SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

SILVER BULLETS - Espirito Santo Investment Bank incorporating ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THIRD QUARTER 2010<br />

Mitchells & Butlers<br />

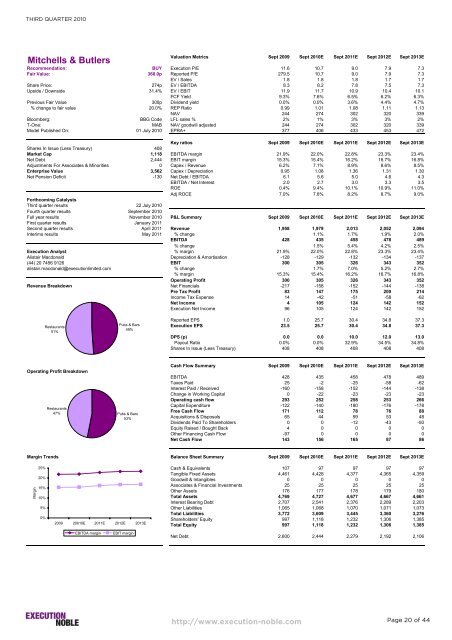

Valuation Metrics Sept 2009 Sept 2010E Sept 2011E Sept 2012E Sept 2013E<br />

Recommendation: BUY Execution P/E 11.6 10.7 9.0 7.9 7.3<br />

Fair Value: 360.0p Reported P/E 279.5 10.7 9.0 7.9 7.3<br />

EV / Sales 1.8 1.8 1.8 1.7 1.7<br />

Share Price: 274p EV / EBITDA 8.3 8.2 7.8 7.5 7.3<br />

Upside / Downside 31.4% EV / EBIT 11.9 11.7 10.9 10.4 10.1<br />

FCF Yield 9.3% 7.6% 6.5% 6.2% 6.3%<br />

Previous Fair Value 300p Dividend yield 0.0% 0.0% 3.6% 4.4% 4.7%<br />

% change to fair value 20.0% REP Ratio 0.99 1.01 1.08 1.11 1.13<br />

NAV 244 274 302 320 339<br />

Bloomberg: BBG Code LFL sales % 2% 1% 3% 3% 2%<br />

T-One: MAB NAV goodwill adjusted 244 274 302 320 339<br />

Model Published On: 01 July 2010 EPRA+ 377 406 433 453 472<br />

Key ratios Sept 2009 Sept 2010E Sept 2011E Sept 2012E Sept 2013E<br />

Shares In Issue (Less Treasury) 408<br />

Market Cap 1,118 EBITDA margin 21.9% 22.0% 22.8% 23.3% 23.4%<br />

Net Debt 2,444 EBIT margin 15.3% 15.4% 16.2% 16.7% 16.8%<br />

Adjustments For Associates & Minorities 0 Capex / Revenue 6.2% 7.1% 8.9% 8.6% 8.5%<br />

Enterprise Value 3,562 Capex / Depreciation 0.95 1.08 1.36 1.31 1.30<br />

Net Pension Deficit -130 Net Debt / EBITDA 6.1 5.6 5.0 4.6 4.3<br />

EBITDA / Net Interest 2.0 2.7 3.0 3.3 3.5<br />

ROE 0.4% 9.4% 10.1% 10.9% 11.0%<br />

Forthcoming Catalysts<br />

Adj ROCE 7.0% 7.6% 8.2% 8.7% 9.0%<br />

Third quarter results 22 July 2010<br />

Fourth quarter results September 2010<br />

Full year results November 2010 P&L Summary Sept 2009 Sept 2010E Sept 2011E Sept 2012E Sept 2013E<br />

First quarter results January 2011<br />

Second quarter results April 2011 Revenue 1,958 1,979 2,013 2,052 2,094<br />

Interims results May 2011 % change 1.1% 1.7% 1.9% 2.0%<br />

EBITDA 428 435 458 478 489<br />

% change 1.5% 5.4% 4.2% 2.5%<br />

Execution Analyst % margin 21.9% 22.0% 22.8% 23.3% 23.4%<br />

Alistair Macdonald Depreciation & Amortisation -128 -129 -132 -134 -137<br />

(44) 20 7456 9126 EBIT 300 305 326 343 352<br />

alistair.macdonald@executionlimited.com % change 1.7% 7.0% 5.2% 2.7%<br />

% margin 15.3% 15.4% 16.2% 16.7% 16.8%<br />

Operating Profit 300 305 326 343 352<br />

Revenue Breakdown Net Financials -217 -158 -152 -144 -138<br />

Pre Tax Profit 83 147 175 200 214<br />

Income Tax Expense 14 -42 -51 -58 -62<br />

Net Income 4 105 124 142 152<br />

Execution Net Income 96 105 124 142 152<br />

Operating Profit Breakdown<br />

Reported EPS 1.0 25.7 30.4 34.8 37.3<br />

Execution EPS 23.5 25.7 30.4 34.8 37.3<br />

DPS (p) 0.0 0.0 10.0 12.0 13.0<br />

Payout Ratio 0.0% 0.0% 32.9% 34.5% 34.8%<br />

Shares In Issue (Less Treasury) 408 408 408 408 408<br />

Cash Flow Summary Sept 2009 Sept 2010E Sept 2011E Sept 2012E Sept 2013E<br />

EBITDA 428 435 458 478 489<br />

Taxes Paid 25 -2 -25 -58 -62<br />

Interest Paid / Received -160 -158 -152 -144 -138<br />

Change in Working Capital 0 -22 -23 -23 -23<br />

Operating cash flow 293 252 258 253 266<br />

Capital Expenditure -122 -140 -180 -176 -178<br />

Free Cash Flow 171 112 78 76 88<br />

Acquisitions & Disposals 65 44 99 53 48<br />

Dividends Paid To Shareholders 0 0 -12 -43 -50<br />

Equity Raised / Bought Back 4 0 0 0 0<br />

Other Financing Cash Flow -97 0 0 0 0<br />

Net Cash Flow 143 156 165 87 86<br />

Margin Trends Balance Sheet Summary Sept 2009 Sept 2010E Sept 2011E Sept 2012E Sept 2013E<br />

Margin<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Restaurants<br />

51%<br />

Restaurants<br />

47%<br />

Pubs & Bars<br />

49%<br />

Pubs & Bars<br />

53%<br />

2009 20010E 2011E 2012E 2013E<br />

EBITDA margin EBIT margin<br />

Cash & Equivalents 107 97 97 97 97<br />

Tangible Fixed Assets 4,461 4,428 4,377 4,365 4,359<br />

Goodwill & Intangibles 0 0 0 0 0<br />

Associates & Financial <strong>Investment</strong>s 25 25 25 25 25<br />

Other Assets 176 177 178 179 180<br />

Total Assets 4,769 4,727 4,677 4,667 4,661<br />

Interest Bearing Debt 2,707 2,541 2,376 2,289 2,203<br />

Other Liabilities 1,065 1,068 1,070 1,071 1,073<br />

Total Liabilities 3,772 3,609 3,445 3,360 3,276<br />

Shareholders' Equity 997 1,118 1,232 1,306 1,385<br />

Total Equity 997 1,118 1,232 1,306 1,385<br />

Net Debt 2,600 2,444 2,279 2,192 2,106<br />

http://www.execution-noble.com<br />

Page 20 of 44