Prospectus-Final (clean) - Malta Financial Services Authority

Prospectus-Final (clean) - Malta Financial Services Authority

Prospectus-Final (clean) - Malta Financial Services Authority

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

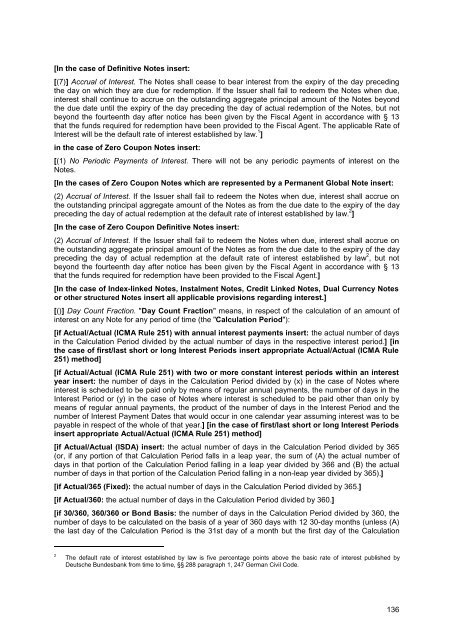

[In the case of Definitive Notes insert:[(7)] Accrual of Interest. The Notes shall cease to bear interest from the expiry of the day precedingthe day on which they are due for redemption. If the Issuer shall fail to redeem the Notes when due,interest shall continue to accrue on the outstanding aggregate principal amount of the Notes beyondthe due date until the expiry of the day preceding the day of actual redemption of the Notes, but notbeyond the fourteenth day after notice has been given by the Fiscal Agent in accordance with § 13that the funds required for redemption have been provided to the Fiscal Agent. The applicable Rate ofInterest will be the default rate of interest established by law. 1 ]in the case of Zero Coupon Notes insert:[(1) No Periodic Payments of Interest. There will not be any periodic payments of interest on theNotes.[In the cases of Zero Coupon Notes which are represented by a Permanent Global Note insert:(2) Accrual of Interest. If the Issuer shall fail to redeem the Notes when due, interest shall accrue onthe outstanding principal aggregate amount of the Notes as from the due date to the expiry of the daypreceding the day of actual redemption at the default rate of interest established by law. 2 ][In the case of Zero Coupon Definitive Notes insert:(2) Accrual of Interest. If the Issuer shall fail to redeem the Notes when due, interest shall accrue onthe outstanding aggregate principal amount of the Notes as from the due date to the expiry of the daypreceding the day of actual redemption at the default rate of interest established by law 2 , but notbeyond the fourteenth day after notice has been given by the Fiscal Agent in accordance with § 13that the funds required for redemption have been provided to the Fiscal Agent.][In the case of Index-linked Notes, Instalment Notes, Credit Linked Notes, Dual Currency Notesor other structured Notes insert all applicable provisions regarding interest.][()] Day Count Fraction. "Day Count Fraction" means, in respect of the calculation of an amount ofinterest on any Note for any period of time (the "Calculation Period"):[if Actual/Actual (ICMA Rule 251) with annual interest payments insert: the actual number of daysin the Calculation Period divided by the actual number of days in the respective interest period.] [inthe case of first/last short or long Interest Periods insert appropriate Actual/Actual (ICMA Rule251) method][if Actual/Actual (ICMA Rule 251) with two or more constant interest periods within an interestyear insert: the number of days in the Calculation Period divided by (x) in the case of Notes whereinterest is scheduled to be paid only by means of regular annual payments, the number of days in theInterest Period or (y) in the case of Notes where interest is scheduled to be paid other than only bymeans of regular annual payments, the product of the number of days in the Interest Period and thenumber of Interest Payment Dates that would occur in one calendar year assuming interest was to bepayable in respect of the whole of that year.] [in the case of first/last short or long Interest Periodsinsert appropriate Actual/Actual (ICMA Rule 251) method][if Actual/Actual (ISDA) insert: the actual number of days in the Calculation Period divided by 365(or, if any portion of that Calculation Period falls in a leap year, the sum of (A) the actual number ofdays in that portion of the Calculation Period falling in a leap year divided by 366 and (B) the actualnumber of days in that portion of the Calculation Period falling in a non-leap year divided by 365).][if Actual/365 (Fixed): the actual number of days in the Calculation Period divided by 365.][if Actual/360: the actual number of days in the Calculation Period divided by 360.][if 30/360, 360/360 or Bond Basis: the number of days in the Calculation Period divided by 360, thenumber of days to be calculated on the basis of a year of 360 days with 12 30-day months (unless (A)the last day of the Calculation Period is the 31st day of a month but the first day of the Calculation2The default rate of interest established by law is five percentage points above the basic rate of interest published byDeutsche Bundesbank from time to time, §§ 288 paragraph 1, 247 German Civil Code.136