<strong>Annual</strong> base salaryThe base salary for members of the EC is set with referenceto positions of equivalent responsibility outside <strong>ABB</strong>, asdetermined using the Hay methodology described above. Itis reviewed annually principally on the basis of Hay’s annualTop Executive Compensation in Europe survey. When consideringchanges in base salary, the executive’s performanceduring the preceding year against individual objectives istaken into account. Under its mandate with <strong>ABB</strong>, Hay alsoconducts job evaluations.BenefitsMembers of the EC receive pension benefits, payable into theSwiss <strong>ABB</strong> Pension Fund and <strong>ABB</strong> Supplementary InsurancePlan (the regulations are available at www.abbvorsorge.ch).The current level of pension benefits was set in 2006 on thebasis of results from a survey of pension conditions for Swissbasedexecutives at Adecco, Ciba, Dow, Nestlé, Novartis,Roche, Serono, Syngenta and Sulzer that <strong>ABB</strong> commissionedfrom Towers Watson, a consultant. The survey was repeatedin 2010 and a new benchmarking exercise will be conductedin 2013. Towers Watson also provides actuarial services to<strong>ABB</strong>, and pension advisory services in connection with mergersand acquisitions transactions.The compensation of EC members also includes socialsecurity contributions and other benefits, as outlined in thetable in section 2.4 of this Remuneration report. The Boardhas decided to provide tax equalization for EC membersresident outside Switzerland to the extent that they are notable to claim a tax credit in their country of residence forincome taxes they have paid in Switzerland.Short-term variable compensationPayment of the short-term variable component is conditionalon the fulfillment of predefined annual objectives that arespecific, quantifiable and challenging. Short-term variablecompensation for members of the EC and most other seniormanagers throughout the company is based on <strong>Group</strong>performance objectives. For some managers with regional orcountry-level responsibilities, short-term variable compensationis based on related objectives adapted to <strong>ABB</strong>’s goalsin these markets. The CEO recommends the <strong>Group</strong> performanceobjectives to the GNCC, which may make or requestamendments before it submits a proposal to the Board.The Board takes the final decision.The <strong>2012</strong> objectives, shown in the table below, were<strong>Group</strong>-wide metrics that were aligned with the <strong>Group</strong>’s 2015strategic targets that have been communicated to shareholders.Objective (1)WeightingOrders received 12.5%Revenues 12.5%Operational EBITDA (2) 25%Ratio of operating cash flow to operational EBIT (3) 25%Net Promoter Score (NPS) (4) 10%Cost savings 15%The financial objectives exclude the impact of currency fluctuations.See definition in Note 23 to <strong>ABB</strong>’s Consolidated Financial Statements.Operating cash flow is defined as net cash provided by operating activities, reversingthe impact of interest and taxes. Operational EBIT is defined as Operational EBITDAbefore excluding depreciation and amortization.NPS is a metric based on dividing customers into three categories: Promoters, Passives,and Detractors. This is achieved by asking customers in a one-question survey whetherthey would recommend <strong>ABB</strong> to a colleague. In <strong>2012</strong>, <strong>ABB</strong> had a target to increase thenumber of countries that have improved their NPS score.(1)(2)(3)(4)The payout for fully achieving the predefined annual objectivesis equivalent to 150 percent of the base salary forthe CEO and 100 percent of the base salary for other membersof the EC. Underperformance results in a lower payout,or none at all if performance is below a certain threshold.If the objectives are exceeded, the Board has the discretionto approve a payout that is up to 50 percent higher (representingup to 225 percent of the base salary for the CEOand 150 percent of the base salary for other members of theEC). For <strong>2012</strong>, the Board exercised its discretion and awardeda 10 percent higher payout, reflecting the company’s performanceagainst the objectives.34 Remuneration report | <strong>ABB</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>

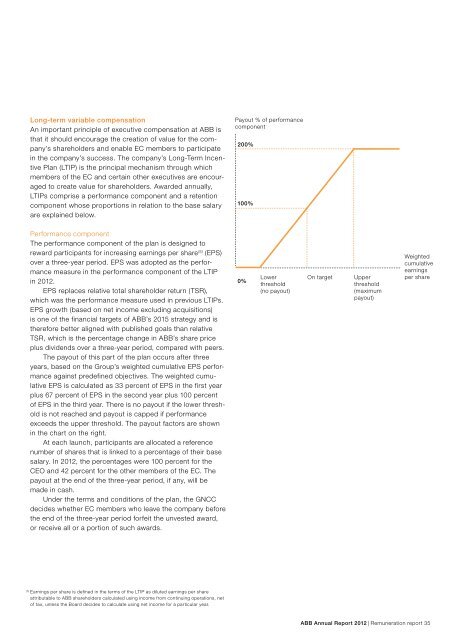

Long-term variable compensationAn important principle of executive compensation at <strong>ABB</strong> isthat it should encourage the creation of value for the company’sshareholders and enable EC members to participatein the company’s success. The company’s Long-Term IncentivePlan (LTIP) is the principal mechanism through whichmembers of the EC and certain other executives are encouragedto create value for shareholders. Awarded annually,LTIPs comprise a performance component and a retentioncomponent whose proportions in relation to the base salaryare explained below.Payout % of performancecomponent200%100%Performance componentThe performance component of the plan is designed toreward participants for increasing earnings per share (5) (EPS)over a three-year period. EPS was adopted as the performancemeasure in the performance component of the LTIPin <strong>2012</strong>.EPS replaces relative total shareholder return (TSR),which was the performance measure used in previous LTIPs.EPS growth (based on net income excluding acquisitions)is one of the financial targets of <strong>ABB</strong>’s 2015 strategy and istherefore better aligned with published goals than relativeTSR, which is the percentage change in <strong>ABB</strong>’s share priceplus dividends over a three-year period, compared with peers.The payout of this part of the plan occurs after threeyears, based on the <strong>Group</strong>’s weighted cumulative EPS performanceagainst predefined objectives. The weighted cumulativeEPS is calculated as 33 percent of EPS in the first yearplus 67 percent of EPS in the second year plus 100 percentof EPS in the third year. There is no payout if the lower thresholdis not reached and payout is capped if performanceexceeds the upper threshold. The payout factors are shownin the chart on the right.At each launch, participants are allocated a referencenumber of shares that is linked to a percentage of their basesalary. In <strong>2012</strong>, the percentages were 100 percent for theCEO and 42 percent for the other members of the EC. Thepayout at the end of the three-year period, if any, will bemade in cash.Under the terms and conditions of the plan, the GNCCdecides whether EC members who leave the company beforethe end of the three-year period forfeit the unvested award,or receive all or a portion of such awards.0%Lowerthreshold(no payout)On targetUpperthreshold(maximumpayout)Weightedcumulativeearningsper share(5)Earnings per share is defined in the terms of the LTIP as diluted earnings per shareattributable to <strong>ABB</strong> shareholders calculated using income from continuing operations, netof tax, unless the Board decides to calculate using net income for a particular year.<strong>ABB</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | Remuneration report 35

- Page 1: Building on our technology leadersh

- Page 4 and 5: This is ABBABB is one of the world

- Page 6 and 7: Chairman and CEO letterDear shareho

- Page 8 and 9: We will also be looking at ways to

- Page 10 and 11: HighlightsResilient performance thr

- Page 12 and 13: As of March 1, 2013Executive Commit

- Page 14 and 15: 12 Corporate governance report | AB

- Page 16 and 17: 1. Principles1.1 General principles

- Page 18 and 19: The following table sets forth, as

- Page 20 and 21: 3.2 Changes to the share capitalIn

- Page 22 and 23: 4.3 Shareholders’ dividend rights

- Page 24 and 25: As at December 31, 2012, the member

- Page 26 and 27: Brice Koch was appointed Executive

- Page 28 and 29: 10. Auditors10.1 AuditorsErnst & Yo

- Page 30 and 31: 28 Remuneration report | ABB Annual

- Page 32 and 33: ABB’s success depends on its abil

- Page 34 and 35: 1.3 Board compensation in 2012Compe

- Page 38 and 39: Historical payout of performance co

- Page 40 and 41: Base salaryShort-term variablecompe

- Page 42 and 43: 6.2 EC ownership of ABB sharesand o

- Page 44 and 45: 42 Financial review | ABB Annual Re

- Page 46 and 47: Operating and financial reviewand p

- Page 48 and 49: In May 2012, the Low Voltage Produc

- Page 50 and 51: In a market environment in which ne

- Page 52 and 53: We record provisions for our contin

- Page 54 and 55: Goodwill and other intangible asset

- Page 56 and 57: We also incur expenses other than c

- Page 58 and 59: In 2011, orders in the Power Produc

- Page 60 and 61: We determine the geographic distrib

- Page 62 and 63: In 2012, “Capital gains, net” w

- Page 64 and 65: Divisional analysisPower ProductsTh

- Page 66 and 67: Continued pricing pressure in some

- Page 68 and 69: OrdersIn 2012, orders were flat due

- Page 70 and 71: The geographic distribution of orde

- Page 72 and 73: In 2011, revenues increased, driven

- Page 74 and 75: Throughout 2012 and 2011, the inves

- Page 76 and 77: Current liabilitiesDecember 31, ($

- Page 78 and 79: Total cash disbursements for the pu

- Page 80 and 81: Consolidated Financial StatementsCo

- Page 82 and 83: Consolidated Balance SheetsDecember

- Page 84 and 85: Consolidated Statements of Changes

- Page 86 and 87:

Notes to theConsolidated Financial

- Page 88 and 89:

Note 2Significant accounting polici

- Page 90 and 91:

Note 2Significant accounting polici

- Page 92 and 93:

Note 2Significant accounting polici

- Page 94 and 95:

Note 3Acquisitions and increasesin

- Page 96 and 97:

Note 3Acquisitions and increasesin

- Page 98 and 99:

Note 5Financial instrumentsCurrency

- Page 100 and 101:

Note 5Financial instruments, contin

- Page 102 and 103:

Note 6Fair valuesRecurring fair val

- Page 104 and 105:

Note 7Receivables, net, continued

- Page 106 and 107:

Note 9Other non-current assets“Ot

- Page 108 and 109:

Note 11Goodwill and other intangibl

- Page 110 and 111:

Note 12Debt, continuedThe 4.625% EU

- Page 112 and 113:

Note 14Leases, continuedNote 15Comm

- Page 114 and 115:

Note 15Commitments and contingencie

- Page 116 and 117:

Note 16Taxes, continuedIn 2012, 201

- Page 118 and 119:

Note 16Taxes, continuedAt December

- Page 120 and 121:

Note 17Employee benefits, continued

- Page 122 and 123:

Note 17Employee benefits, continued

- Page 124 and 125:

Note 18Share-based paymentarrangeme

- Page 126 and 127:

Note 18Share-based paymentarrangeme

- Page 128 and 129:

Note 19Stockholders’ equityAt bot

- Page 130 and 131:

Note 21Other comprehensive incomeTh

- Page 132 and 133:

Note 23Operating segment andgeograp

- Page 134 and 135:

Note 23Operating segment andgeograp

- Page 136 and 137:

Note 23Operating segment andgeograp

- Page 138 and 139:

Report of the Statutory Auditor on

- Page 140 and 141:

Financial Statements of ABB Ltd, Zu

- Page 142 and 143:

Note 6Stockholders’ equityShareca

- Page 144 and 145:

Note 10Board of Directors compensat

- Page 146 and 147:

Note 11Executive Committeecompensat

- Page 148 and 149:

Note 11Executive Committeecompensat

- Page 150 and 151:

Note 12Share ownership of ABB byBoa

- Page 152 and 153:

Proposed appropriation of available

- Page 154 and 155:

Investor informationABB Ltd share p

- Page 156 and 157:

Stock exchange listingsABB Ltd is l

- Page 158 and 159:

2012 price trend for ABB Ltd shares

- Page 160:

ABB LtdCorporate Communications P.O