Financial Plan - Cornell University Division of Budget & Planning

Financial Plan - Cornell University Division of Budget & Planning

Financial Plan - Cornell University Division of Budget & Planning

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

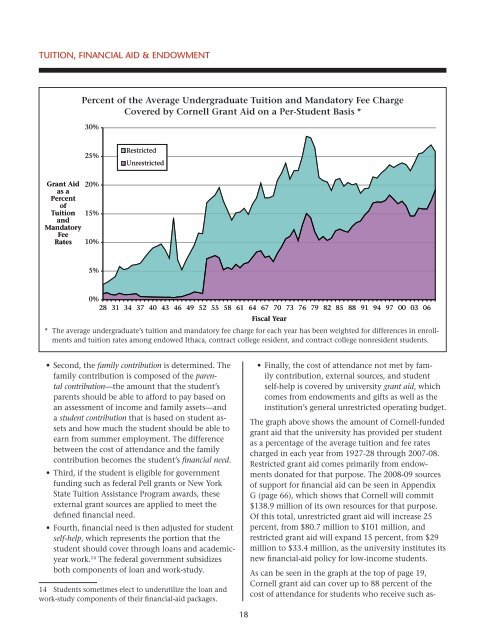

Tuition, <strong>Financial</strong> Aid & EndowmentPercent <strong>of</strong> the Average Undergraduate Tuition and Mandatory Fee ChargeCovered by <strong>Cornell</strong> Grant Aid on a Per-Student Basis *30%25%RestrictedUnrestrictedGrant Aidas aPercent<strong>of</strong>TuitionandMandatoryFeeRates20%15%10%5%0%28 31 34 37 40 43 46 49 52 55 58 61 64 67 70 73 76 79 82 85 88 91 94 97 00 03 06Fiscal Year* The average undergraduate’s tuition and mandatory fee charge for each year has been weighted for differences in enrollmentsand tuition rates among endowed Ithaca, contract college resident, and contract college nonresident students.• Second, the family contribution is determined. Thefamily contribution is composed <strong>of</strong> the parentalcontribution—the amount that the student’sparents should be able to afford to pay based onan assessment <strong>of</strong> income and family assets—anda student contribution that is based on student assetsand how much the student should be able toearn from summer employment. The differencebetween the cost <strong>of</strong> attendance and the familycontribution becomes the student’s financial need.• Third, if the student is eligible for governmentfunding such as federal Pell grants or New YorkState Tuition Assistance Program awards, theseexternal grant sources are applied to meet thedefined financial need.• Fourth, financial need is then adjusted for studentself-help, which represents the portion that thestudent should cover through loans and academicyearwork. 14 The federal government subsidizesboth components <strong>of</strong> loan and work-study.14 Students sometimes elect to underutilize the loan andwork-study components <strong>of</strong> their financial-aid packages.• Finally, the cost <strong>of</strong> attendance not met by familycontribution, external sources, and studentself-help is covered by university grant aid, whichcomes from endowments and gifts as well as theinstitution’s general unrestricted operating budget.The graph above shows the amount <strong>of</strong> <strong>Cornell</strong>-fundedgrant aid that the university has provided per studentas a percentage <strong>of</strong> the average tuition and fee ratescharged in each year from 1927-28 through 2007-08.Restricted grant aid comes primarily from endowmentsdonated for that purpose. The 2008-09 sources<strong>of</strong> support for financial aid can be seen in AppendixG (page 66), which shows that <strong>Cornell</strong> will commit$138.9 million <strong>of</strong> its own resources for that purpose.Of this total, unrestricted grant aid will increase 25percent, from $80.7 million to $101 million, andrestricted grant aid will expand 15 percent, from $29million to $33.4 million, as the university institutes itsnew financial-aid policy for low-income students.As can be seen in the graph at the top <strong>of</strong> page 19,<strong>Cornell</strong> grant aid can cover up to 88 percent <strong>of</strong> thecost <strong>of</strong> attendance for students who receive such as-18