The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

The Executive Compensation Controversy - Fondazione Rodolfo ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

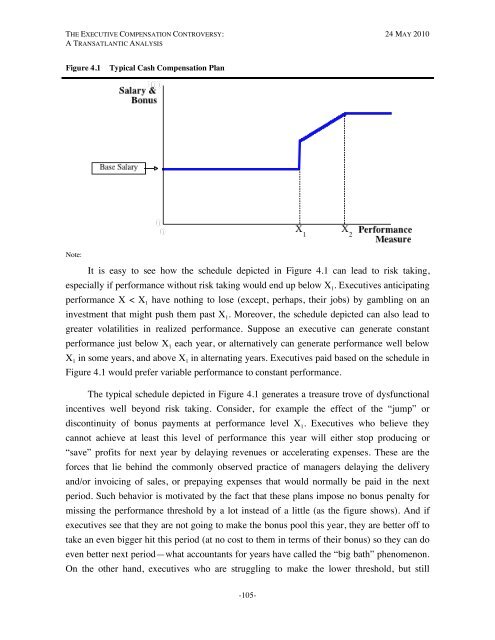

THE EXECUTIVE COMPENSATION CONTROVERSY: 24 MAY 2010A TRANSATLANTIC ANALYSISFigure 4.1Typical Cash <strong>Compensation</strong> PlanNote:It is easy to see how the schedule depicted in Figure 4.1 can lead to risk taking,especially if performance without risk taking would end up below X 1 . <strong>Executive</strong>s anticipatingperformance X < X 1 have nothing to lose (except, perhaps, their jobs) by gambling on aninvestment that might push them past X 1 . Moreover, the schedule depicted can also lead togreater volatilities in realized performance. Suppose an executive can generate constantperformance just below X 1 each year, or alternatively can generate performance well belowX 1 in some years, and above X 1 in alternating years. <strong>Executive</strong>s paid based on the schedule inFigure 4.1 would prefer variable performance to constant performance.<strong>The</strong> typical schedule depicted in Figure 4.1 generates a treasure trove of dysfunctionalincentives well beyond risk taking. Consider, for example the effect of the “jump” ordiscontinuity of bonus payments at performance level X 1 . <strong>Executive</strong>s who believe theycannot achieve at least this level of performance this year will either stop producing or“save” profits for next year by delaying revenues or accelerating expenses. <strong>The</strong>se are theforces that lie behind the commonly observed practice of managers delaying the deliveryand/or invoicing of sales, or prepaying expenses that would normally be paid in the nextperiod. Such behavior is motivated by the fact that these plans impose no bonus penalty formissing the performance threshold by a lot instead of a little (as the figure shows). And ifexecutives see that they are not going to make the bonus pool this year, they are better off totake an even bigger hit this period (at no cost to them in terms of their bonus) so they can doeven better next period—what accountants for years have called the “big bath” phenomenon.On the other hand, executives who are struggling to make the lower threshold, but still-105-