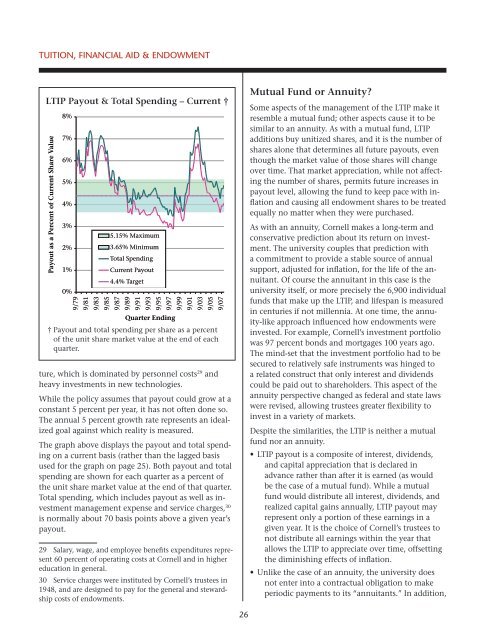

Tuition, <strong>Financial</strong> Aid & EndowmentLTIP Payout & Total Spending – Current †Payout as a Percent <strong>of</strong> Current Share Value8%7%6%5%4%3%2%1%0%5.15% Maximum3.65% MinimumTotal SpendingCurrent Payout4.4% Target9/799/819/839/859/879/899/919/939/959/979/999/019/039/059/07Quarter Ending† Payout and total spending per share as a percent<strong>of</strong> the unit share market value at the end <strong>of</strong> eachquarter.ture, which is dominated by personnel costs 29 andheavy investments in new technologies.While the policy assumes that payout could grow at aconstant 5 percent per year, it has not <strong>of</strong>ten done so.The annual 5 percent growth rate represents an idealizedgoal against which reality is measured.The graph above displays the payout and total spendingon a current basis (rather than the lagged basisused for the graph on page 25). Both payout and totalspending are shown for each quarter as a percent <strong>of</strong>the unit share market value at the end <strong>of</strong> that quarter.Total spending, which includes payout as well as investmentmanagement expense and service charges, 30is normally about 70 basis points above a given year’spayout.29 Salary, wage, and employee benefits expenditures represent60 percent <strong>of</strong> operating costs at <strong>Cornell</strong> and in highereducation in general.30 Service charges were instituted by <strong>Cornell</strong>’s trustees in1948, and are designed to pay for the general and stewardshipcosts <strong>of</strong> endowments.Mutual Fund or Annuity?Some aspects <strong>of</strong> the management <strong>of</strong> the LTIP make itresemble a mutual fund; other aspects cause it to besimilar to an annuity. As with a mutual fund, LTIPadditions buy unitized shares, and it is the number <strong>of</strong>shares alone that determines all future payouts, eventhough the market value <strong>of</strong> those shares will changeover time. That market appreciation, while not affectingthe number <strong>of</strong> shares, permits future increases inpayout level, allowing the fund to keep pace with inflationand causing all endowment shares to be treatedequally no matter when they were purchased.As with an annuity, <strong>Cornell</strong> makes a long-term andconservative prediction about its return on investment.The university couples that prediction witha commitment to provide a stable source <strong>of</strong> annualsupport, adjusted for inflation, for the life <strong>of</strong> the annuitant.Of course the annuitant in this case is theuniversity itself, or more precisely the 6,900 individualfunds that make up the LTIP, and lifespan is measuredin centuries if not millennia. At one time, the annuity-likeapproach influenced how endowments wereinvested. For example, <strong>Cornell</strong>’s investment portfoliowas 97 percent bonds and mortgages 100 years ago.The mind-set that the investment portfolio had to besecured to relatively safe instruments was hinged toa related construct that only interest and dividendscould be paid out to shareholders. This aspect <strong>of</strong> theannuity perspective changed as federal and state lawswere revised, allowing trustees greater flexibility toinvest in a variety <strong>of</strong> markets.Despite the similarities, the LTIP is neither a mutualfund nor an annuity.• LTIP payout is a composite <strong>of</strong> interest, dividends,and capital appreciation that is declared inadvance rather than after it is earned (as wouldbe the case <strong>of</strong> a mutual fund). While a mutualfund would distribute all interest, dividends, andrealized capital gains annually, LTIP payout mayrepresent only a portion <strong>of</strong> these earnings in agiven year. It is the choice <strong>of</strong> <strong>Cornell</strong>’s trustees tonot distribute all earnings within the year thatallows the LTIP to appreciate over time, <strong>of</strong>fsettingthe diminishing effects <strong>of</strong> inflation.• Unlike the case <strong>of</strong> an annuity, the university doesnot enter into a contractual obligation to makeperiodic payments to its “annuitants.” In addition,26

Tuition, <strong>Financial</strong> Aid & Endowmentthe endowment’s extremely long time horizoninfluences investment and payout choices that arenot congruent with the model used by a typicalannuity, which assumes an eventual termination<strong>of</strong> the annuity payments.Managing DebtFor the first 100 years <strong>of</strong> <strong>Cornell</strong>’s existence, its trusteeswere parsimonious in the use <strong>of</strong> debt, believing,as noted in a 1975 trustee report, that “while investmentsprovide resources for the future, debt createsa mortgage against future income.” 31 <strong>Cornell</strong> hadnearly gone bankrupt in the 1870’s and 1880’s andwas strained severely during World War I and theGreat Depression, incurring $1.5 million in operatinglosses and unfunded capital expenses between 1925and 1937 that were <strong>of</strong>fset by the decapitalization <strong>of</strong> aportion <strong>of</strong> the <strong>Cornell</strong> endowment. 32 Generations <strong>of</strong><strong>Cornell</strong> trustees, including those <strong>of</strong> the mid-twentiethcentury, were suspect <strong>of</strong> incurring obligations thatwould be difficult to meet. Two factors combined toalter this point <strong>of</strong> view and helped set in motion theuniversity’s current approach to debt:• The creation <strong>of</strong> the Dormitory Authority <strong>of</strong> the State<strong>of</strong> New York (DASYN) in 1944, first to constructdormitories for the State Teachers’ Colleges andsubsequently (in 1960) to bond construction projectsfor private colleges and universities• The need to expand <strong>Cornell</strong>’s facilities to accommodateboth enrollment growth and an expansion inresearch activitiesAs described in that 1975 trustee report:Prior to 1965 the <strong>University</strong> had little debt. At that time,the pressures to expand <strong>University</strong> facilities and the readyavailability <strong>of</strong> government-backed credit from both stateand federal sources led <strong>Cornell</strong>’s trustees to re-evaluateand liberalize earlier policies to permit assuming limitedamounts <strong>of</strong> debt for essential facilities—particularly thoseexpected to generate substantial revenues—or whoseconstruction could be partially supported from gifts.<strong>Cornell</strong>’s annual debt service payments to DASNYquickly rose from zero in 1962 to $3.8 million in31 “Report <strong>of</strong> the Trustee Ad Hoc Committee on CapitalFinancing.” Ithaca: <strong>Cornell</strong> <strong>University</strong>, 1975.32 Board <strong>of</strong> Trustees. “Minutes (Apr. 29, 1939).” Ithaca:<strong>Cornell</strong> <strong>University</strong>.Outstanding External Debt by Category(dollars in millions)4/30/71 % <strong>of</strong> 2/29/08 % <strong>of</strong>Category Principal Total Principal TotalResidence/Dining $33.4 67% $290.7 38%Physical <strong>Plan</strong>t 3.5 7% 137.2 18%Academic 7.0 14% 305.7 39%Other/Miscellaneous 6.2 12% 39.7 5%Total 50.1 100% 773.3 100%1972-73. 33 For most <strong>of</strong> the 1960’s and 1970’s, debt wasused to finance dormitories and utility projects, wherethe debt service could be built into revenue streamswith defined rate structures. Few facilities projectsthat were academic, administrative, or general supportin nature were debt financed. The trustees’ approachunderwent a second evolutionary change in the lastdecades <strong>of</strong> the twentieth century, as the judicious use<strong>of</strong> debt—within an overall financial framework thatviewed endowment and debt as two sides <strong>of</strong> the samecoin—was embraced. The advantageous use <strong>of</strong> debthas become a form <strong>of</strong> investment that recognizes thatprogrammatic returns may have the same relevanceand currency as financial returns. The university nowexamines the total amount <strong>of</strong> debt that it can reasonablyincur while maintaining its current debt ratings,and allocates access to that debt as a resource.As a result <strong>of</strong> these changes, <strong>Cornell</strong> expanded its use<strong>of</strong> tax-exempt debt and began to issue taxable debt(beginning in 1987) and variable-rate debt where ratesand terms were advantageous. <strong>Cornell</strong> has also enteredinto forward-swap agreements to lock in rates onanticipated borrowings and has issued both tax-exemptand taxable commercial paper when conditionswarrant, creating a matrix <strong>of</strong> debt instruments thatapproaches the complexity <strong>of</strong> the university’s investmentportfolio. As with investments, debt is managedin a pooled fashion (where permitted), and theinternal payment <strong>of</strong> debt service for various projects isseparated from the external repayment <strong>of</strong> debt by theuniversity. The trustees’ change in approach <strong>of</strong> usingdebt to finance academic construction projects canbe seen in the table above, which shows that almost33 “Report <strong>of</strong> the Advisory committee on <strong>Financial</strong> <strong>Plan</strong>ningto the President” (Cranch Report). Ithaca: <strong>Cornell</strong><strong>University</strong>, 1972.27

- Page 5 and 6: Operating plan - highlightsIntroduc

- Page 8: Operating plan - highlightsComposit

- Page 11 and 12: Tuition, Financial Aid & Endowmentm

- Page 13 and 14: Tuition, Financial Aid & Endowmentu

- Page 15 and 16: Tuition, Financial Aid & EndowmentC

- Page 17 and 18: Tuition, Financial Aid & Endowmentf

- Page 19 and 20: Tuition, Financial Aid & EndowmentD

- Page 21 and 22: Tuition, Financial Aid & EndowmentC

- Page 23 and 24: Tuition, Financial Aid & EndowmentS

- Page 25: Tuition, Financial Aid & Endowmentw

- Page 31 and 32: Tuition, Financial Aid & Endowmentp

- Page 33 and 34: Operating plan - DetailsIthaca Camp

- Page 35 and 36: Operating plan - DetailsSignificant

- Page 37 and 38: Operating plan - Detailstive staff

- Page 39 and 40: Operating plan - Detailsand develop

- Page 41 and 42: Operating plan - DetailsCentrallyOt

- Page 43 and 44: Operating plan - DetailsMedical Col

- Page 45 and 46: Capital PlanDistribution of Space -

- Page 47 and 48: Capital Plan• New York State supp

- Page 49 and 50: Capital PlanFUNDING SOURCESFINANCIN

- Page 51 and 52: Capital PlanEXPENDITURE PATTERNEsti

- Page 53 and 54: Capital PlanFUNDING SOURCESFINANCIN

- Page 55 and 56: Capital PlanEXPENDITURE PATTERNEsti

- Page 57 and 58: Capital PlanEXPENDITURE PATTERNEsti

- Page 59 and 60: Capital PlanDebt Service by Operati

- Page 61 and 62: BStudent Fees and Other Tuition Rat

- Page 63 and 64: DUndergraduate Tuition, Fees, Room,

- Page 65 and 66: FAverage Nine-Month Faculty Salarie

- Page 67 and 68: HNew York State AppropriationsSourc

- Page 69 and 70: JInvestment Assets, Returns, and Pa

- Page 71 and 72: LGifts/Contributions - Through Marc

- Page 73 and 74: NWorkforce - Ithaca Campus2007-08 I

- Page 75 and 76: PU.S. Senate ResponseThe Senate Com

- Page 77 and 78:

U.S. Senate Response (continued)of

- Page 79 and 80:

U.S. Senate Response (continued)inc

- Page 81 and 82:

U.S. Senate Response (continued)fro

- Page 83 and 84:

U.S. Senate Response (continued)Tab

- Page 85 and 86:

U.S. Senate Response (continued)Tab

- Page 87 and 88:

U.S. Senate Response (continued)Tab