Financial Plan - Cornell University Division of Budget & Planning

Financial Plan - Cornell University Division of Budget & Planning

Financial Plan - Cornell University Division of Budget & Planning

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

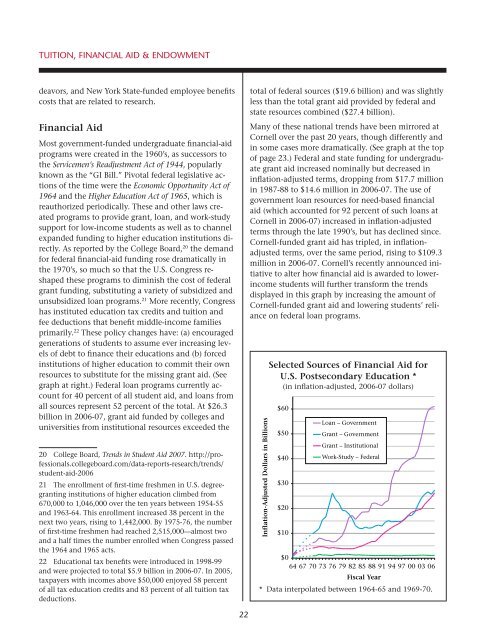

Tuition, <strong>Financial</strong> Aid & Endowmentdeavors, and New York State-funded employee benefitscosts that are related to research.<strong>Financial</strong> AidMost government-funded undergraduate financial-aidprograms were created in the 1960’s, as successors tothe Servicemen’s Readjustment Act <strong>of</strong> 1944, popularlyknown as the “GI Bill.” Pivotal federal legislative actions<strong>of</strong> the time were the Economic Opportunity Act <strong>of</strong>1964 and the Higher Education Act <strong>of</strong> 1965, which isreauthorized periodically. These and other laws createdprograms to provide grant, loan, and work-studysupport for low-income students as well as to channelexpanded funding to higher education institutions directly.As reported by the College Board, 20 the demandfor federal financial-aid funding rose dramatically inthe 1970’s, so much so that the U.S. Congress reshapedthese programs to diminish the cost <strong>of</strong> federalgrant funding, substituting a variety <strong>of</strong> subsidized andunsubsidized loan programs. 21 More recently, Congresshas instituted education tax credits and tuition andfee deductions that benefit middle-income familiesprimarily. 22 These policy changes have: (a) encouragedgenerations <strong>of</strong> students to assume ever increasing levels<strong>of</strong> debt to finance their educations and (b) forcedinstitutions <strong>of</strong> higher education to commit their ownresources to substitute for the missing grant aid. (Seegraph at right.) Federal loan programs currently accountfor 40 percent <strong>of</strong> all student aid, and loans fromall sources represent 52 percent <strong>of</strong> the total. At $26.3billion in 2006-07, grant aid funded by colleges anduniversities from institutional resources exceeded the20 College Board, Trends in Student Aid 2007. http://pr<strong>of</strong>essionals.collegeboard.com/data-reports-research/trends/student-aid-200621 The enrollment <strong>of</strong> first-time freshmen in U.S. degreegrantinginstitutions <strong>of</strong> higher education climbed from670,000 to 1,046,000 over the ten years between 1954-55and 1963-64. This enrollment increased 38 percent in thenext two years, rising to 1,442,000. By 1975-76, the number<strong>of</strong> first-time freshmen had reached 2,515,000—almost twoand a half times the number enrolled when Congress passedthe 1964 and 1965 acts.22 Educational tax benefits were introduced in 1998-99and were projected to total $5.9 billion in 2006-07. In 2005,taxpayers with incomes above $50,000 enjoyed 58 percent<strong>of</strong> all tax education credits and 83 percent <strong>of</strong> all tuition taxdeductions.total <strong>of</strong> federal sources ($19.6 billion) and was slightlyless than the total grant aid provided by federal andstate resources combined ($27.4 billion).Many <strong>of</strong> these national trends have been mirrored at<strong>Cornell</strong> over the past 20 years, though differently andin some cases more dramatically. (See graph at the top<strong>of</strong> page 23.) Federal and state funding for undergraduategrant aid increased nominally but decreased ininflation-adjusted terms, dropping from $17.7 millionin 1987-88 to $14.6 million in 2006-07. The use <strong>of</strong>government loan resources for need-based financialaid (which accounted for 92 percent <strong>of</strong> such loans at<strong>Cornell</strong> in 2006-07) increased in inflation-adjustedterms through the late 1990’s, but has declined since.<strong>Cornell</strong>-funded grant aid has tripled, in inflationadjustedterms, over the same period, rising to $109.3million in 2006-07. <strong>Cornell</strong>’s recently announced initiativeto alter how financial aid is awarded to lowerincomestudents will further transform the trendsdisplayed in this graph by increasing the amount <strong>of</strong><strong>Cornell</strong>-funded grant aid and lowering students’ relianceon federal loan programs.Inflation-Adjusted Dollars in BillionsSelected Sources <strong>of</strong> <strong>Financial</strong> Aid forU.S. Postsecondary Education *(in inflation-adjusted, 2006-07 dollars)$60$50$40$30$20$10Loan – GovernmentGrant – GovernmentGrant – InstitutionalWork-Study – Federal$064 67 70 73 76 79 82 85 88 91 94 97 00 03 06Fiscal Year* Data interpolated between 1964-65 and 1969-70.22