The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

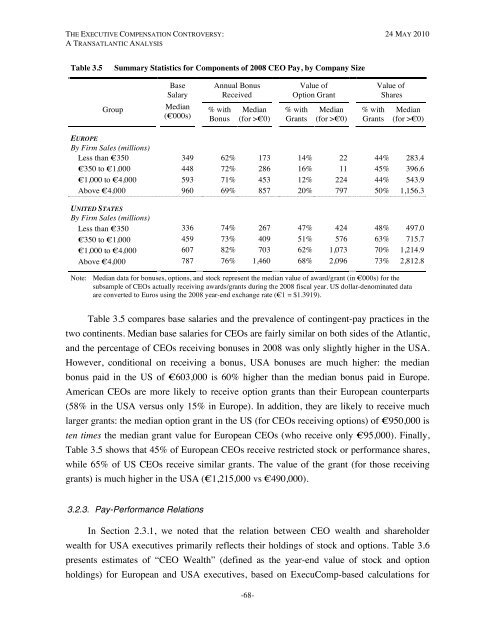

THE EXECUTIVE COMPENSATION CONTROVERSY: 24 MAY 2010A TRANSATLANTIC ANALYSISTable 3.5Summary Statistics for Components of 2008 CEO Pay, by Company SizeBaseSalaryAnnual BonusReceivedValue ofOption GrantValue ofSharesGroupMedian(€000s)% withBonusMedian(for >€0)% withGrantsMedian(for >€0)% withGrantsMedian(for >€0)EUROPEBy Firm Sales (millions)Less than €350 349 62% 173 14% 22 44% 283.4€350 to €1,000 448 72% 286 16% 11 45% 396.6€1,000 to €4,000 593 71% 453 12% 224 44% 543.9Above €4,000 960 69% 857 20% 797 50% 1,156.3UNITED STATESBy Firm Sales (millions)Less than €350 336 74% 267 47% 424 48% 497.0€350 to €1,000 459 73% 409 51% 576 63% 715.7€1,000 to €4,000 607 82% 703 62% 1,073 70% 1,214.9Above €4,000 787 76% 1,460 68% 2,096 73% 2,812.8Note: Median data for bonuses, options, and stock represent the median value of award/grant (in €000s) for thesubsample of CEOs actually receiving awards/grants during the 2008 fiscal year. US dollar-denominated dataare converted to Euros using the 2008 year-end exchange rate (€1 = $1.3919).Table 3.5 compares base salaries and the prevalence of contingent-pay practices in thetwo continents. Median base salaries for CEOs are fairly similar on both sides of the Atlantic,and the percentage of CEOs receiving bonuses in 2008 was only slightly higher in the USA.However, conditional on receiving a bonus, USA bonuses are much higher: the medianbonus paid in the US of €603,000 is 60% higher than the median bonus paid in Europe.American CEOs are more likely to receive option grants than their European counterparts(58% in the USA versus only 15% in Europe). In addition, they are likely to receive muchlarger grants: the median option grant in the US (for CEOs receiving options) of €950,000 isten times the median grant value for European CEOs (who receive only €95,000). Finally,Table 3.5 shows that 45% of European CEOs receive restricted stock or performance shares,while 65% of US CEOs receive similar grants. <strong>The</strong> value of the grant (for those receivinggrants) is much higher in the USA (€1,215,000 vs €490,000).3.2.3. Pay-Performance RelationsIn Section 2.3.1, we noted that the relation between CEO wealth and shareholderwealth for USA executives primarily reflects their holdings of stock and options. Table 3.6presents estimates of “CEO Wealth” (defined as the year-end value of stock and optionholdings) for European and USA executives, based on ExecuComp-based calculations for-68-