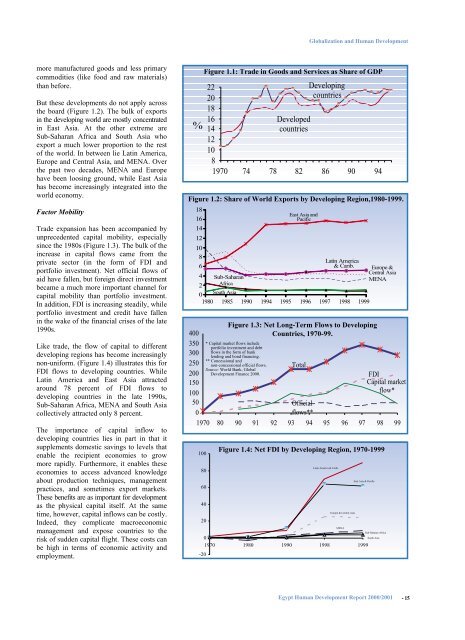

Globalization and <strong>Human</strong> <strong>Development</strong>more manufactured goods and less primarycommodities (like food and raw materials)than before.But these developments do not apply acrossthe board (Figure 1.2). The bulk of exportsin the developing world are mostly concentratedin East Asia. At the other extreme areSub-Saharan Africa and South Asia whoexport a much lower proportion to the restof the world. In between lie Latin America,Europe and Central Asia, and MENA. Overthe past two decades, MENA and Europehave been loosing ground, while East Asiahas become increasingly integrated into theworld economy.Factor MobilityTrade expansion has been accompanied byunprecedented capital mobility, especiallysince the 1980s (Figure 1.3). The bulk of theincrease in capital flows came from theprivate sector (in the form of FDI andportfolio investment). Net official flows ofaid have fallen, but foreign direct investmentbecame a much more important channel forcapital mobility than portfolio investment.In addition, FDI is increasing steadily, whileportfolio investment and credit have fallenin the wake of the financial crises of the late1990s.Like trade, the flow of capital to differentdeveloping regions has become increasinglynon-uniform. (Figure 1.4) illustrates this forFDI flows to developing countries. WhileLatin America and East Asia attractedaround 78 percent of FDI flows todeveloping countries in the late 1990s,Sub-Saharan Africa, MENA and South Asiacollectively attracted only 8 percent.The importance of capital inflow todeveloping countries lies in part in that itsupplements domestic savings to levels thatenable the recipient economies to growmore rapidly. Furthermore, it enables theseeconomies to access advanced knowledgeabout production techniques, managementpractices, and sometimes export markets.These benefits are as important for developmentas the physical capital itself. At the sametime, however, capital inflows can be costly.Indeed, they complicate macroeconomicmanagement and expose countries to therisk of sudden capital flight. These costs canbe high in terms of economic activity andemployment.%181614121086Figure 1.1: Trade in Goods and Services as Share of GDP222018161412108DevelopedcountriesDevelopingcountries1970 74 78 82 86 90 94Figure 1.2: Share of World Exports by Developing Region,1980-1999.400350300250200150100500East Asia andPacificLatin America&Carib.4 Sub-Saharan2 Africa0South Asia1980 1985 1990 1994 1995 1996 1997 1998 1999Figure 1.3: Net Long-Term Flows to DevelopingCountries, 1970-99.TotalOfficialflows**Europe &Central AsiaMENAFDICapital marketflow*1970 80 90 91 92 93 94 95 96 97 98 9910080604020-20* Capital market flows includeportfolio investment and debtflows in the form of banklending and bond financing.** Concessional andnon-concessional official flows.Source: World Bank, Global<strong>Development</strong> Finance 2000.Figure 1.4: Net FDI by Developing Region, 1970-1999Latin America & Carib.Europe & Central AsiaMENAEast Asia & Pacific01970 1980 1990 1998 1999Sub-Saharan AfricaSouth AsiaEgypt <strong>Human</strong> <strong>Development</strong> Report 2000/2001 - 15

Globalization and <strong>Human</strong> <strong>Development</strong>Remittances frommigration in countrieslike Egypt constitutean important sourceof foreign exchangeearnings.As for labor mobility, data is hard to comeby. However, the IMF reports that the sizeof the labor force born in other countries hasincreased by one-half during the period1965-90. The same report further notes thatmost migration is between developing countries.Remittances from migration in countrieslike Egypt constitute an important source offoreign exchange earnings.The Nature of Recent GlobalizationThe current episode of world integration isnot new. Historically, the ratio of trade toGDP grew from 1820 to 1913, followed bya period of low integration between 1913and 1950 due to the two world wars andprotectionism during the Great Depression.After 1950, however, industrial economiesled the integration process to reach, by the1970s, the levels of integration previouslywitnessed at the turn of the century. Sincethen, the trade liberalization policiesadopted by several developing countrieshave intensified the level of worldintegration to levels not seen before.While the recent wave of globalization isnot new, trade is now much deeper andcapital flows are more far-reaching thanbefore. According to Krugman, the currentwave of globalization in trade ischaracterized by: (1) a rise in intra-industrytrade, (2) an increased break in productiongeographically, (3) new countries with hightrade-GDP ratios, and (4) large exports ofmanufactured goods from low- tohigh-wage countries. Similarly, although thelevel of capital inflow to GDP is not highernow than it used to be a hundred years ago,it is different in character. Fishlow notesthat earlier capital inflows were received bygovernments in colonized countries, andwere devoted to a narrow range ofinfrastructure projects. Today, both thenature of the borrowers and the allocationsof capital are more diverse.What is equally interesting is that thepotential for reversal of the current wave ofglobalization is considered much lower thanbefore. There are those who argue thatpolitical pressure will eventually mount toerect higher trade barriers, slow downimmigration, and restrict capital flows. Toothers, however, the probability of areversal of the current wave of globalizationseems low based on the rationale that thesteady expansion and cyclical stabilityexperienced by developed countries in thepost-war period supports open traderegimes. Most countries now have socialinsurance schemes (e.g. for unemployment)and escape clauses in world tradeagreements, both of which ease the negativeeffects of competition from imports. Inaddition, the new wave of globalization iscreating its own supporters at home,especially those engaged in exports.Accordingly, globalization seems to be hereto stay.Globalization and <strong>Human</strong> <strong>Development</strong>If globalization is here to stay, at least forthe foreseeable future, it is important to askseveral questions. Does it reduce or increasepoverty? Does it equalize income acrossand within nations, or does it worsenincome distribution? More broadly, does itimprove the quality of life or not? We willdiscuss these questions in turn.Globalization and PovertyThe most basic argument in favor of apositive association between globalizationand poverty reduction contends that greateropenness increases competition and accessto capital, technology, cheaper imports, andlarger export markets. Greater competitionleads to a more efficient allocation ofresources and a division of labor thatenables countries to focus on doing whatthey can do best. Greater access to capital,technology, cheaper imports and marketsallows countries to do more than theywould have been able to do on their own.As a result, per capita income, including percapita income of the poor, increases fasterthan would otherwise be the case.This argument may not hold in practicehowever. First, there is no guarantee thatopenness will increase per capita income.The main reason for this is that openness isbut one of the preconditions for fastereconomic growth. Indeed, standard growthregressions often include on the right handside a number of initial conditions (e.g.initial per capita income, human capitalstock, a measure of inequality) and anumber of policy variables (includingopenness, rule of law, size of government).Where countries do not possess other progrowth conditions, openness may notnecessarily lead to higher per capita income.Similarly, even if openness is associatedwith faster growth in per capita income,there is no guarantee that poverty will16 -Egypt <strong>Human</strong> <strong>Development</strong> Report 2000/2001