Prospectus-Final (clean) - Malta Financial Services Authority

Prospectus-Final (clean) - Malta Financial Services Authority

Prospectus-Final (clean) - Malta Financial Services Authority

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

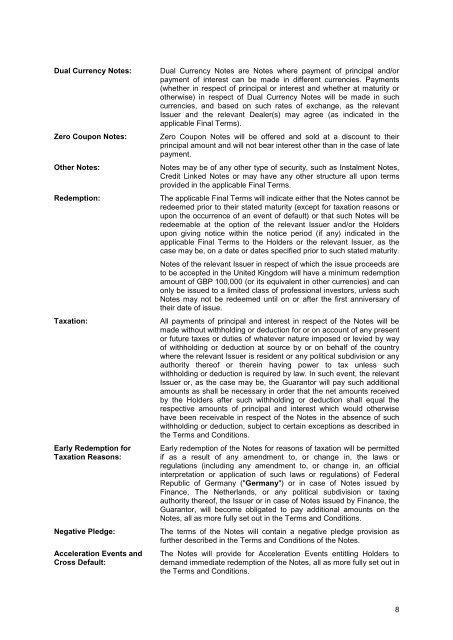

Dual Currency Notes:Zero Coupon Notes:Other Notes:Redemption:Taxation:Early Redemption forTaxation Reasons:Negative Pledge:Acceleration Events andCross Default:Dual Currency Notes are Notes where payment of principal and/orpayment of interest can be made in different currencies. Payments(whether in respect of principal or interest and whether at maturity orotherwise) in respect of Dual Currency Notes will be made in suchcurrencies, and based on such rates of exchange, as the relevantIssuer and the relevant Dealer(s) may agree (as indicated in theapplicable <strong>Final</strong> Terms).Zero Coupon Notes will be offered and sold at a discount to theirprincipal amount and will not bear interest other than in the case of latepayment.Notes may be of any other type of security, such as Instalment Notes,Credit Linked Notes or may have any other structure all upon termsprovided in the applicable <strong>Final</strong> Terms.The applicable <strong>Final</strong> Terms will indicate either that the Notes cannot beredeemed prior to their stated maturity (except for taxation reasons orupon the occurrence of an event of default) or that such Notes will beredeemable at the option of the relevant Issuer and/or the Holdersupon giving notice within the notice period (if any) indicated in theapplicable <strong>Final</strong> Terms to the Holders or the relevant Issuer, as thecase may be, on a date or dates specified prior to such stated maturity.Notes of the relevant Issuer in respect of which the issue proceeds areto be accepted in the United Kingdom will have a minimum redemptionamount of GBP 100,000 (or its equivalent in other currencies) and canonly be issued to a limited class of professional investors, unless suchNotes may not be redeemed until on or after the first anniversary oftheir date of issue.All payments of principal and interest in respect of the Notes will bemade without withholding or deduction for or on account of any presentor future taxes or duties of whatever nature imposed or levied by wayof withholding or deduction at source by or on behalf of the countrywhere the relevant Issuer is resident or any political subdivision or anyauthority thereof or therein having power to tax unless suchwithholding or deduction is required by law. In such event, the relevantIssuer or, as the case may be, the Guarantor will pay such additionalamounts as shall be necessary in order that the net amounts receivedby the Holders after such withholding or deduction shall equal therespective amounts of principal and interest which would otherwisehave been receivable in respect of the Notes in the absence of suchwithholding or deduction, subject to certain exceptions as described inthe Terms and Conditions.Early redemption of the Notes for reasons of taxation will be permittedif as a result of any amendment to, or change in, the laws orregulations (including any amendment to, or change in, an officialinterpretation or application of such laws or regulations) of FederalRepublic of Germany ("Germany") or in case of Notes issued byFinance, The Netherlands, or any political subdivision or taxingauthority thereof, the Issuer or in case of Notes issued by Finance, theGuarantor, will become obligated to pay additional amounts on theNotes, all as more fully set out in the Terms and Conditions.The terms of the Notes will contain a negative pledge provision asfurther described in the Terms and Conditions of the Notes.The Notes will provide for Acceleration Events entitling Holders todemand immediate redemption of the Notes, all as more fully set out inthe Terms and Conditions.8