Outlook for Air Transport to the Year 2015 - FILT CGIL Foggia

Outlook for Air Transport to the Year 2015 - FILT CGIL Foggia

Outlook for Air Transport to the Year 2015 - FILT CGIL Foggia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

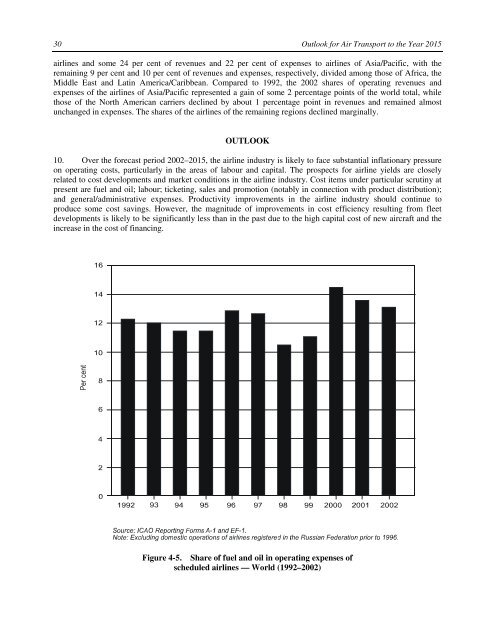

30 <strong>Outlook</strong> <strong>for</strong> <strong>Air</strong> <strong>Transport</strong> <strong>to</strong> <strong>the</strong> <strong>Year</strong> <strong>2015</strong>airlines and some 24 per cent of revenues and 22 per cent of expenses <strong>to</strong> airlines of Asia/Pacific, with <strong>the</strong>remaining 9 per cent and 10 per cent of revenues and expenses, respectively, divided among those of Africa, <strong>the</strong>Middle East and Latin America/Caribbean. Compared <strong>to</strong> 1992, <strong>the</strong> 2002 shares of operating revenues andexpenses of <strong>the</strong> airlines of Asia/Pacific represented a gain of some 2 percentage points of <strong>the</strong> world <strong>to</strong>tal, whilethose of <strong>the</strong> North American carriers declined by about 1 percentage point in revenues and remained almostunchanged in expenses. The shares of <strong>the</strong> airlines of <strong>the</strong> remaining regions declined marginally.OUTLOOK10. Over <strong>the</strong> <strong>for</strong>ecast period 2002–<strong>2015</strong>, <strong>the</strong> airline industry is likely <strong>to</strong> face substantial inflationary pressureon operating costs, particularly in <strong>the</strong> areas of labour and capital. The prospects <strong>for</strong> airline yields are closelyrelated <strong>to</strong> cost developments and market conditions in <strong>the</strong> airline industry. Cost items under particular scrutiny atpresent are fuel and oil; labour; ticketing, sales and promotion (notably in connection with product distribution);and general/administrative expenses. Productivity improvements in <strong>the</strong> airline industry should continue <strong>to</strong>produce some cost savings. However, <strong>the</strong> magnitude of improvements in cost efficiency resulting from fleetdevelopments is likely <strong>to</strong> be significantly less than in <strong>the</strong> past due <strong>to</strong> <strong>the</strong> high capital cost of new aircraft and <strong>the</strong>increase in <strong>the</strong> cost of financing.Figure 4-5. Share of fuel and oil in operating expenses ofscheduled airlines — World (1992–2002)