SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THIRD QUARTER 2010<br />

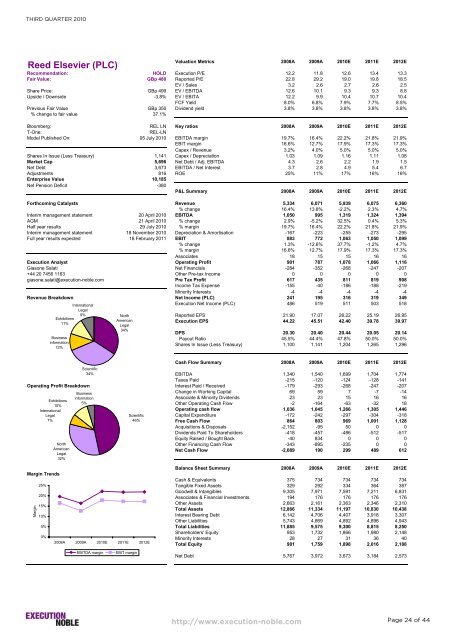

Reed Elsevier (PLC)<br />

Valuation Metrics 2008A 2009A 2010E 2011E 2012E<br />

Recommendation: HOLD Execution P/E 12.2 11.8 12.6 13.4 13.3<br />

Fair Value: GBp 480 Reported P/E 22.8 29.2 19.0 19.8 18.5<br />

EV / Sales 3.2 2.6 2.7 2.6 2.5<br />

Share Price: GBp 499 EV / EBITDA 12.6 10.1 9.3 9.3 8.8<br />

Upside / Downside -3.8% EV / EBITA 12.2 9.9 10.4 10.7 10.4<br />

FCF Yield 8.0% 6.8% 7.9% 7.7% 8.5%<br />

Previous Fair Value GBp 350 Dividend yield 3.8% 3.8% 3.8% 3.8% 3.8%<br />

% change to fair value 37.1%<br />

Bloomberg: REL LN Key ratios 2008A 2009A 2010E 2011E 2012E<br />

T-One: REL-LN<br />

Model Published On: 05 July 2010 EBITDA margin 19.7% 16.4% 22.2% 21.8% 21.9%<br />

EBIT margin 16.6% 12.7% 17.9% 17.3% 17.3%<br />

Capex / Revenue 3.2% 4.0% 5.0% 5.0% 5.0%<br />

Shares In Issue (Less Treasury) 1,141 Capex / Depreciation 1.03 1.09 1.16 1.11 1.08<br />

Market Cap 5,696 Net Debt / Adj. EBITDA 4.3 2.6 2.2 1.9 1.5<br />

Net Debt 3,673 EBITDA / Net Interest 3.7 2.8 4.9 5.4 6.7<br />

Adjustments 816 ROE 25% 11% 17% 16% 16%<br />

Enterprise Value 10,185<br />

Net Pension Deficit -380<br />

P&L Summary 2008A 2009A 2010E 2011E 2012E<br />

Forthcoming Catalysts Revenue 5,334 6,071 5,939 6,075 6,360<br />

% change 16.4% 13.8% -2.2% 2.3% 4.7%<br />

Interim management statement 20 April 2010 EBITDA 1,050 995 1,319 1,324 1,394<br />

AGM 21 April 2010 % change 2.9% -5.2% 32.5% 0.4% 5.3%<br />

Half year results 29 July 2010 % margin 19.7% 16.4% 22.2% 21.8% 21.9%<br />

Interim management statement 18 November 2010 Depreciation & Amortisation -167 -223 -255 -273 -295<br />

Full year results expected 18 February 2011 EBIT 883 772 1,063 1,050 1,099<br />

% change 1.3% -12.6% 37.7% -1.2% 4.7%<br />

% margin 16.6% 12.7% 17.9% 17.3% 17.3%<br />

Associates 18 15 15 16 16<br />

Execution Analyst Operating Profit 901 787 1,078 1,066 1,116<br />

Giasone Salati Net Financials -284 -352 -268 -247 -207<br />

+44 20 7456 1163 Other Pre-tax Income 0 0 0 0 0<br />

giasone.salati@execution-noble.com Pre Tax Profit 617 435 811 819 908<br />

Income Tax Expense -155 -40 -186 -188 -219<br />

Minority Interests -4 -4 -4 -4 -4<br />

Revenue Breakdown Net Income (PLC) 241 195 316 319 349<br />

International<br />

Legal<br />

Execution Net Income (PLC) 486 519 511 503 518<br />

Reported EPS 21.90 17.07 26.22 25.19 26.95<br />

Execution EPS 44.22 45.51 42.40 39.78 39.97<br />

DPS 20.30 20.40 20.44 20.05 20.14<br />

Payout Ratio 45.5% 44.4% 47.8% 50.0% 50.0%<br />

Shares In Issue (Less Treasury) 1,100 1,141 1,204 1,265 1,296<br />

Cash Flow Summary 2008A 2009A 2010E 2011E 2012E<br />

EBITDA 1,340 1,540 1,699 1,704 1,774<br />

Taxes Paid -215 -120 -124 -128 -141<br />

Operating Profit Breakdown Interest Paid / Received -179 -293 -268 -247 -207<br />

Margin Trends<br />

Margin<br />

Exhibitions<br />

11%<br />

Business<br />

information<br />

12%<br />

Exhibitions<br />

10%<br />

International<br />

Legal<br />

7%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

North<br />

American<br />

Legal<br />

32%<br />

9%<br />

Scientific<br />

34%<br />

Business<br />

information<br />

5%<br />

North<br />

American<br />

Legal<br />

34%<br />

Scientific<br />

46%<br />

2008A 2009A 2010E 2011E 2012E<br />

EBITDA margin EBIT margin<br />

Change in Working Capital 69 59 7 -7 -14<br />

Associate & Minority Dividends 23 23 15 16 16<br />

Other Operating Cash Flow -2 -164 -63 -32 18<br />

Operating cash flow 1,036 1,045 1,266 1,305 1,446<br />

Capital Expenditure -172 -242 -297 -304 -318<br />

Free Cash Flow 864 803 969 1,001 1,128<br />

Acquisitions & Disposals -2,152 -95 50 0 0<br />

Dividends Paid To Shareholders -418 -457 -486 -512 -517<br />

Equity Raised / Bought Back -40 834 0 0 0<br />

Other Financing Cash Flow -343 -895 -235 0 0<br />

Net Cash Flow -2,089 190 299 489 612<br />

Balance Sheet Summary 2008A 2009A 2010E 2011E 2012E<br />

Cash & Equivalents 375 734 734 734 734<br />

Tangible Fixed Assets 329 292 334 364 387<br />

Goodwill & Intangibles 9,305 7,971 7,591 7,211 6,831<br />

Associates & Financial <strong>Investment</strong>s 194 176 176 176 176<br />

Other Assets 2,663 2,161 2,363 2,346 2,310<br />

Total Assets 12,866 11,334 11,197 10,830 10,438<br />

Interest Bearing Debt 6,142 4,706 4,407 3,918 3,307<br />

Other Liabilities 5,743 4,869 4,892 4,896 4,943<br />

Total Liabilities 11,885 9,575 9,300 8,815 8,250<br />

Shareholders' Equity 953 1,732 1,866 1,980 2,148<br />

Minority Interests 28 27 31 36 40<br />

Total Equity 981 1,759 1,898 2,016 2,188<br />

Net Debt 5,767 3,972 3,673 3,184 2,573<br />

http://www.execution-noble.com<br />

Page 24 of 44