- Page 1 and 2:

CHAPTER-1WEST BENGAL1.1 WEST BENGAL

- Page 3 and 4:

3d) Ensuring that there is signific

- Page 5 and 6:

5(a) State Project Office (SPO), Sa

- Page 7 and 8:

71.7 DEMOGRAPHIC AND EDUCATIONAL PR

- Page 9 and 10:

9The authorities of the Society are

- Page 11 and 12:

11ORGANISATIONAL CHARTSTATE IMPLEME

- Page 13 and 14: 13South 24 Parganas - Against 45 me

- Page 15 and 16: 15YearThe position of the contractu

- Page 17 and 18: 17of child population in a specific

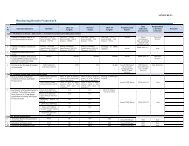

- Page 19 and 20: 19Sl.No.Acti vi tyAWPproposed2005-2

- Page 21: 21Table-3(Rupees in lakh)Sl.No.Acti

- Page 24 and 25: 24Institute of Education Management

- Page 26 and 27: 26The above status indicated tardy

- Page 28 and 29: 28Table- 7(Rup ees in lakh )2 0 0 6

- Page 30 and 31: 30Table- 9M ur s hida ba dSout h 24

- Page 32 and 33: 324 activities (Block Resource Cent

- Page 34 and 35: 342.6 FUND FLOW2.6.1FUNDING NORMS :

- Page 36 and 37: 362.6.3 LEVEL OF INVESTMENT BY STAT

- Page 38 and 39: 38annual outlay was not received in

- Page 40 and 41: 40December 2008) depicted a Govt. o

- Page 42 and 43: 42Table 11Year/Date ofsanctionAmoun

- Page 44 and 45: 44(vii) Delayed and short release o

- Page 46 and 47: 462.7.3 Rush of Expenditure in Marc

- Page 48 and 49: 48Table 13(Rupees in lakh)SlNo.Name

- Page 50 and 51: 50Cash and Bank Balance held at dis

- Page 52 and 53: 52(B)DISTRICT : SOUTH 24 PARGANAS(R

- Page 54 and 55: 542.7.7 BANK BALANCES HELD BY THE S

- Page 56 and 57: 56audited earlier than the issue of

- Page 58 and 59: 58The Society did not maintain sepa

- Page 60 and 61: 60MAINTENANCE OF ACCOUNTS AND AUDIT

- Page 62 and 63: 62Further, it was seen that the Ann

- Page 66 and 67: 66(vii) The Mission did not charge

- Page 68 and 69: 68Bengal to CLRCS and school level

- Page 70 and 71: 70SPO, Salt Lake AND DPOs, Murshida

- Page 72 and 73: 728. Most of the schools visited ha

- Page 74 and 75: 74d) Rs.40,000.00 being computer gr

- Page 76 and 77: 763.10 INTERNAL AUDIT :In terms of

- Page 78 and 79: 78CHAPTER-4SCHOOLS, TEACHERS, STUDE

- Page 80 and 81: 80primary and upper primary schools

- Page 82 and 83: 824.8 STUDENTS :4.8.1 Primary Educa

- Page 84 and 85: 84Position of teachers in relation

- Page 86 and 87: 86Table 21ParticularsTotal member o

- Page 88 and 89: 88teachers were trained on Physical

- Page 90 and 91: 904.11 STATE COUNCIL OF EDUCATIONAL

- Page 92 and 93: 92Child Census-2006, was conducted

- Page 94 and 95: 94also offered by P&RDD, NSK which

- Page 96 and 97: 96The overall completion, Repeater,

- Page 98 and 99: 984.12.5 BRIDGE COURSE CENTRES ( BC

- Page 100 and 101: 10087,020) with a view to enrolling

- Page 102 and 103: 102Out of 1,233 Study Centres appro

- Page 104 and 105: 104Table 302005-06 2006-07 2007-08

- Page 106 and 107: 106September 2008) only 5.08% of th

- Page 108 and 109: 1084.13.3 The table below depicts t

- Page 110 and 111: 110During 2008-09 (upto November 20

- Page 112 and 113: 11214.13.6 The following table depi

- Page 114 and 115:

114Educational QualificationTrainin

- Page 116 and 117:

116Table 33YearTarget Physi calC WS

- Page 118 and 119:

118The circumstances attributable t

- Page 120 and 121:

120conditions, etc. Records reveale

- Page 122 and 123:

122Diagnostic Achievement Test (DAT

- Page 124 and 125:

124YearTarget10 days regula r teach

- Page 126 and 127:

126end of Classes-II and IV. Howeve

- Page 128 and 129:

128Table 34(Rs. in lakh)PrimaryPhys

- Page 130 and 131:

130South 24-Parganas -Shortfall in

- Page 132 and 133:

132TABLE-1Table 36(Rs. In lakh)2005

- Page 134 and 135:

134primary school teachers were not

- Page 136 and 137:

136CHAPTER-66.1 MAINTENANCE GRANTPa

- Page 138 and 139:

138disburse 44.87 per cent of the m

- Page 140 and 141:

140CHAPTER-77.1 Maintenance and rep

- Page 142 and 143:

142District Project Office through

- Page 144 and 145:

1442008). The District Project Offi

- Page 146 and 147:

146CHAPTER-88.1 FREE TEST BOOKSAt p

- Page 148 and 149:

148But in absence of any account of

- Page 150 and 151:

150The Village Education Committee

- Page 152 and 153:

152TABLE-4 2Financial ProgressActiv

- Page 154 and 155:

154expenditure of Rs.549.35 lakh wa

- Page 156 and 157:

156Table 45(Rs. In lakh)2 0 0 5 -2

- Page 158 and 159:

1582 0 0 5 -2 00 6Type o fI nstruct

- Page 160 and 161:

160(SIS) released lump sum of Rs.60

- Page 162 and 163:

162It was revealed from records tha

- Page 164 and 165:

164and improving upon quality of le

- Page 166 and 167:

166Besides ,an amount of Rs.1,96,37

- Page 168 and 169:

168were procured and suppliedduring

- Page 170 and 171:

170years (2005-06 and 2006-07) and

- Page 172 and 173:

172and effective for the students,

- Page 174 and 175:

174[Amount in lakh]Date of release

- Page 176 and 177:

176(c) to improve the Quality of ed

- Page 178 and 179:

1782. Birbhum 50.35 19.363. Cooch B

- Page 180 and 181:

180NPEGEL further provides that blo

- Page 182 and 183:

182declaring EBB status and 4 (iden

- Page 184 and 185:

184districts fulfilling the main pa

- Page 186 and 187:

186It was observed that (i) there w

- Page 188 and 189:

188(iii) For the years 2005-2006 to

- Page 190 and 191:

190population with low female liter

- Page 192 and 193:

192Sl.NoDistr icts(identif ie d)Tot

- Page 194 and 195:

194numbers of out of school girls i

- Page 196 and 197:

196construction of hostels under KG

- Page 198 and 199:

198released by both the Government

- Page 200 and 201:

20011.2.6 The KGBV school visited b

- Page 202 and 203:

202Number ofAWCsChildrenYearState M

- Page 204 and 205:

204Pri ma ry Ed ucation(i n pe rcen

- Page 206 and 207:

206The State Mission undertook the

- Page 208 and 209:

208South 24 Pg s. 3 3 .07 1 .63 1 1

- Page 210 and 211:

210As per para 36.1 of the MFM & P,

- Page 212 and 213:

212Darjeeling 2 6 .35 1 .58 1 8 .76

- Page 214 and 215:

214IMPROPER UTILISATION OF SSA FUND

- Page 216 and 217:

216please be stated over of the amo

- Page 218 and 219:

218Apart from the above, one volunt

- Page 220 and 221:

220An abstract of specific features

- Page 222 and 223:

222♦A section of the population i

- Page 224 and 225:

224(i) Schools having dilapidated b

- Page 226 and 227:

226(Kandi CLRC) damaged and water l

- Page 228 and 229:

228Under SSA norms, one time grant

- Page 230 and 231:

230Purandarpur High, Nabagram Saunt

- Page 232 and 233:

2326 Khidir pur Primary7 Ugra Bhatp

- Page 234 and 235:

234Thus out of 56 schools visited b

- Page 236 and 237:

236No instance of delay in commence

- Page 238 and 239:

238door survey and identified the c

- Page 240 and 241:

240cement bags, Mats etc. students

- Page 242 and 243:

242In all the schools visited by th

- Page 244 and 245:

244It emerges from the above table

- Page 246 and 247:

246(i)To enhance the performance of

- Page 248 and 249:

248However, supply of free text boo

- Page 250 and 251:

250programme remained suspended til

- Page 252 and 253:

25215.30 Non-availability of water

- Page 254 and 255:

254CLRc, and schools is necessary a

- Page 256 and 257:

256Study Team. Special and differen

- Page 258 and 259:

25816.10 CWSNThe expenditures on CW