SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THIRD QUARTER 2010<br />

Finmeccanica<br />

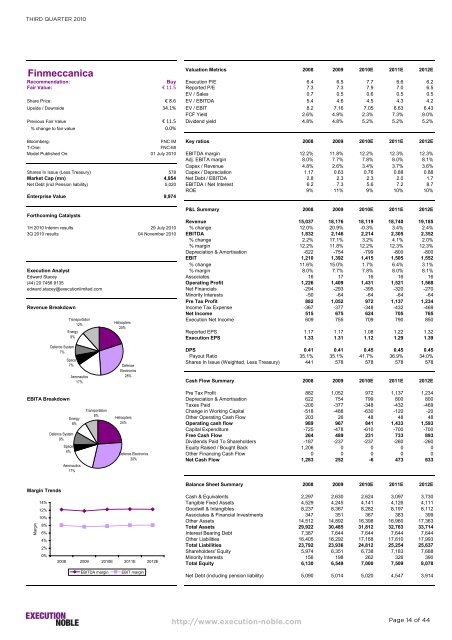

Valuation Metrics 2008 2009 2010E 2011E 2012E<br />

Recommendation: Buy Execution P/E 6.4 6.5 7.7 6.6 6.2<br />

Fair Value: € 11.5 Reported P/E 7.3 7.3 7.9 7.0 6.5<br />

EV / Sales 0.7 0.5 0.6 0.5 0.5<br />

Share Price: € 8.6 EV / EBITDA 5.4 4.6 4.5 4.3 4.2<br />

Upside / Downside 34.1% EV / EBIT 8.2 7.16 7.05 6.63 6.43<br />

FCF Yield 2.6% 4.9% 2.3% 7.3% 9.0%<br />

Previous Fair Value € 11.5 Dividend yield 4.8% 4.8% 5.2% 5.2% 5.2%<br />

% change to fair value 0.0%<br />

Bloomberg: FNC IM Key ratios 2008 2009 2010E 2011E 2012E<br />

T-One: FNC-MI<br />

Model Published On: 01 July 2010 EBITDA margin 12.2% 11.8% 12.2% 12.3% 12.3%<br />

Adj. EBITA margin 8.0% 7.7% 7.8% 8.0% 8.1%<br />

Capex / Revenue 4.8% 2.6% 3.4% 3.7% 3.6%<br />

Shares In Issue (Less Treasury) 578 Capex / Depreciation 1.17 0.63 0.76 0.88 0.88<br />

Market Cap (mn) 4,954 Net Debt / EBITDA 2.8 2.3 2.3 2.0 1.7<br />

Net Debt (incl Pension liability) 5,020 EBITDA / Net Interest 6.2 7.3 5.6 7.2 8.7<br />

ROE 9% 11% 9% 10% 10%<br />

Enterprise Value 9,974<br />

P&L Summary 2008 2009 2010E 2011E 2012E<br />

Forthcoming Catalysts<br />

Revenue 15,037 18,176 18,119 18,740 19,185<br />

1H 2010 Interim results 29 July 2010 % change 12.0% 20.9% -0.3% 3.4% 2.4%<br />

3Q 2010 results 04 November 2010 EBITDA 1,832 2,146 2,214 2,305 2,352<br />

% change 2.2% 17.1% 3.2% 4.1% 2.0%<br />

% margin 12.2% 11.8% 12.2% 12.3% 12.3%<br />

Depreciation & Amortisation -622 -754 -799 -800 -800<br />

EBIT 1,210 1,392 1,415 1,505 1,552<br />

% change 11.6% 15.0% 1.7% 6.4% 3.1%<br />

Execution Analyst % margin 8.0% 7.7% 7.8% 8.0% 8.1%<br />

Edward Stacey Associates 16 17 16 16 16<br />

(44) 20 7456 9135 Operating Profit 1,226 1,409 1,431 1,521 1,568<br />

edward.stacey@executionlimited.com Net Financials -294 -293 -395 -320 -270<br />

Minority Interests -50 -64 -64 -64 -64<br />

Pre Tax Profit 882 1,052 972 1,137 1,234<br />

Revenue Breakdown Income Tax Expense -367 -377 -348 -432 -469<br />

Net Income 515 675 624 705 765<br />

Transportation<br />

12%<br />

Energy<br />

Helicopters<br />

20%<br />

Execution Net Income<br />

Reported EPS<br />

609<br />

1.17<br />

755<br />

1.17<br />

709<br />

1.08<br />

790<br />

1.22<br />

850<br />

1.32<br />

9%<br />

Execution EPS 1.33 1.31 1.12 1.29 1.39<br />

DPS 0.41 0.41 0.45 0.45 0.45<br />

Payout Ratio 35.1% 35.1% 41.7% 36.9% 34.0%<br />

Shares In Issue (Weighted, Less Treasury) 441 578 578 578 578<br />

Cash Flow Summary 2008 2009 2010E 2011E 2012E<br />

Pre Tax Profit 882 1,052 972 1,137 1,234<br />

EBITA Breakdown Depreciation & Amortisation 622 754 799 800 800<br />

Margin Trends<br />

Margin<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Defence System<br />

7%<br />

Space<br />

7%<br />

Defence System<br />

9%<br />

Space<br />

4%<br />

Aeronautics<br />

17%<br />

Energy<br />

8%<br />

Aeronautics<br />

17%<br />

Transportation<br />

8%<br />

Defence<br />

Electronics<br />

28%<br />

Helicopters<br />

24%<br />

Defence Electronics<br />

30%<br />

2008 2009 2010E 2011E 2012E<br />

Adj. EBITDA margin Adj. EBIT EBIT margin margin<br />

Taxes Paid -200 -377 -348 -432 -469<br />

Change in Working Capital -518 -488 -630 -120 -20<br />

Other Operating Cash Flow 203 26 48 48 48<br />

Operating cash flow 989 967 841 1,433 1,593<br />

Capital Expenditure -725 -478 -610 -700 -700<br />

Free Cash Flow 264 489 231 733 893<br />

Dividends Paid To Shareholders -187 -237 -237 -260 -260<br />

Equity Raised / Bought Back 1,206 0 0 0 0<br />

Other Financing Cash Flow 0 0 0 0 0<br />

Net Cash Flow 1,283 252 -6 473 633<br />

Balance Sheet Summary 2008 2009 2010E 2011E 2012E<br />

Cash & Equivalents 2,297 2,630 2,624 3,097 3,730<br />

Tangible Fixed Assets 4,529 4,245 4,141 4,126 4,111<br />

Goodwill & Intangibles 8,237 8,367 8,282 8,197 8,112<br />

Associates & Financial <strong>Investment</strong>s 347 351 367 383 399<br />

Other Assets 14,512 14,892 16,398 16,960 17,363<br />

Total Assets 29,922 30,485 31,812 32,763 33,714<br />

Interest Bearing Debt 7,387 7,644 7,644 7,644 7,644<br />

Other Liabilities 16,405 16,292 17,168 17,610 17,993<br />

Total Liabilities 23,792 23,936 24,812 25,254 25,637<br />

Shareholders' Equity 5,974 6,351 6,738 7,183 7,688<br />

Minority Interests 156 198 262 326 390<br />

Total Equity 6,130 6,549 7,000 7,509 8,078<br />

Net Debt (including pension liability) 5,090 5,014 5,020 4,547 3,914<br />

http://www.execution-noble.com<br />

Page 14 of 44