SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THIRD QUARTER 2010<br />

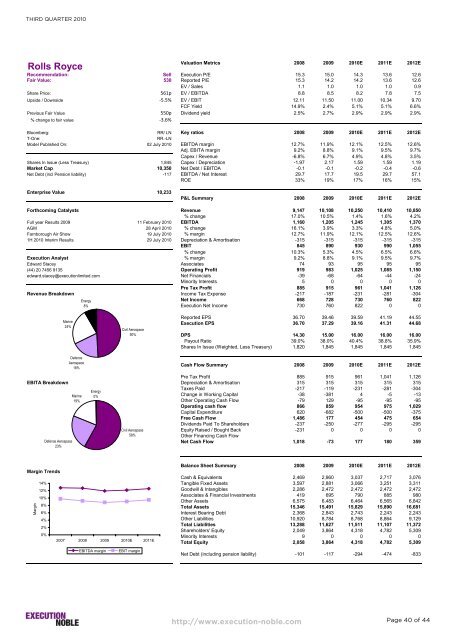

Rolls Royce<br />

Valuation Metrics 2008 2009 2010E 2011E 2012E<br />

Recommendation: Sell Execution P/E 15.3 15.0 14.3 13.6 12.6<br />

Fair Value: 530 Reported P/E 15.3 14.2 14.2 13.6 12.6<br />

EV / Sales 1.1 1.0 1.0 1.0 0.9<br />

Share Price: 561p EV / EBITDA 8.8 8.5 8.2 7.8 7.5<br />

Upside / Downside -5.5% EV / EBIT 12.11 11.50 11.00 10.34 9.70<br />

FCF Yield 14.9% 2.4% 5.1% 5.1% 6.6%<br />

Previous Fair Value 550p Dividend yield 2.5% 2.7% 2.9% 2.9% 2.9%<br />

% change to fair value -3.6%<br />

Bloomberg: RR/ LN Key ratios 2008 2009 2010E 2011E 2012E<br />

T-One: RR.-LN<br />

Model Published On: 02 July 2010 EBITDA margin 12.7% 11.9% 12.1% 12.5% 12.6%<br />

Adj. EBITA margin 9.2% 8.8% 9.1% 9.5% 9.7%<br />

Capex / Revenue -6.8% 6.7% 4.9% 4.8% 3.5%<br />

Shares In Issue (Less Treasury) 1,845 Capex / Depreciation -1.97 2.17 1.59 1.59 1.19<br />

Market Cap 10,350 Net Debt / EBITDA -0.1 -0.1 -0.2 -0.4 -0.6<br />

Net Debt (incl Pension liability) -117 EBITDA / Net Interest 29.7 17.7 19.5 29.7 57.1<br />

ROE 33% 19% 17% 16% 15%<br />

Enterprise Value 10,233<br />

P&L Summary 2008 2009 2010E 2011E 2012E<br />

Forthcoming Catalysts Revenue 9,147 10,108 10,250 10,410 10,850<br />

% change 17.0% 10.5% 1.4% 1.6% 4.2%<br />

Full year Results 2009 11 February 2010 EBITDA 1,160 1,205 1,245 1,305 1,370<br />

AGM 28 April 2010 % change 16.1% 3.9% 3.3% 4.8% 5.0%<br />

Farnborough Air Show 19 July 2010 % margin 12.7% 11.9% 12.1% 12.5% 12.6%<br />

1H 2010 Interim Results 29 July 2010 Depreciation & Amortisation -315 -315 -315 -315 -315<br />

EBIT 845 890 930 990 1,055<br />

% change 10.3% 5.3% 4.5% 6.5% 6.6%<br />

Execution Analyst % margin 9.2% 8.8% 9.1% 9.5% 9.7%<br />

Edward Stacey Associates 74 93 95 95 95<br />

(44) 20 7456 9135 Operating Profit 919 983 1,025 1,085 1,150<br />

edward.stacey@executionlimited.com Net Financials -39 -68 -64 -44 -24<br />

Minority Interests 5 0 0 0 0<br />

Pre Tax Profit 885 915 961 1,041 1,126<br />

Revenue Breakdown Income Tax Expense -217 -187 -231 -281 -304<br />

Net Income 668 728 730 760 822<br />

Execution Net Income 730 760 822 0 0<br />

Reported EPS 36.70 39.46 39.59 41.19 44.55<br />

Execution EPS 36.70 37.29 39.16 41.31 44.68<br />

DPS 14.30 15.00 16.00 16.00 16.00<br />

Payout Ratio 39.0% 38.0% 40.4% 38.8% 35.9%<br />

Shares In Issue (Weighted, Less Treasury) 1,820 1,845 1,845 1,845 1,845<br />

Defence<br />

Aerospace<br />

18%<br />

Cash Flow Summary 2008 2009 2010E 2011E 2012E<br />

Pre Tax Profit 885 915 961 1,041 1,126<br />

EBITA Breakdown Depreciation & Amortisation 315 315 315 315 315<br />

Margin Trends<br />

Margin<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Marine<br />

24%<br />

Defence Aerospace<br />

23%<br />

Marine<br />

19%<br />

Energy<br />

8%<br />

Energy<br />

0%<br />

Civil Aerospace<br />

50%<br />

Civil Aerospace<br />

58%<br />

2007 2008 2009 2010E 2011E<br />

Adj. EBITDA margin Adj. EBIT EBIT margin margin<br />

Taxes Paid -217 -119 -231 -281 -304<br />

Change in Working Capital -38 -381 4 -5 -13<br />

Other Operating Cash Flow -79 129 -95 -95 -95<br />

Operating cash flow 866 859 954 975 1,029<br />

Capital Expenditure 620 -682 -500 -500 -375<br />

Free Cash Flow 1,486 177 454 475 654<br />

Dividends Paid To Shareholders -237 -250 -277 -295 -295<br />

Equity Raised / Bought Back -231 0 0 0 0<br />

Other Financing Cash Flow<br />

Net Cash Flow 1,018 -73 177 180 359<br />

Balance Sheet Summary 2008 2009 2010E 2011E 2012E<br />

Cash & Equivalents 2,469 2,960 3,037 2,717 3,076<br />

Tangible Fixed Assets 3,597 2,881 3,066 3,251 3,311<br />

Goodwill & Intangibles 2,286 2,472 2,472 2,472 2,472<br />

Associates & Financial <strong>Investment</strong>s 419 695 790 885 980<br />

Other Assets 6,575 6,483 6,464 6,565 6,842<br />

Total Assets 15,346 15,491 15,829 15,890 16,681<br />

Interest Bearing Debt 2,368 2,843 2,743 2,243 2,243<br />

Other Liabilities 10,920 8,784 8,768 8,864 9,129<br />

Total Liabilities 13,288 11,627 11,511 11,107 11,372<br />

Shareholders' Equity 2,049 3,864 4,318 4,782 5,309<br />

Minority Interests 9 0 0 0 0<br />

Total Equity 2,058 3,864 4,318 4,782 5,309<br />

Net Debt (including pension liability) -101 -117 -294 -474 -833<br />

http://www.execution-noble.com<br />

Page 40 of 44