The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

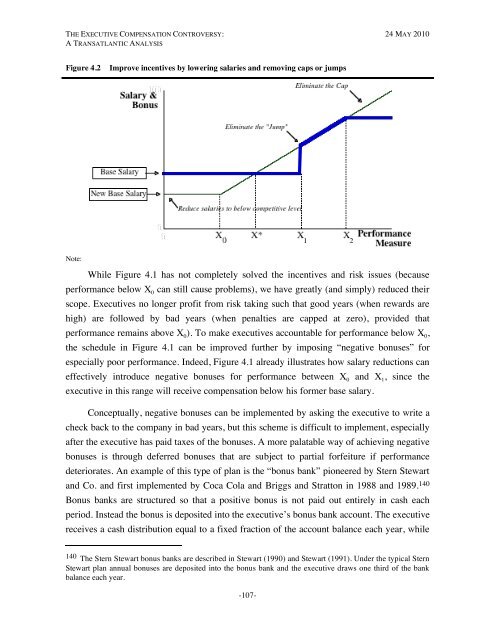

THE EXECUTIVE COMPENSATION CONTROVERSY: 24 MAY 2010A TRANSATLANTIC ANALYSISFigure 4.2Improve incentives by lowering salaries and removing caps or jumpsNote:While Figure 4.1 has not completely solved the incentives and risk issues (becauseperformance below X 0 can still cause problems), we have greatly (and simply) reduced theirscope. <strong>Executive</strong>s no longer profit from risk taking such that good years (when rewards arehigh) are followed by bad years (when penalties are capped at zero), provided thatperformance remains above X 0 ). To make executives accountable for performance below X 0 ,the schedule in Figure 4.1 can be improved further by imposing “negative bonuses” forespecially poor performance. Indeed, Figure 4.1 already illustrates how salary reductions caneffectively introduce negative bonuses for performance between X 0 and X 1 , since theexecutive in this range will receive compensation below his former base salary.Conceptually, negative bonuses can be implemented by asking the executive to write acheck back to the company in bad years, but this scheme is difficult to implement, especiallyafter the executive has paid taxes of the bonuses. A more palatable way of achieving negativebonuses is through deferred bonuses that are subject to partial forfeiture if performancedeteriorates. An example of this type of plan is the “bonus bank” pioneered by Stern Stewartand Co. and first implemented by Coca Cola and Briggs and Stratton in 1988 and 1989. 140Bonus banks are structured so that a positive bonus is not paid out entirely in cash eachperiod. Instead the bonus is deposited into the executive’s bonus bank account. <strong>The</strong> executivereceives a cash distribution equal to a fixed fraction of the account balance each year, while140 <strong>The</strong> Stern Stewart bonus banks are described in Stewart (1990) and Stewart (1991). Under the typical SternStewart plan annual bonuses are deposited into the bonus bank and the executive draws one third of the bankbalance each year.-107-