SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THIRD QUARTER 2010<br />

Aviva<br />

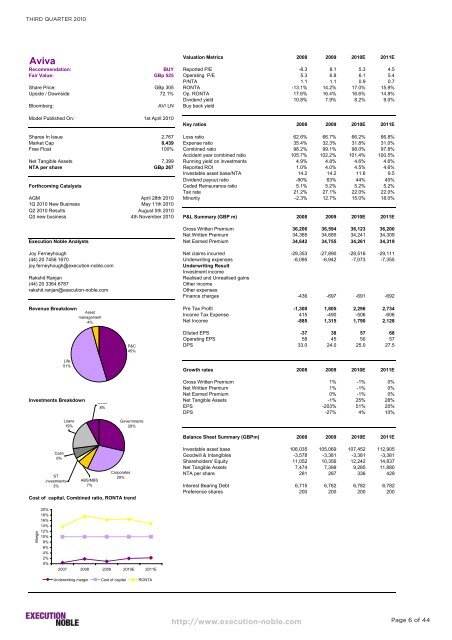

Valuation Metrics 2008 2009 2010E 2011E<br />

Recommendation: BUY Reported P/E -8.3 8.1 5.3 4.5<br />

Fair Value: GBp 525 Operating P/E 5.3 6.8 6.1 5.4<br />

P/NTA 1.1 1.1 0.9 0.7<br />

Share Price: GBp 305 RONTA -13.1% 14.2% 17.0% 15.9%<br />

Upside / Downside 72.1% Op. RONTA 17.6% 16.4% 16.6% 14.8%<br />

Dividend yield 10.8% 7.9% 8.2% 9.0%<br />

Bloomberg: AV/ LN Buy back yield<br />

Model Published On: 1st April 2010<br />

Key ratios 2008 2009 2010E 2011E<br />

Shares In Issue 2,767 Loss ratio 62.6% 66.7% 66.2% 66.8%<br />

Market Cap 8,439 Expense ratio 35.4% 32.3% 31.8% 31.0%<br />

Free Float 100% Combined ratio 98.2% 99.1% 98.0% 97.8%<br />

Accident year combined ratio 105.7% 102.2% 101.4% 100.5%<br />

Net Tangible Assets 7,399 Running yield on investments 4.9% 4.8% 4.6% 4.6%<br />

NTA per share GBp 267 Reported ROI 1.0% 4.0% 4.5% 4.6%<br />

Investable asset base/NTA 14.2 14.2 11.6 9.5<br />

Dividend payout ratio -90% 63% 44% 40%<br />

Forthcoming Catalysts Ceded Reinsurance ratio 5.1% 5.2% 5.2% 5.2%<br />

Tax rate 21.2% 27.1% 22.0% 22.0%<br />

AGM April 28th 2010 Minority -2.3% 12.7% 15.0% 18.0%<br />

1Q 2010 New Business May 11th 2010<br />

Q2 2010 Results August 5th 2010<br />

Q3 new business 4th November 2010 P&L Summary (GBP m) 2008 2009 2010E 2011E<br />

Gross Written Premium 36,206 36,594 36,123 36,200<br />

Net Written Premium 34,365 34,685 34,241 34,309<br />

Execution Noble Analysts Net Earned Premium 34,642 34,755 34,261 34,319<br />

Joy Ferneyhough Net claims incurred -29,353 -27,890 -28,516 -29,111<br />

(44) 20 7456 1670 Underwriting expenses -8,095 -6,942 -7,073 -7,355<br />

joy.ferneyhough@execution-noble.com Underwriting Result<br />

<strong>Investment</strong> income<br />

Rakshit Ranjan Realised and Unrealised gains<br />

(44) 20 3364 6787 Other income<br />

rakshit.ranjan@execution-noble.com Other expenses<br />

Finance charges -436 -697 -691 -692<br />

Revenue Breakdown Pre Tax Profit -1,300 1,805 2,296 2,734<br />

Income Tax Expense 415 -490 -506 -606<br />

Net Income -885 1,315 1,790 2,128<br />

Diluted EPS -37 38 57 68<br />

Operating EPS 58 45 50 57<br />

DPS 33.0 24.0 25.0 27.5<br />

Growth rates 2008 2009 2010E 2011E<br />

Gross Written Premium 1% -1% 0%<br />

Net Written Premium 1% -1% 0%<br />

Net Earned Premium 0% -1% 0%<br />

<strong>Investment</strong>s Breakdown Net Tangible Assets -1% 25% 28%<br />

Cost of capital, Combined ratio, RONTA trend<br />

Margin<br />

Life<br />

51%<br />

ST<br />

investments<br />

3%<br />

20%<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Cash<br />

6%<br />

Loans<br />

19%<br />

Asset<br />

managament<br />

4%<br />

ABS/MBS<br />

7%<br />

Other<br />

8%<br />

P&C<br />

45%<br />

Governments<br />

28%<br />

Corporates<br />

29%<br />

2007 2008 2009 2010E 2011E<br />

Underwriting margin Cost of capital RONTA<br />

EPS -203% 51% 20%<br />

DPS -27% 4% 10%<br />

Balance Sheet Summary (GBPm) 2008 2009 2010E 2011E<br />

Investable asset base 106,035 105,069 107,452 112,905<br />

Goodwill & Intangibles -3,578 -3,381 -3,381 -3,381<br />

Shareholders' Equity 11,052 10,356 12,242 14,837<br />

Net Tangible Assets 7,474 7,399 9,285 11,880<br />

NTA per share 281 267 336 429<br />

Interest Bearing Debt 6,715 6,782 6,782 6,782<br />

Preference shares 200 200 200 200<br />

http://www.execution-noble.com<br />

Page 6 of 44