SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THIRD QUARTER 2010<br />

Reckitt Benckiser<br />

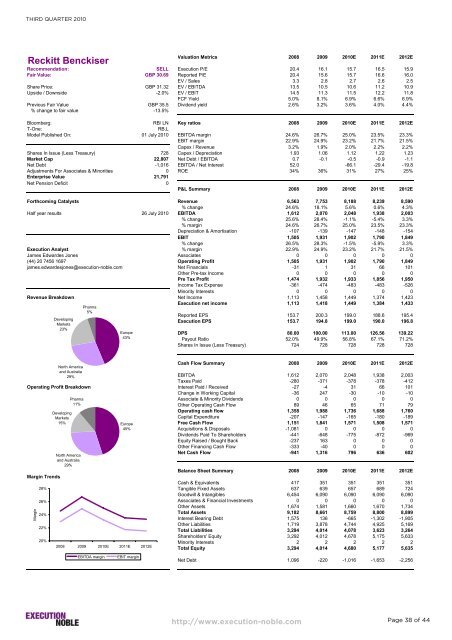

Valuation Metrics 2008 2009 2010E 2011E 2012E<br />

Recommendation: SELL Execution P/E 20.4 16.1 15.7 16.5 15.9<br />

Fair Value: GBP 30.69 Reported P/E 20.4 15.6 15.7 16.6 16.0<br />

EV / Sales 3.3 2.8 2.7 2.6 2.5<br />

Share Price: GBP 31.32 EV / EBITDA 13.5 10.5 10.6 11.2 10.9<br />

Upside / Downside -2.0% EV / EBIT 14.5 11.3 11.5 12.2 11.8<br />

FCF Yield 5.0% 8.1% 6.9% 6.6% 6.9%<br />

Previous Fair Value GBP 35.5 Dividend yield 2.6% 3.2% 3.6% 4.0% 4.4%<br />

% change to fair value -13.5%<br />

Bloomberg: RB/ LN Key ratios 2008 2009 2010E 2011E 2012E<br />

T-One: RB.L<br />

Model Published On: 01 July 2010 EBITDA margin 24.6% 26.7% 25.0% 23.5% 23.3%<br />

EBIT margin 22.9% 24.9% 23.2% 21.7% 21.5%<br />

Capex / Revenue 3.2% 1.9% 2.0% 2.2% 2.2%<br />

Shares In Issue (Less Treasury) 728 Capex / Depreciation 1.93 1.06 1.12 1.22 1.23<br />

Market Cap 22,807 Net Debt / EBITDA 0.7 -0.1 -0.5 -0.9 -1.1<br />

Net Debt -1,016 EBITDA / Net Interest 52.0 -66.1 -29.4 -19.8<br />

Adjustments For Associates & Minorities 0 ROE 34% 36% 31% 27% 25%<br />

Enterprise Value 21,791<br />

Net Pension Deficit 0<br />

P&L Summary 2008 2009 2010E 2011E 2012E<br />

Forthcoming Catalysts Revenue 6,563 7,753 8,188 8,239 8,590<br />

% change 24.6% 18.1% 5.6% 0.6% 4.3%<br />

Half year results 26 July 2010 EBITDA 1,612 2,070 2,048 1,938 2,003<br />

% change 25.6% 28.4% -1.1% -5.4% 3.3%<br />

% margin 24.6% 26.7% 25.0% 23.5% 23.3%<br />

Depreciation & Amortisation -107 -139 -147 -148 -154<br />

EBIT 1,505 1,931 1,902 1,790 1,849<br />

% change 26.5% 28.3% -1.5% -5.9% 3.3%<br />

Execution Analyst % margin 22.9% 24.9% 23.2% 21.7% 21.5%<br />

James Edwardes Jones Associates 0 0 0 0 0<br />

(44) 20 7456 1697 Operating Profit 1,505 1,931 1,902 1,790 1,849<br />

james.edwardesjones@execution-noble.com Net Financials -31 1 31 66 101<br />

Other Pre-tax Income 0 0 0 0 0<br />

Pre Tax Profit 1,474 1,932 1,933 1,856 1,950<br />

Income Tax Expense -361 -474 -483 -483 -526<br />

Minority Interests 0 0 0 0 0<br />

Revenue Breakdown Net Income 1,113 1,458 1,449 1,374 1,423<br />

Execution net income 1,113 1,418 1,449 1,384 1,433<br />

Reported EPS 153.7 200.3 199.0 188.6 195.4<br />

Execution EPS 153.7 194.8 199.0 190.0 196.8<br />

DPS 80.00 100.00 113.00 126.56 139.22<br />

Payout Ratio 52.0% 49.9% 56.8% 67.1% 71.2%<br />

Shares In Issue (Less Treasury) 724 728 728 728 728<br />

Cash Flow Summary 2008 2009 2010E 2011E 2012E<br />

EBITDA 1,612 2,070 2,048 1,938 2,003<br />

Taxes Paid -280 -371 -378 -378 -412<br />

Operating Profit Breakdown Interest Paid / Received -27 -4 31 66 101<br />

Margin Trends<br />

Margin<br />

28%<br />

26%<br />

24%<br />

22%<br />

20%<br />

Developing<br />

Markets<br />

23%<br />

North America<br />

and Australia<br />

29%<br />

Pharma<br />

11%<br />

Developing<br />

Markets<br />

15%<br />

North America<br />

and Australia<br />

29%<br />

Pharma<br />

5%<br />

Europe<br />

43%<br />

Europe<br />

45%<br />

2008 2009 2010E 2011E 2012E<br />

EBITDA margin EBIT margin<br />

Change in Working Capital -36 247 -30 -10 -10<br />

Associate & Minority Dividends 0 0 0 0 0<br />

Other Operating Cash Flow 89 46 65 71 79<br />

Operating cash flow 1,358 1,988 1,736 1,688 1,760<br />

Capital Expenditure -207 -147 -165 -180 -189<br />

Free Cash Flow 1,151 1,841 1,571 1,508 1,571<br />

Acquisitions & Disposals -1,081 0 0 0 0<br />

Dividends Paid To Shareholders -441 -648 -775 -872 -969<br />

Equity Raised / Bought Back -237 163 0 0 0<br />

Other Financing Cash Flow -333 -40 0 0 0<br />

Net Cash Flow -941 1,316 796 636 602<br />

Balance Sheet Summary 2008 2009 2010E 2011E 2012E<br />

Cash & Equivalents 417 351 351 351 351<br />

Tangible Fixed Assets 637 639 657 689 724<br />

Goodwill & Intangibles 6,454 6,090 6,090 6,090 6,090<br />

Associates & Financial <strong>Investment</strong>s 0 0 0 0 0<br />

Other Assets 1,674 1,581 1,660 1,670 1,734<br />

Total Assets 9,182 8,661 8,759 8,800 8,899<br />

Interest Bearing Debt 1,575 136 -665 -1,302 -1,905<br />

Other Liabilities 1,719 3,878 4,744 4,925 5,169<br />

Total Liabilities 3,294 4,014 4,078 3,623 3,264<br />

Shareholders' Equity 3,292 4,012 4,678 5,175 5,633<br />

Minority Interests 2 2 2 2 2<br />

Total Equity 3,294 4,014 4,680 5,177 5,635<br />

Net Debt 1,096 -220 -1,016 -1,653 -2,256<br />

http://www.execution-noble.com<br />

Page 38 of 44