The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

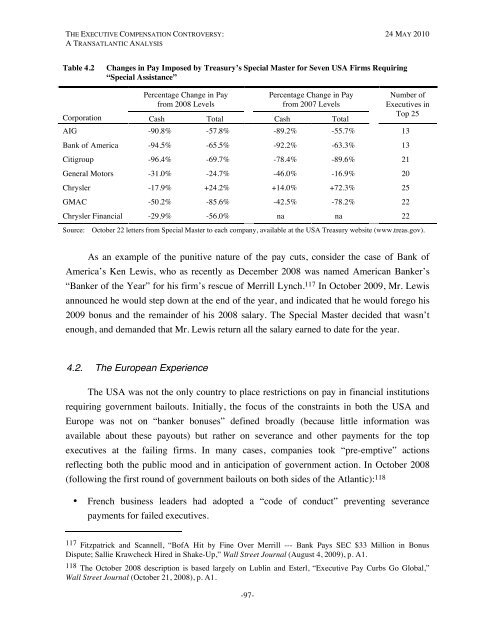

THE EXECUTIVE COMPENSATION CONTROVERSY: 24 MAY 2010A TRANSATLANTIC ANALYSISTable 4.2Changes in Pay Imposed by Treasury’s Special Master for Seven USA Firms Requiring“Special Assistance”Percentage Change in Payfrom 2008 LevelsPercentage Change in Payfrom 2007 LevelsCorporation Cash Total Cash TotalNumber of<strong>Executive</strong>s inTop 25AIG -90.8% -57.8% -89.2% -55.7% 13Bank of America -94.5% -65.5% -92.2% -63.3% 13Citigroup -96.4% -69.7% -78.4% -89.6% 21General Motors -31.0% -24.7% -46.0% -16.9% 20Chrysler -17.9% +24.2% +14.0% +72.3% 25GMAC -50.2% -85.6% -42.5% -78.2% 22Chrysler Financial -29.9% -56.0% na na 22Source: October 22 letters from Special Master to each company, available at the USA Treasury website (www.treas.gov).As an example of the punitive nature of the pay cuts, consider the case of Bank ofAmerica’s Ken Lewis, who as recently as December 2008 was named American Banker’s“Banker of the Year” for his firm’s rescue of Merrill Lynch. 117 In October 2009, Mr. Lewisannounced he would step down at the end of the year, and indicated that he would forego his2009 bonus and the remainder of his 2008 salary. <strong>The</strong> Special Master decided that wasn’tenough, and demanded that Mr. Lewis return all the salary earned to date for the year.4.2. <strong>The</strong> European Experience<strong>The</strong> USA was not the only country to place restrictions on pay in financial institutionsrequiring government bailouts. Initially, the focus of the constraints in both the USA andEurope was not on “banker bonuses” defined broadly (because little information wasavailable about these payouts) but rather on severance and other payments for the topexecutives at the failing firms. In many cases, companies took “pre-emptive” actionsreflecting both the public mood and in anticipation of government action. In October 2008(following the first round of government bailouts on both sides of the Atlantic): 118• French business leaders had adopted a “code of conduct” preventing severancepayments for failed executives.117 Fitzpatrick and Scannell, “BofA Hit by Fine Over Merrill --- Bank Pays SEC $33 Million in BonusDispute; Sallie Krawcheck Hired in Shake-Up,” Wall Street Journal (August 4, 2009), p. A1.118 <strong>The</strong> October 2008 description is based largely on Lublin and Esterl, “<strong>Executive</strong> Pay Curbs Go Global,”Wall Street Journal (October 21, 2008), p. A1.-97-