Note 3Acquisitions and increasesin controlling interests, continuedThe aggregate preliminary allocation of the purchase consideration for business acquisitions in <strong>2012</strong> is as follows:Weighted-averageAllocated amountsuseful life($ in millions) Thomas & Betts Other Total Thomas & BettsCustomer relationships 1,169 18 1,187 18 yearsTechnology 179 43 222 5 yearsTrade names 155 6 161 10 yearsOrder backlog 12 1 13 7.5 monthsIntangible assets 1,515 68 1,583 15 yearsFixed assets 458 25 483Debt acquired (619) – (619)Deferred tax liabilities (1,080) (24) (1,104)Inventories 300 38 338Other assets and liabilities, net (1) 84 (17) 67Goodwill (2) 2,723 172 2,895Total consideration (net of cash acquired) (3) 3,381 262 3,643Gross receivables from the Thomas & Betts acquisition totaled $387 million; the fair value of which was $344 million after rebates and allowance for estimated uncollectable receivables.The Company does not expect the majority of goodwill recognized to be deductible for income tax purposes.Cash acquired in the Thomas & Betts acquisition totaled $521 million. Additional consideration for the Thomas & Betts acquisition included $94 million related to the cash settlement ofstock options held by Thomas & Betts employees at the acquisition date and $5 million representing the fair value of replacement vested stock options issued to Thomas & Bettsemployees at the acquisition date. The fair value of these stock options was estimated using a Black-Scholes model.(1)(2)(3)The preliminary estimated fair values of the assets acquired and liabilities assumed for business combinations in <strong>2012</strong>are based on preliminary calculations and valuations, and facts and circumstances that existed at the respectiveacquisition dates. The Company’s estimates and assumptions are subject to change during the measurement periodsof those acquisitions. The area where preliminary estimates are not yet finalized primarily relates to certain deferredtax liabilities.The Company’s Consolidated Income Statement for <strong>2012</strong> includes total revenues of $1,541 million and a net loss(including acquisition-related charges) of $10 million in respect of Thomas & Betts since the date of acquisition.The unaudited pro forma financial information in the table below summarizes the combined pro forma results of theCompany and Thomas & Betts for <strong>2012</strong> and 2011, as if Thomas & Betts had been acquired on January 1, 2011.($ in millions) <strong>2012</strong> 2011Total revenues 40,251 40,288Income from continuing operations, net of tax 2,923 3,381The unaudited pro forma results above include certain adjustments related to the Thomas & Betts acquisition.The table below summarizes the adjustments necessary to present the pro forma financial information of the Companyand Thomas & Betts combined, as if Thomas & Betts had been acquired on January 1, 2011.Adjustments($ in millions) <strong>2012</strong> 2011Impact on cost of sales from additional amortization of intangible assets(excluding order backlog capitalized upon acquisition) (26) (69)Impact on cost of sales from amortization of order backlog capitalized upon acquisition 12 (12)Impact on cost of sales from fair valuing acquired inventory 31 (31)Impact on cost of sales from additional depreciation of fixed assets (12) (33)Interest expense on Thomas & Betts debt 5 21Impact on selling, general and administrative expenses from Thomas & Betts stock-option plans 16 –Impact on selling, general and administrative expenses from acquisition-related costs 56 (20)Impact on interest and other finance expense from bridging facility costs 13 –Other (5) (15)Income taxes (7) 44Total pro forma adjustments 83 (115)The pro forma results are for information purposes only and do not include any anticipated cost synergies or othereffects of the planned integration of Thomas & Betts. Accordingly, such pro forma amounts are not necessarily indicativeof the results that would have occurred had the acquisition been completed on the date indicated, nor are theyindicative of the future operating results of the combined company.92 Financial review | <strong>ABB</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>

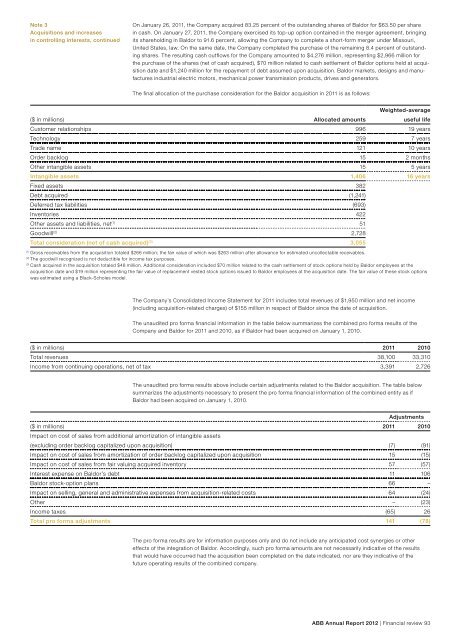

Note 3Acquisitions and increasesin controlling interests, continuedOn January 26, 2011, the Company acquired 83.25 percent of the outstanding shares of Baldor for $63.50 per sharein cash. On January 27, 2011, the Company exercised its top-up option contained in the merger agreement, bringingits shareholding in Baldor to 91.6 percent, allowing the Company to complete a short-form merger under Missouri,United States, law. On the same date, the Company completed the purchase of the remaining 8.4 percent of outstandingshares. The resulting cash outflows for the Company amounted to $4,276 million, representing $2,966 million forthe purchase of the shares (net of cash acquired), $70 million related to cash settlement of Baldor options held at acquisitiondate and $1,240 million for the repayment of debt assumed upon acquisition. Baldor markets, designs and manufacturesindustrial electric motors, mechanical power transmission products, drives and generators.The final allocation of the purchase consideration for the Baldor acquisition in 2011 is as follows:($ in millions) Allocated amountsWeighted-averageuseful lifeCustomer relationships 996 19 yearsTechnology 259 7 yearsTrade name 121 10 yearsOrder backlog 15 2 monthsOther intangible assets 15 5 yearsIntangible assets 1,406 16 yearsFixed assets 382Debt acquired (1,241)Deferred tax liabilities (693)Inventories 422Other assets and liabilities, net (1) 51Goodwill (2) 2,728Total consideration (net of cash acquired) (3) 3,055Gross receivables from the acquisition totaled $266 million; the fair value of which was $263 million after allowance for estimated uncollectable receivables.The goodwill recognized is not deductible for income tax purposes.Cash acquired in the acquisition totaled $48 million. Additional consideration included $70 million related to the cash settlement of stock options held by Baldor employees at theacquisition date and $19 million representing the fair value of replacement vested stock options issued to Baldor employees at the acquisition date. The fair value of these stock optionswas estimated using a Black-Scholes model.(1)(2)(3)The Company’s Consolidated Income Statement for 2011 includes total revenues of $1,950 million and net income(including acquisition-related charges) of $155 million in respect of Baldor since the date of acquisition.The unaudited pro forma financial information in the table below summarizes the combined pro forma results of theCompany and Baldor for 2011 and 2010, as if Baldor had been acquired on January 1, 2010.($ in millions) 2011 2010Total revenues 38,100 33,310Income from continuing operations, net of tax 3,391 2,726The unaudited pro forma results above include certain adjustments related to the Baldor acquisition. The table belowsummarizes the adjustments necessary to present the pro forma financial information of the combined entity as ifBaldor had been acquired on January 1, 2010.Adjustments($ in millions) 2011 2010Impact on cost of sales from additional amortization of intangible assets(excluding order backlog capitalized upon acquisition) (7) (91)Impact on cost of sales from amortization of order backlog capitalized upon acquisition 15 (15)Impact on cost of sales from fair valuing acquired inventory 57 (57)Interest expense on Baldor’s debt 11 106Baldor stock-option plans 66 –Impact on selling, general and administrative expenses from acquisition-related costs 64 (24)Other – (23)Income taxes (65) 26Total pro forma adjustments 141 (78)The pro forma results are for information purposes only and do not include any anticipated cost synergies or othereffects of the integration of Baldor. Accordingly, such pro forma amounts are not necessarily indicative of the resultsthat would have occurred had the acquisition been completed on the date indicated, nor are they indicative of thefuture operating results of the combined company.<strong>ABB</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> | Financial review 93

- Page 1:

Building on our technology leadersh

- Page 4 and 5:

This is ABBABB is one of the world

- Page 6 and 7:

Chairman and CEO letterDear shareho

- Page 8 and 9:

We will also be looking at ways to

- Page 10 and 11:

HighlightsResilient performance thr

- Page 12 and 13:

As of March 1, 2013Executive Commit

- Page 14 and 15:

12 Corporate governance report | AB

- Page 16 and 17:

1. Principles1.1 General principles

- Page 18 and 19:

The following table sets forth, as

- Page 20 and 21:

3.2 Changes to the share capitalIn

- Page 22 and 23:

4.3 Shareholders’ dividend rights

- Page 24 and 25:

As at December 31, 2012, the member

- Page 26 and 27:

Brice Koch was appointed Executive

- Page 28 and 29:

10. Auditors10.1 AuditorsErnst & Yo

- Page 30 and 31:

28 Remuneration report | ABB Annual

- Page 32 and 33:

ABB’s success depends on its abil

- Page 34 and 35:

1.3 Board compensation in 2012Compe

- Page 36 and 37:

Annual base salaryThe base salary f

- Page 38 and 39:

Historical payout of performance co

- Page 40 and 41:

Base salaryShort-term variablecompe

- Page 42 and 43:

6.2 EC ownership of ABB sharesand o

- Page 44 and 45: 42 Financial review | ABB Annual Re

- Page 46 and 47: Operating and financial reviewand p

- Page 48 and 49: In May 2012, the Low Voltage Produc

- Page 50 and 51: In a market environment in which ne

- Page 52 and 53: We record provisions for our contin

- Page 54 and 55: Goodwill and other intangible asset

- Page 56 and 57: We also incur expenses other than c

- Page 58 and 59: In 2011, orders in the Power Produc

- Page 60 and 61: We determine the geographic distrib

- Page 62 and 63: In 2012, “Capital gains, net” w

- Page 64 and 65: Divisional analysisPower ProductsTh

- Page 66 and 67: Continued pricing pressure in some

- Page 68 and 69: OrdersIn 2012, orders were flat due

- Page 70 and 71: The geographic distribution of orde

- Page 72 and 73: In 2011, revenues increased, driven

- Page 74 and 75: Throughout 2012 and 2011, the inves

- Page 76 and 77: Current liabilitiesDecember 31, ($

- Page 78 and 79: Total cash disbursements for the pu

- Page 80 and 81: Consolidated Financial StatementsCo

- Page 82 and 83: Consolidated Balance SheetsDecember

- Page 84 and 85: Consolidated Statements of Changes

- Page 86 and 87: Notes to theConsolidated Financial

- Page 88 and 89: Note 2Significant accounting polici

- Page 90 and 91: Note 2Significant accounting polici

- Page 92 and 93: Note 2Significant accounting polici

- Page 96 and 97: Note 3Acquisitions and increasesin

- Page 98 and 99: Note 5Financial instrumentsCurrency

- Page 100 and 101: Note 5Financial instruments, contin

- Page 102 and 103: Note 6Fair valuesRecurring fair val

- Page 104 and 105: Note 7Receivables, net, continued

- Page 106 and 107: Note 9Other non-current assets“Ot

- Page 108 and 109: Note 11Goodwill and other intangibl

- Page 110 and 111: Note 12Debt, continuedThe 4.625% EU

- Page 112 and 113: Note 14Leases, continuedNote 15Comm

- Page 114 and 115: Note 15Commitments and contingencie

- Page 116 and 117: Note 16Taxes, continuedIn 2012, 201

- Page 118 and 119: Note 16Taxes, continuedAt December

- Page 120 and 121: Note 17Employee benefits, continued

- Page 122 and 123: Note 17Employee benefits, continued

- Page 124 and 125: Note 18Share-based paymentarrangeme

- Page 126 and 127: Note 18Share-based paymentarrangeme

- Page 128 and 129: Note 19Stockholders’ equityAt bot

- Page 130 and 131: Note 21Other comprehensive incomeTh

- Page 132 and 133: Note 23Operating segment andgeograp

- Page 134 and 135: Note 23Operating segment andgeograp

- Page 136 and 137: Note 23Operating segment andgeograp

- Page 138 and 139: Report of the Statutory Auditor on

- Page 140 and 141: Financial Statements of ABB Ltd, Zu

- Page 142 and 143: Note 6Stockholders’ equityShareca

- Page 144 and 145:

Note 10Board of Directors compensat

- Page 146 and 147:

Note 11Executive Committeecompensat

- Page 148 and 149:

Note 11Executive Committeecompensat

- Page 150 and 151:

Note 12Share ownership of ABB byBoa

- Page 152 and 153:

Proposed appropriation of available

- Page 154 and 155:

Investor informationABB Ltd share p

- Page 156 and 157:

Stock exchange listingsABB Ltd is l

- Page 158 and 159:

2012 price trend for ABB Ltd shares

- Page 160:

ABB LtdCorporate Communications P.O