SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THIRD QUARTER 2010<br />

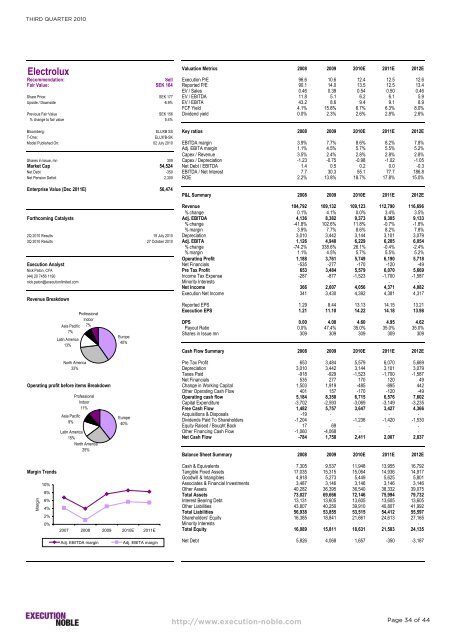

Electrolux<br />

Valuation Metrics 2008 2009 2010E 2011E 2012E<br />

Recommendation: Sell Execution P/E 96.6 10.6 12.4 12.5 12.6<br />

Fair Value: SEK 164 Reported P/E 90.1 14.0 13.5 12.5 13.4<br />

EV / Sales 0.46 0.39 0.54 0.50 0.46<br />

Share Price: SEK 177 EV / EBITDA 11.8 5.1 6.2 6.1 5.9<br />

Upside / Downside -6.9% EV / EBITA 43.2 8.6 9.4 9.1 8.9<br />

FCF Yield 4.1% 15.8% 6.7% 6.3% 8.0%<br />

Previous Fair Value SEK 156 Dividend yield 0.0% 2.3% 2.6% 2.8% 2.6%<br />

% change to fair value 5.4%<br />

Bloomberg: ELUXB SS Key ratios 2008 2009 2010E 2011E 2012E<br />

T-One: ELUX'B-SK<br />

Model Published On: 02 July 2010 EBITDA margin 3.9% 7.7% 8.6% 8.2% 7.8%<br />

Adj. EBITA margin 1.1% 4.5% 5.7% 5.5% 5.2%<br />

Capex / Revenue 3.5% 2.4% 2.8% 2.8% 2.8%<br />

Shares in Issue, mn 309 Capex / Depreciation -1.23 -0.75 -0.98 -1.02 -1.05<br />

Market Cap 54,524 Net Debt / EBITDA 1.4 0.5 0.2 0.0 -0.3<br />

Net Debt -350 EBITDA / Net Interest 7.7 30.3 55.1 77.7 186.8<br />

Net Pension Deficit 2,300 ROE 2.2% 13.8% 18.7% 17.8% 15.0%<br />

Enterprise Value (Dec 2011E) 56,474<br />

P&L Summary 2008 2009 2010E 2011E 2012E<br />

Revenue 104,792 109,132 109,123 112,790 116,696<br />

% change 0.1% 4.1% 0.0% 3.4% 3.5%<br />

Forthcoming Catalysts Adj. EBITDA 4,136 8,382 9,373 9,305 9,133<br />

% change -41.8% 102.6% 11.8% -0.7% -1.8%<br />

% margin 3.9% 7.7% 8.6% 8.2% 7.8%<br />

2Q 2010 Results 19 July 2010 Depreciation 3,010 3,442 3,144 3,101 3,079<br />

3Q 2010 Results 27 October 2010 Adj. EBITA 1,126 4,940 6,229 6,205 6,054<br />

% change -74.2% 338.6% 26.1% -0.4% -2.4%<br />

% margin 1.1% 4.5% 5.7% 5.5% 5.2%<br />

Operating Profit 1,188 3,761 5,749 6,190 5,718<br />

Execution Analyst Net Financials -535 -277 -170 -120 -49<br />

Nick Paton, CFA Pre Tax Profit 653 3,484 5,579 6,070 5,669<br />

(44) 20 7456 1190 Income Tax Expense -287 -877 -1,523 -1,700 -1,587<br />

nick.paton@executionlimited.com Minority Interests -<br />

-<br />

-<br />

-<br />

-<br />

Net Income 366 2,607 4,056 4,371 4,082<br />

Revenue Breakdown<br />

Execution Net Income 341 3,430 4,392 4,381 4,317<br />

Reported EPS 1.29 8.44 13.13 14.15 13.21<br />

Professional<br />

Indoor<br />

7%<br />

Execution EPS 1.21 11.10 14.22 14.18 13.98<br />

DPS 0.00 4.00 4.60 4.95 4.62<br />

Payout Ratio 0.0% 47.4% 35.0% 35.0% 35.0%<br />

Shares in Issue mn 309 309 309 309 309<br />

Cash Flow Summary 2008 2009 2010E 2011E 2012E<br />

Pre Tax Profit 653 3,484 5,579 6,070 5,669<br />

Depreciation 3,010 3,442 3,144 3,101 3,079<br />

Taxes Paid -918 -929 -1,523 -1,700 -1,587<br />

Net Financials 535 277 170 120 49<br />

Operating profit before items Breakdown Change in Working Capital 1,503 1,919 -485 -895 442<br />

Other Operating Cash Flow 401 157 -170 -120 -49<br />

Operating cash flow 5,184 8,350 6,715 6,576 7,602<br />

Capital Expenditure -3,702 -2,593 -3,069 -3,149 -3,235<br />

Free Cash Flow 1,482 5,757 3,647 3,427 4,366<br />

Acquisitions & Disposals -19 -<br />

-<br />

-<br />

-<br />

Dividends Paid To Shareholders -1,204 -<br />

-1,236 -1,420 -1,530<br />

Equity Raised / Bought Back 17 69 -<br />

-<br />

-<br />

Other Financing Cash Flow -1,060 -4,068 -<br />

-<br />

-<br />

Net Cash Flow -784 1,758 2,411 2,007 2,837<br />

Balance Sheet Summary 2008 2009 2010E 2011E 2012E<br />

Cash & Equivalents 7,305 9,537 11,948 13,955 16,792<br />

Margin Trends Tangible Fixed Assets 17,035 15,315 15,064 14,936 14,917<br />

Goodwill & Intangibles 4,918 5,273 5,449 5,625 5,801<br />

10%<br />

Associates & Financial <strong>Investment</strong>s 3,487 3,146 3,146 3,146 3,146<br />

8%<br />

Other Assets<br />

Total Assets<br />

40,282<br />

73,027<br />

36,395<br />

69,666<br />

36,540<br />

72,146<br />

38,332<br />

75,994<br />

39,075<br />

79,732<br />

6%<br />

Interest Bearing Debt 13,131 13,605 13,605 13,605 13,605<br />

4%<br />

2%<br />

Other Liabilities<br />

Total Liabilities<br />

Shareholders' Equity<br />

43,807<br />

56,938<br />

16,385<br />

40,250<br />

53,855<br />

18,841<br />

39,910<br />

53,515<br />

21,661<br />

40,807<br />

54,412<br />

24,613<br />

41,992<br />

55,597<br />

27,165<br />

0%<br />

Minority Interests -<br />

-<br />

-<br />

-<br />

-<br />

2007 2008 2009 2010E 2011E<br />

Total Equity 16,089 15,811 18,631 21,583 24,135<br />

Adj. EBITDA margin Adj. EBITA margin<br />

Net Debt 5,826 4,068 1,657 -350 -3,187<br />

Margin<br />

Asia Pacific<br />

7%<br />

Latin America<br />

13%<br />

North America<br />

33%<br />

Asia Pacific<br />

9%<br />

Professional<br />

Indoor<br />

11%<br />

Latin America<br />

15%<br />

North America<br />

25%<br />

Europe<br />

40%<br />

Europe<br />

40%<br />

http://www.execution-noble.com<br />

Page 34 of 44