SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THIRD QUARTER 2010<br />

H&M<br />

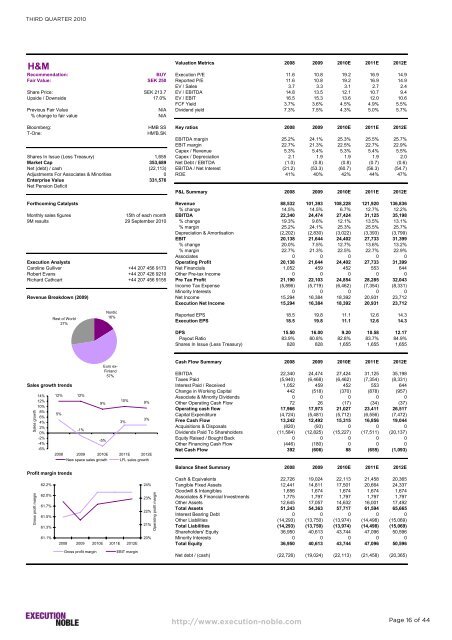

Valuation Metrics 2008 2009 2010E 2011E 2012E<br />

Recommendation: BUY Execution P/E 11.6 10.8 19.2 16.9 14.9<br />

Fair Value: SEK 250 Reported P/E 11.6 10.8 19.2 16.9 14.9<br />

EV / Sales 3.7 3.3 3.1 2.7 2.4<br />

Share Price: SEK 213.7 EV / EBITDA 14.8 13.5 12.1 10.7 9.4<br />

Upside / Downside 17.0% EV / EBIT 16.5 15.3 13.6 12.0 10.6<br />

FCF Yield 3.7% 3.6% 4.5% 4.9% 5.5%<br />

Previous Fair Value N/A Dividend yield 7.3% 7.5% 4.3% 5.0% 5.7%<br />

% change to fair value N/A<br />

Bloomberg: HMB SS Key ratios 2008 2009 2010E 2011E 2012E<br />

T-One: HM'B.SK<br />

EBITDA margin 25.2% 24.1% 25.3% 25.5% 25.7%<br />

EBIT margin 22.7% 21.3% 22.5% 22.7% 22.9%<br />

Capex / Revenue 5.3% 5.4% 5.3% 5.4% 5.5%<br />

Shares In Issue (Less Treasury) 1,655 Capex / Depreciation 2.1 1.9 1.9 1.9 2.0<br />

Market Cap 353,689 Net Debt / EBITDA (1.0) (0.8) (0.8) (0.7) (0.6)<br />

Net (debt) / cash (22,113) EBITDA / Net Interest (21.2) (53.3) (60.7) (56.3) (54.7)<br />

Adjustments For Associates & Minorities 0 ROE 41% 40% 42% 44% 47%<br />

Enterprise Value 331,576<br />

Net Pension Deficit<br />

P&L Summary 2008 2009 2010E 2011E 2012E<br />

Forthcoming Catalysts Revenue 88,532 101,393 108,228 121,920 136,836<br />

% change 14.5% 14.5% 6.7% 12.7% 12.2%<br />

Monthly sales figures 15th of each month EBITDA 22,340 24,474 27,424 31,125 35,198<br />

9M results 29 September 2010 % change 19.3% 9.6% 12.1% 13.5% 13.1%<br />

% margin 25.2% 24.1% 25.3% 25.5% 25.7%<br />

Depreciation & Amortisation (2,202) (2,830) (3,022) (3,393) (3,799)<br />

EBIT 20,138 21,644 24,402 27,733 31,399<br />

% change 20.0% 7.5% 12.7% 13.6% 13.2%<br />

% margin 22.7% 21.3% 22.5% 22.7% 22.9%<br />

Associates 0 0 0 0 0<br />

Execution Analysts Operating Profit 20,138 21,644 24,402 27,733 31,399<br />

Caroline Gulliver +44 207 456 9173 Net Financials 1,052 459 452 553 644<br />

Robert Evans +44 207 426 9210 Other Pre-tax Income 0 0 0 0 0<br />

Richard Cathcart +44 207 456 9155 Pre Tax Profit 21,190 22,103 24,854 28,285 32,043<br />

Income Tax Expense (5,896) (5,719) (6,462) (7,354) (8,331)<br />

Minority Interests 0 0 0 0 0<br />

Revenue Breakdown (2009) Net Income 15,294 16,384 18,392 20,931 23,712<br />

Execution Net Income 15,294 16,384 18,392 20,931 23,712<br />

Reported EPS 18.5 19.8 11.1 12.6 14.3<br />

Execution EPS 18.5 19.8 11.1 12.6 14.3<br />

DPS 15.50 16.00 9.20 10.58 12.17<br />

Payout Ratio 83.9% 80.8% 82.8% 83.7% 84.9%<br />

Shares In Issue (Less Treasury) 828 828 1,655 1,655 1,655<br />

Cash Flow Summary 2008 2009 2010E 2011E 2012E<br />

EBITDA 22,340 24,474 27,424 31,125 35,198<br />

Taxes Paid (5,940) (6,468) (6,462) (7,354) (8,331)<br />

Sales growth trends Interest Paid / Received 1,052 459 452 553 644<br />

Sales growth<br />

Profit margin trends<br />

Gross profit margin<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

-2%<br />

-4%<br />

-6%<br />

62.2%<br />

62.0%<br />

61.7%<br />

61.5%<br />

61.3%<br />

61.1%<br />

Rest of World<br />

27%<br />

12% 12%<br />

5%<br />

-1%<br />

Nordic<br />

16%<br />

Euro ex-<br />

Finland<br />

57%<br />

9%<br />

-5%<br />

10%<br />

3%<br />

9%<br />

3%<br />

2008 2009 2010E 2011E 2012E<br />

New space sales growth LFL sales growth<br />

2008 2009 2010E 2011E 2012E<br />

Gross profit margin EBIT margin<br />

24%<br />

23%<br />

22%<br />

21%<br />

20%<br />

Operating profit margin<br />

Change in Working Capital 442 (518) (370) (878) (957)<br />

Associate & Minority Dividends 0 0 0 0 0<br />

Other Operating Cash Flow 72 26 (17) (34) (37)<br />

Operating cash flow 17,966 17,973 21,027 23,411 26,517<br />

Capital Expenditure (4,724) (5,481) (5,712) (6,556) (7,472)<br />

Free Cash Flow 13,242 12,492 15,315 16,856 19,044<br />

Acquisitions & Disposals (820) (93) 0 0 0<br />

Dividends Paid To Shareholders (11,584) (12,825) (15,227) (17,511) (20,137)<br />

Equity Raised / Bought Back 0 0 0 0 0<br />

Other Financing Cash Flow (446) (180) 0 0 0<br />

Net Cash Flow 392 (606) 88 (655) (1,093)<br />

Balance Sheet Summary 2008 2009 2010E 2011E 2012E<br />

Cash & Equivalents 22,726 19,024 22,113 21,458 20,365<br />

Tangible Fixed Assets 12,441 14,811 17,501 20,664 24,337<br />

Goodwill & Intangibles 1,656 1,674 1,674 1,674 1,674<br />

Associates & Financial <strong>Investment</strong>s 1,775 1,797 1,797 1,797 1,797<br />

Other Assets 12,645 17,057 14,632 16,001 17,492<br />

Total Assets 51,243 54,363 57,717 61,594 65,665<br />

Interest Bearing Debt 0 0 0 0 0<br />

Other Liabilities (14,293) (13,750) (13,974) (14,498) (15,069)<br />

Total Liabilities (14,293) (13,750) (13,974) (14,498) (15,069)<br />

Shareholders' Equity 36,950 40,613 43,744 47,096 50,596<br />

Minority Interests 0 0 0 0 0<br />

Total Equity 36,950 40,613 43,744 47,096 50,596<br />

Net debt / (cash) (22,726) (19,024) (22,113) (21,458) (20,365)<br />

http://www.execution-noble.com<br />

Page 16 of 44