SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THIRD QUARTER 2010<br />

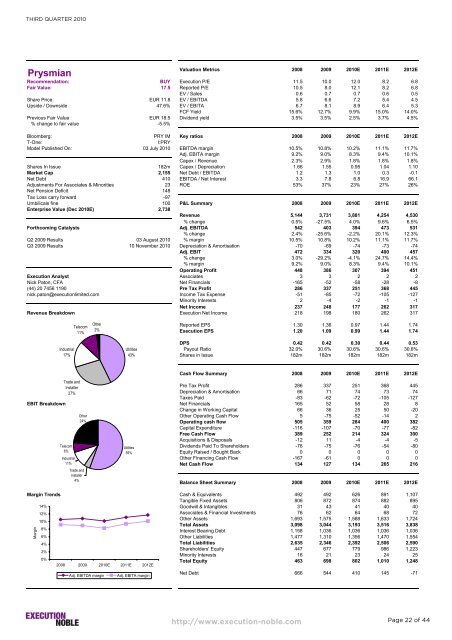

Prysmian<br />

Valuation Metrics 2008 2009 2010E 2011E 2012E<br />

Recommendation: BUY Execution P/E 11.5 10.0 12.0 8.2 6.8<br />

Fair Value: 17.5 Reported P/E 10.5 8.0 12.1 8.2 6.8<br />

EV / Sales 0.6 0.7 0.7 0.6 0.5<br />

Share Price: EUR 11.8 EV / EBITDA 5.8 6.6 7.2 5.4 4.5<br />

Upside / Downside 47.6% EV / EBITA 6.7 8.1 8.9 6.4 5.3<br />

FCF Yield 15.6% 12.7% 9.9% 15.0% 14.0%<br />

Previous Fair Value EUR 18.5 Dividend yield 3.5% 3.5% 2.5% 3.7% 4.5%<br />

% change to fair value -5.5%<br />

Bloomberg: PRY IM Key ratios 2008 2009 2010E 2011E 2012E<br />

T-One: I:PRY<br />

Model Published On: 03 July 2010 EBITDA margin 10.5% 10.8% 10.2% 11.1% 11.7%<br />

Adj. EBITA margin 9.2% 9.0% 8.3% 9.4% 10.1%<br />

Capex / Revenue 2.3% 2.9% 1.8% 1.8% 1.8%<br />

Shares In Issue 182m Capex / Depreciation 1.66 1.55 0.95 1.04 1.10<br />

Market Cap 2,155 Net Debt / EBITDA 1.2 1.3 1.0 0.3 -0.1<br />

Net Debt 410 EBITDA / Net Interest 3.3 7.8 6.8 16.9 66.1<br />

Adjustments For Associates & Minorities 23 ROE 53% 37% 23% 27% 26%<br />

Net Pension Deficit 148<br />

Tax Loss carry forward -97<br />

Umbilicals fine 100 P&L Summary 2008 2009 2010E 2011E 2012E<br />

Enterprise Value (Dec 2010E) 2,738<br />

Revenue 5,144 3,731 3,881 4,254 4,530<br />

% change 0.5% -27.5% 4.0% 9.6% 6.5%<br />

Forthcoming Catalysts Adj. EBITDA 542 403 394 473 531<br />

% change 2.4% -25.6% -2.2% 20.1% 12.3%<br />

Q2 2009 Results 03 August 2010 % margin 10.5% 10.8% 10.2% 11.1% 11.7%<br />

Q3 2009 Results 10 November 2010 Depreciation & Amortisation -70 -69 -74 -73 -74<br />

Adj. EBIT 472 334 320 400 457<br />

% change 3.0% -29.2% -4.1% 24.7% 14.4%<br />

% margin 9.2% 9.0% 8.3% 9.4% 10.1%<br />

Operating Profit 448 386 307 394 451<br />

Execution Analyst Associates 3 3 2 2 2<br />

Nick Paton, CFA Net Financials -165 -52 -58 -28 -8<br />

(44) 20 7456 1190 Pre Tax Profit 286 337 251 368 445<br />

nick.paton@executionlimited.com Income Tax Expense -51 -85 -72 -105 -127<br />

Minority Interests 2 -4 -2 -1 -1<br />

Net Income 237 248 177 262 317<br />

Revenue Breakdown Execution Net Income 218 198 180 262 317<br />

Reported EPS 1.30 1.36 0.97 1.44 1.74<br />

Execution EPS 1.20 1.09 0.99 1.44 1.74<br />

DPS 0.42 0.42 0.30 0.44 0.53<br />

Payout Ratio 32.0% 30.6% 30.6% 30.6% 30.6%<br />

Shares in Issue 182m 182m 182m 182m 182m<br />

Cash Flow Summary 2008 2009 2010E 2011E 2012E<br />

Pre Tax Profit 286 337 251 368 445<br />

Depreciation & Amortisation 66 71 74 73 74<br />

Taxes Paid -83 -62 -72 -105 -127<br />

EBIT Breakdown Net Financials 165 52 58 28 8<br />

Change in Working Capital 66 36 25 50 -20<br />

Other Operating Cash Flow 5 -75 -52 -14 2<br />

Operating cash flow 505 359 284 400 382<br />

Capital Expenditure -116 -107 -70 -77 -82<br />

Free Cash Flow 389 252 214 324 300<br />

Acquisitions & Disposals -12 11 -4 -4 -5<br />

Dividends Paid To Shareholders -76 -75 -76 -54 -80<br />

Equity Raised / Bought Back 0 0 0 0 0<br />

Other Financing Cash Flow -167 -61 0 0 0<br />

Net Cash Flow 134 127 134 265 216<br />

Balance Sheet Summary 2008 2009 2010E 2011E 2012E<br />

Margin Trends Cash & Equivalents 492 492 626 891 1,107<br />

Tangible Fixed Assets 806 872 874 882 895<br />

14%<br />

Goodwill & Intangibles 31 43 41 40 40<br />

12%<br />

Associates & Financial <strong>Investment</strong>s 76 62 64 68 72<br />

10%<br />

Other Assets<br />

Total Assets<br />

1,693<br />

3,098<br />

1,575<br />

3,044<br />

1,588<br />

3,193<br />

1,633<br />

3,516<br />

1,724<br />

3,838<br />

8%<br />

Interest Bearing Debt 1,158 1,036 1,036 1,036 1,036<br />

6%<br />

Other Liabilities 1,477 1,310 1,356 1,470 1,554<br />

4%<br />

Total Liabilities 2,635 2,346 2,392 2,506 2,590<br />

2%<br />

Shareholders' Equity<br />

Minority Interests<br />

447<br />

16<br />

677<br />

21<br />

779<br />

23<br />

986<br />

24<br />

1,223<br />

25<br />

0%<br />

2008 2009 2010E 2011E 2012E<br />

Total Equity 463 698 802 1,010 1,248<br />

Adj. EBITDA margin Adj. EBITA margin<br />

Net Debt 666 544 410 145 -71<br />

Margin<br />

Industrial<br />

17%<br />

Trade and<br />

Installer<br />

27%<br />

Telecom<br />

6%<br />

Industrial<br />

11%<br />

Telecom<br />

11%<br />

Other<br />

24%<br />

Trade and<br />

Installer<br />

4%<br />

Other<br />

2%<br />

Utilities<br />

43%<br />

Utilities<br />

55%<br />

http://www.execution-noble.com<br />

Page 22 of 44