The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

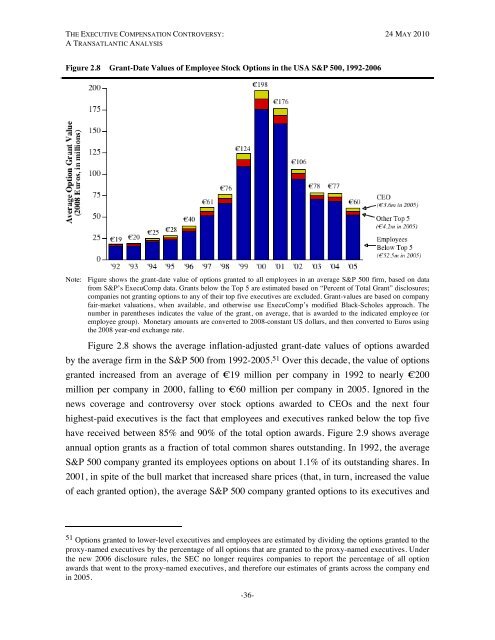

THE EXECUTIVE COMPENSATION CONTROVERSY: 24 MAY 2010A TRANSATLANTIC ANALYSISFigure 2.8 Grant-Date Values of Employee Stock Options in the USA S&P 500, 1992-2006Note: Figure shows the grant-date value of options granted to all employees in an average S&P 500 firm, based on datafrom S&P’s ExecuComp data. Grants below the Top 5 are estimated based on “Percent of Total Grant” disclosures;companies not granting options to any of their top five executives are excluded. Grant-values are based on companyfair-market valuations, when available, and otherwise use ExecuComp’s modified Black-Scholes approach. <strong>The</strong>number in parentheses indicates the value of the grant, on average, that is awarded to the indicated employee (oremployee group). Monetary amounts are converted to 2008-constant US dollars, and then converted to Euros usingthe 2008 year-end exchange rate.Figure 2.8 shows the average inflation-adjusted grant-date values of options awardedby the average firm in the S&P 500 from 1992-2005. 51 Over this decade, the value of optionsgranted increased from an average of €19 million per company in 1992 to nearly €200million per company in 2000, falling to €60 million per company in 2005. Ignored in thenews coverage and controversy over stock options awarded to CEOs and the next fourhighest-paid executives is the fact that employees and executives ranked below the top fivehave received between 85% and 90% of the total option awards. Figure 2.9 shows averageannual option grants as a fraction of total common shares outstanding. In 1992, the averageS&P 500 company granted its employees options on about 1.1% of its outstanding shares. In2001, in spite of the bull market that increased share prices (that, in turn, increased the valueof each granted option), the average S&P 500 company granted options to its executives and51 Options granted to lower-level executives and employees are estimated by dividing the options granted to theproxy-named executives by the percentage of all options that are granted to the proxy-named executives. Underthe new 2006 disclosure rules, the SEC no longer requires companies to report the percentage of all optionawards that went to the proxy-named executives, and therefore our estimates of grants across the company endin 2005.-36-