and credit <strong>of</strong> the nation. Senator JustineS. Morrill <strong>of</strong> Vermont, the author <strong>of</strong> the 1865 Land-Grant Act, railed against the proposal as it was debatedin Congress:If the first step were taken in making paper a legal tender,we must go on. …having tested this facile mode <strong>of</strong> payingdebts, I fear the stern and honest mode <strong>of</strong> taxationwould be repugnant to many constituencies, and thatthe doors <strong>of</strong> the temple <strong>of</strong> paper money would not soonagain be closed. Gentlemen may think otherwise, but,like a certain heroine who “Said she’d ne’er consent, andconsented still,” Congress would consent. If we have notthe virtue and the power to resist the temptation now,while our reputation is spotless, we shall have still lesswhen the whole country becomes debauched. 36Despite Senator Morrill’s worst fears, the nation andthe world moved away from precious metals as theanchor for currency and currency exchanges. Oneunintended consequence <strong>of</strong> allowing currencies t<strong>of</strong>loat, as they now do, is for prices to rise faster thanreal changes in productivity. This can occur because <strong>of</strong>excess demand for goods and services or the need <strong>of</strong>producers to increase prices to maintain pr<strong>of</strong>it marginsin the face <strong>of</strong> increased costs. Governments nowattempt to manage inflation through their monetary36 Bolles, Albert S., The <strong>Financial</strong> History <strong>of</strong> the United States,from 1861 to 1885. New York: D. Appleton & Co., 1886.30

Tuition, <strong>Financial</strong> Aid & Endowmentpolicies by regulating the amount <strong>of</strong> money in circulationand the cost <strong>of</strong> credit issued by central banks,such as the Federal Reserve in the United States.In theory, it should not matter whether costs andprices inflate, deflate, or remain the same as long asall elements <strong>of</strong> the economy experience the changesimilarly. In practice, there is great psychologicalvalue in managing the economy to create a low,modulated inflation rate that can be anticipated andaccommodated. Because inflation creates the illusion<strong>of</strong> constant improvement, it masks real (fundamental)changes in costs and earnings. In this capacity,inflation has become the endorphin <strong>of</strong> the moderneconomy. Alternatively, lack <strong>of</strong> inflation, or worse, deflation,connotes regression and deterioration. Even ifit is demonstrable that one’s decrease in salary is being<strong>of</strong>fset by a decrease in one’s cost <strong>of</strong> living, the formerremains difficult to accept.For higher education, inflation is especially problematic.While tuition, endowment payout, and salaryincrease rates may be announced six months prior tothe start <strong>of</strong> a fiscal year, they must be planned wellbefore then. That planning involves making educatedguesses about hundreds <strong>of</strong> individual cost elements,most <strong>of</strong> which will experience a variety <strong>of</strong> inflationarychanges and taken together constitute a complexmoving target. Under- or over-estimating these individualinflationary pressures will result in rate changesthat fail to maintain parity with the general measures<strong>of</strong> inflation such as the CPI, even if that goal weredesirable. The tendency is to overestimate inflationarygrowth, as many rates (such as tuition) are difficult toadjust once the fiscal year begins, and the economicpenalty for underestimating inflation is real.pressing demands <strong>of</strong> the immediate situation and theeventual needs <strong>of</strong> future generations. Increasingly, theuniversity makes these decisions in an environmentwhere the federal and state government commitmentto higher education appears to be wavering, the abilityand willingness <strong>of</strong> students to bear a fair share <strong>of</strong> thecost <strong>of</strong> education is in question, and public understanding<strong>of</strong> university finances is minimal.In her March 2008 Academic State <strong>of</strong> the <strong>University</strong>address, Provost Martin noted that:…the relative disappearance <strong>of</strong> a focus on interiority isone <strong>of</strong> my biggest concerns. I am not talking about aninteriority that takes the form <strong>of</strong> navel gazing or asocialindividualism, but one that fosters awareness, a sense<strong>of</strong> responsibility, the development <strong>of</strong> individuality, theability to integrate what we take in and to establishour own sense <strong>of</strong> value—all things that require engagingwith the world around us, with other people, butalso engaging with the person we are in the process<strong>of</strong> becoming.The importance <strong>of</strong> this “interiority” can be extrapolatedfrom the individual to the institution as <strong>Cornell</strong>, inthe face <strong>of</strong> external pressures such as the U.S. SenateCommittee on Finance’s inquiry, continues to focus itspolicies on what is best for <strong>Cornell</strong> and its community<strong>of</strong> students, faculty, staff, and alumni. Doing so requiresthat the university employ the balance <strong>of</strong> freedomand responsibility that was articulated so well byCarl Becker, who observed that despite the free rangethat he was granted as a faculty member at <strong>Cornell</strong> hewas nonetheless “…very much bound. Not bound byorders imposed upon me from above or outside, butbound by some inner sense <strong>of</strong> responsibility [to do] …the best I was capable <strong>of</strong> doing.” 37External Pressures/InteriorityWhile it is clearly <strong>Cornell</strong>’s legal prerogative to determinetuition, provide financial aid, and set endowmentpayout, it has historically considered the interests<strong>of</strong> all constituencies in establishing policies andmaking annual rate adjustments for these factors. Indoing so, the university attempts to balance the financialneed <strong>of</strong> its academic programs with the significantimpact that its tuition and financial-aid practices haveon students and their families and to maintain anequilibrium in the use <strong>of</strong> its endowment between the37 Becker, Carl L., “Freedom and Responsibility,” [In]<strong>Cornell</strong> <strong>University</strong>: founders and the founding. Ithaca: <strong>Cornell</strong><strong>University</strong> Press, 1943.31

- Page 5 and 6: Operating plan - highlightsIntroduc

- Page 8: Operating plan - highlightsComposit

- Page 11 and 12: Tuition, Financial Aid & Endowmentm

- Page 13 and 14: Tuition, Financial Aid & Endowmentu

- Page 15 and 16: Tuition, Financial Aid & EndowmentC

- Page 17 and 18: Tuition, Financial Aid & Endowmentf

- Page 19 and 20: Tuition, Financial Aid & EndowmentD

- Page 21 and 22: Tuition, Financial Aid & EndowmentC

- Page 23 and 24: Tuition, Financial Aid & EndowmentS

- Page 25 and 26: Tuition, Financial Aid & Endowmentw

- Page 27: Tuition, Financial Aid & Endowmentt

- Page 33 and 34: Operating plan - DetailsIthaca Camp

- Page 35 and 36: Operating plan - DetailsSignificant

- Page 37 and 38: Operating plan - Detailstive staff

- Page 39 and 40: Operating plan - Detailsand develop

- Page 41 and 42: Operating plan - DetailsCentrallyOt

- Page 43 and 44: Operating plan - DetailsMedical Col

- Page 45 and 46: Capital PlanDistribution of Space -

- Page 47 and 48: Capital Plan• New York State supp

- Page 49 and 50: Capital PlanFUNDING SOURCESFINANCIN

- Page 51 and 52: Capital PlanEXPENDITURE PATTERNEsti

- Page 53 and 54: Capital PlanFUNDING SOURCESFINANCIN

- Page 55 and 56: Capital PlanEXPENDITURE PATTERNEsti

- Page 57 and 58: Capital PlanEXPENDITURE PATTERNEsti

- Page 59 and 60: Capital PlanDebt Service by Operati

- Page 61 and 62: BStudent Fees and Other Tuition Rat

- Page 63 and 64: DUndergraduate Tuition, Fees, Room,

- Page 65 and 66: FAverage Nine-Month Faculty Salarie

- Page 67 and 68: HNew York State AppropriationsSourc

- Page 69 and 70: JInvestment Assets, Returns, and Pa

- Page 71 and 72: LGifts/Contributions - Through Marc

- Page 73 and 74: NWorkforce - Ithaca Campus2007-08 I

- Page 75 and 76: PU.S. Senate ResponseThe Senate Com

- Page 77 and 78: U.S. Senate Response (continued)of

- Page 79 and 80:

U.S. Senate Response (continued)inc

- Page 81 and 82:

U.S. Senate Response (continued)fro

- Page 83 and 84:

U.S. Senate Response (continued)Tab

- Page 85 and 86:

U.S. Senate Response (continued)Tab

- Page 87 and 88:

U.S. Senate Response (continued)Tab