SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THIRD QUARTER 2010<br />

Mitchells and Butlers<br />

Margin expansion on track<br />

Operating margin expansion is key to upgrades at MAB and the early<br />

signs from 1H suggest it is on track to hit its three year target. The<br />

market remains skeptical, but two strong IMS statements this quarter<br />

should help build confidence in the story. Whilst, consumer concerns<br />

remain, MAB is stretching average spend northwards replacing price<br />

sensitive consumers with more affluent ones. This will help it pass<br />

through price increases in advance of the VAT hike and offer<br />

protection should spending further deteriorate. Buy, Fair Value 360p.<br />

Target of 200-300bps is ambitious, but not unrealistic<br />

MAB’s operating margin seems to lag the food led competition, on a lease adjusted<br />

basis, despite operating from a larger estate. Management is targeting a c.200-<br />

300bps increase from the FY2009 operating margin (15.3%) over the next three<br />

years. Achieving this would imply a margin more in kilter with the competition.<br />

Big divide between consensus and the company<br />

MAB told us that there is a ‘big divide between consensus and what we think we<br />

can do’ as the market, including us, has not fully factored in the targeted margin<br />

expansion into estimates. Already, MAB surprised the market with an impressive 1H<br />

margin performance (albeit partly due to one-offs). A flat 2H margin will still imply<br />

a c.70bps improvement this year, positioning it on track to hit its year three target.<br />

MAB recognises the food opportunity<br />

In our Nov 2009 Pub survey we highlighted that consumers were willing to spend<br />

more per meal than what most pubcos charge. MAB appear to be have recognized<br />

this and started to push up average spend per head in 1H. MAB believes this<br />

strategy has seen it replace some of its more price sensitive consumers with more<br />

affluent ones. This is clearly an opportunity to drive LFL sales and margins for the<br />

business and reduces exposure from the more price sensitive demographics.<br />

MAB best positioned to pass through inflation<br />

VAT is going up, and we may yet see a hike in duty announced in the autumn, but<br />

MAB dealt with these issues relatively easily last year. Consumer weakness remains<br />

a concern so pushing through inflation is going to be tough, but we believe MAB is<br />

the best equipped pubco to do this successfully due to its multi brand strategy. At<br />

the same time, its food led offer protects it against increases in alcohol duty while<br />

VAT increases should aid its strategy of gaining more affluent consumers who are<br />

trading down from more expensive alternatives.<br />

World Cup washout a good thing…sunshine remains key<br />

The World Cup is a net negative for MAB due to its food led estate, but a poor<br />

show by England ended any trading fears. Additionally, Whitbread said the impact<br />

from the first two England games was less than expected on its pub restaurants. Of<br />

more importance to MAB is the weather, and although a barbeque is a growing<br />

temptation, as long as the sun is shining the pub trade will benefit.<br />

IMS statements to give market confidence over margins<br />

Confidence over the margin performance will lead to upgrades and with two IMS<br />

statements this quarter (22 July and late September) the opportunity exists to give<br />

the market plenty of assurance. LFL comps get tougher in 2H, but there has been<br />

nothing from the competition to suggest trade has collapsed. Nonetheless, MAB’s<br />

share price has slipped 13% relative to the FTSE All Share since its positive 1H. On<br />

an EV/EBITDA basis, MAB trades on 8.1x our calendar 2010 estimates (sector<br />

average of 8.5x). Additionally, applying a 15% discount to its EPRA adjusted NAV<br />

(to account for its non REIT status) implies a value of 345p per share. Buy.<br />

http://www.execution-noble.com<br />

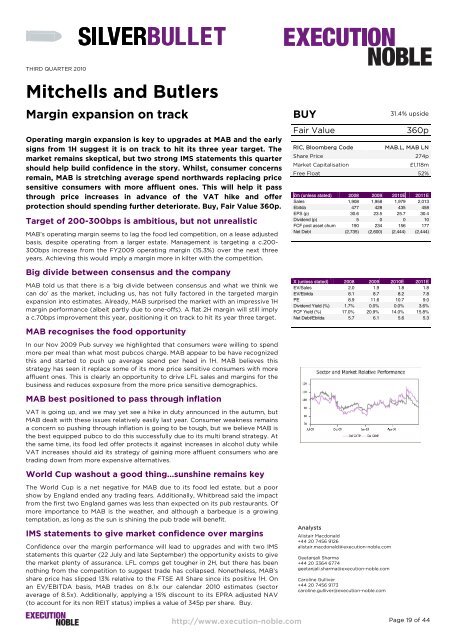

BUY<br />

31.4% upside<br />

Fair Value 360p<br />

RIC, Bloomberg Code MAB.L, MAB LN<br />

Share Price 274p<br />

Market Capitalisation £1,118m<br />

Free Float 52%<br />

£m (unless stated) 2008 2009 2010E 2011E<br />

Sales 1,908 1,958 1,979 2,013<br />

Ebitda 477 428 435 458<br />

EPS (p) 30.6 23.5 25.7 30.4<br />

Dividend (p) 5 0 0 10<br />

FCF post asset churn 190 234 156 177<br />

Net Debt (2,735) (2,600) (2,444) (2,444)<br />

X (unless stated) 2008 2009 2010E 2011E<br />

EV/Sales 2.0 1.9 1.8 1.8<br />

EV/Ebitda 8.1 8.7 8.2 7.8<br />

PE 8.9 11.6 10.7 9.0<br />

Dividend Yield (%) 1.7% 0.0% 0.0% 3.6%<br />

FCF Yield (%) 17.0% 20.9% 14.0% 15.8%<br />

Net Debt/Ebitda 5.7 6.1 5.6 5.3<br />

Analysts<br />

Alistair Macdonald<br />

+44 20 7456 9126<br />

alistair.macdonald@execution-noble.com<br />

Geetanjali Sharma<br />

+44 20 3364 6774<br />

geetanjali.sharma@execution-noble.com<br />

Caroline Gulliver<br />

+44 20 7456 9173<br />

caroline.gulliver@execution-noble.com<br />

Page 19 of 44